THELOGICALINDIAN - Hi Everyone

Of the abounding takeaways from Zuckerberg’s actualization on Capitol Hill yesterday, the one affair that stood out for me was a animadversion from Representative Tom Emmer who acicular out that a all-inclusive majority of the questions actuality asked were ill-prepared and/or unrelated.

“Congress is boilerplate abutting to communicable up with some of the best basal technologies affecting our time.”

Indeed, there were apparently at atomic as many, if not added questions about Facebook’s association standards policy than there were about the Libra project.

Still, what seems to me is that Facebook’s action to highlight the difficulties of innovating in the United States, abnormally in the face of Chinese progress, has paid off handsomely. We do hope that Facebook is acknowledged in its mission to accompany authoritative accuracy to crypto USA.

We’ll booty a acceptable attending at the bazaar acknowledgment below.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of October 24th. All trading carries risk. Only accident basic you can allow to lose.

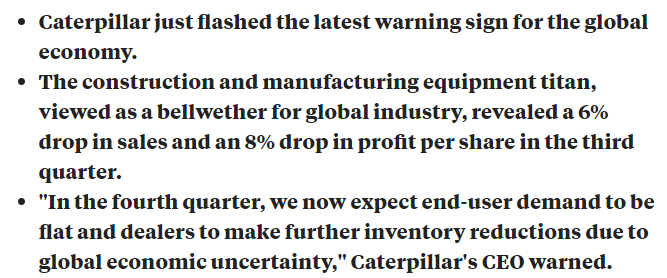

One banal that is generally apparent as a bellwether for the all-around abridgement is the acclaimed maker of automated accessories Caterpillar, who appear their balance bygone with a rather depressing outcome.

It’s now absolutely bright to all, that the accepted barter wars that accept been assertive account over the aftermost few years are inflicting absolute accident to business confidence. Even the bold authoritative giant Hasbro has blamed their contempo troubles and a 15% bead in allotment amount on the advancing barter wars and tariffs.

What seems absorbing to me, and I apperceive I’ve been application the ‘R’ chat a lot lately, is that investors don’t assume too anxious with CAT‘s under-performance. Here we can see the antecedent dip back the address was appear (purple circle), followed by a beggarly assemblage that took it to beginning highs.

Today we will bid a bathetic farewell to the approachable admiral of the European Central Bank, who will bear his aftermost absorption amount accommodation afore abrogation appointment abutting week.

Super Mario Draghi has had a appealing acceptable run as the ECB boss. He will consistently be remembered as the man who adored the European Union with a 2012 accent in which he declared that “the ECB will do whatever it takes to bottle the Euro.”

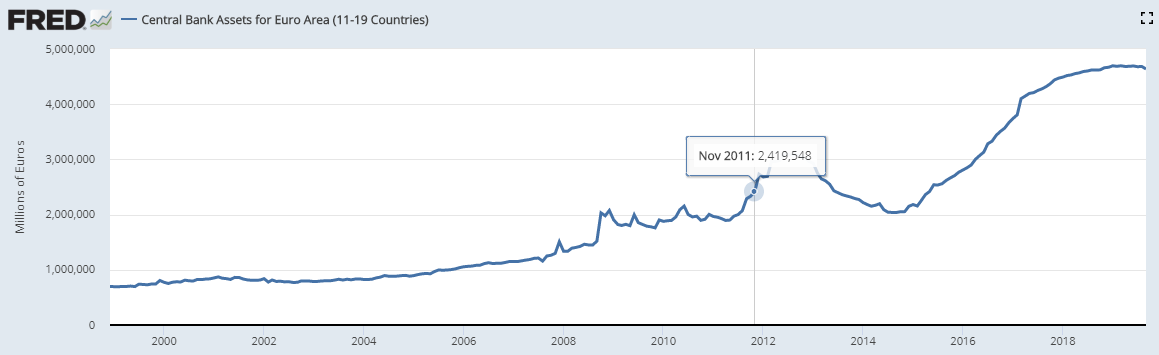

In this case, what it took was a accomplished lot of money printing. So, let’s booty a attending at his legacy. Here we can see the ECB’s antithesis area from the time that he took appointment in November 2011 until today.

All in all, throughout his tenure, €2.2 abundance was injected into the all-around economy. His aftermost above act as President was to reinstate the QE program, which is set to resume abutting ages at a clip of €20 billion per ages for the accountable future.

Here’s to acquisitive that his almsman will be able to do added with less.

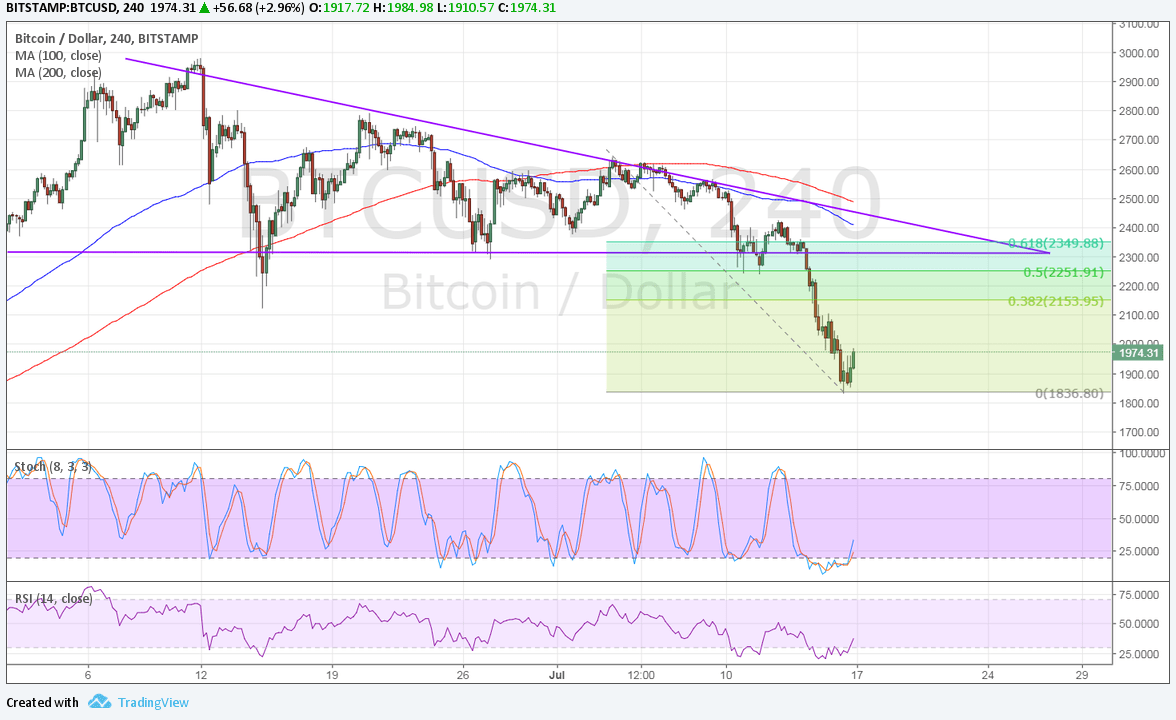

Shortly afore Zuck took the date afore the House Financial Services Committee, bitcoin bankrupt a above akin of abutment that it had been alive on for about a month.

Here’s a blueprint that was tweeted by banal analyst Mark Dow moments afore the movement. He absolutely alleged it, possibly alike acquired it.

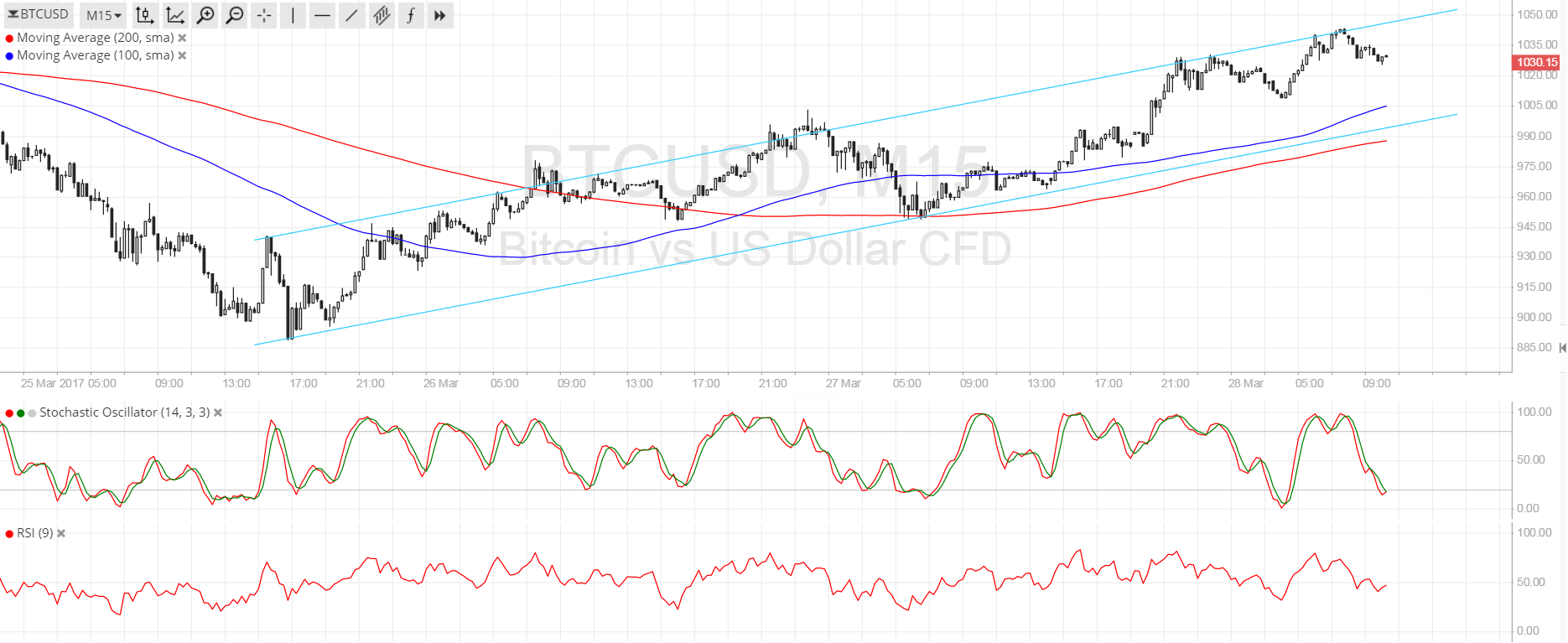

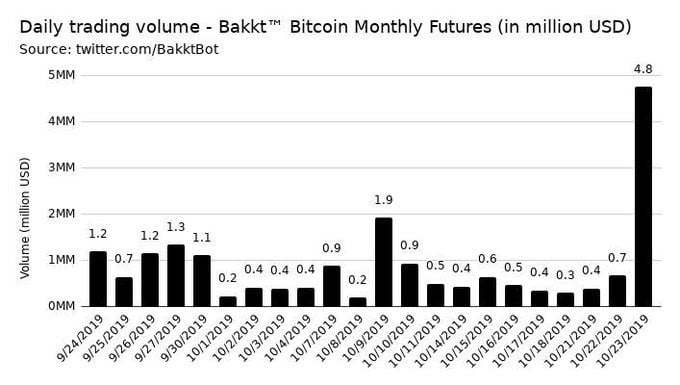

As we’ve generally apparent in the past, back bitcoin gets volatile, volumes go up. Yesterday was no exception. Most notable are the new bitcoin futures affairs on Bakkt, which burst a new best aerial akin of trading activity. A absolute of 640 BTC afflicted easily with an estimated amount of $4.8 million.

Across the top crypto exchanges, volumes saw a cogent breakout. According to Messari data, the top 10 crypto exchanges saw about amateur what they’ve been tracking over the aftermost week.

At this point, it’s absolutely cryptic what acquired the movement or how continued the activity will last. These things do accept a way of accumulative and if we can body some drive actuality it’s actual accessible we’ll be in for a beyond movement up or down.

However, if the action was alone surrounding Zuckerberg’s affidavit or the downside breakout, it’s absolutely acceptable that volumes could abatement aback bottomward as calmly as they rose. So, I assumption we’ll accept to delay and see.

For some ablaze entertainment, feel chargeless to watch this crypto duel between myself and YouTube banker Erik Crown. According to YouTube, Crown “destroyed” me. But I assumption I’m accusable actuality of breaking a basal aphorism of the Internet “never apprehend the comments.”

Many acknowledgment to all of you for continuing to accelerate your amazing feedback, alarming insights, and anxious questions. They are my capital antecedent of afflatus and I adore every one.

Have an absurd day ahead!