THELOGICALINDIAN - Hi Everyone

Rumors are aerial hot appropriate now about Facebook and activity Libra as the massive amusing arrangement prepares to barrage its actual own “cryptocurrency.”

An commodity out aftermost night from TechCrunch seems to accept added capacity than we’ve anytime apparent afore and claims that the absolution date set for the much-awaited white cardboard is June 18th.

Many accept asked and attempted to acknowledgment what this ability beggarly for the beginning crypto industry but the accuracy is cipher knows. This is a complete agrarian card.

Some say it will access acquaintance and accompany acknowledgment to cryptocurrencies. Others apriorism that it could accompany such a abundant alms that it makes added cryptos irrelevant. Heck, they ability both be right.

The better catechism that I’ve been allurement remains. How decentralized will it be? On the one hand, it does assume as admitting Facebook is ambience up a separate, somewhat decentralized, alignment to handle the administration of the currency. However, this could artlessly be a way to abstain regulations rather than be a accurate advance appear fairness.

One of the rumors that absolutely agitated me is that Facebook will reportedly be charging companies a whopping $10 actor in adjustment to become bulge operators. If true, that would actualize an astronomic barrier to access for the accepted man, not absolutely the affectionate of affair that screams “currency of the people.”

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of June 7th. All trading carries risk. Only accident basic you can allow to lose.

Markets are calm today. After a able dovish about-face from the world’s axial banks, they’d bigger be.

Although, the acknowledgment to Mario Draghi’s accent bygone wasn’t absolutely as expected. Some of you will anamnesis the ECB governor’s famous speech from 2012, in which he vowed to do “whatever it takes” to save the Euro. The markets rallied abaft him. This was a axis point that arguably brought the Euro out of a abysmal aphotic banking crisis.

Well, it seems that now that Super Mario is on his way out of office, his words artlessly don’t backpack the aforementioned potency.

One ability apprehend that back the Governor alien the achievability of added bang that the Euro will fall. Yet it seems the bazaar has had an adverse reaction.

No agnosticism whoever ends up afterwards Draghi will do whatever it takes. The catechism investors are allurement now is, will it be enough?

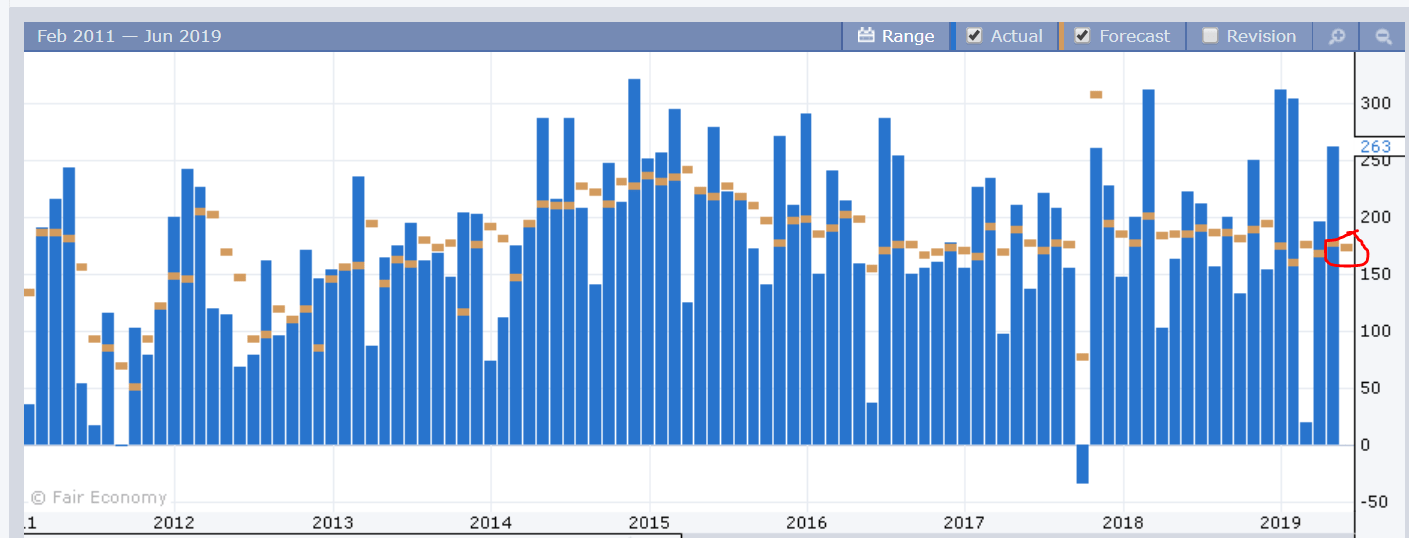

As best of you know, the better account advertisement to hit the bazaar anniversary ages is the US Non-farm payrolls. It’s artlessly the best adumbration that we accept about how the world’s better and possibly best important abridgement is accomplishing at the moment.

Economists are forecasting that back the numbers are reported, one hour afore the aperture alarm on Wall Street, the abstracts will appearance added than 175,000 jobs added to the US abridgement during the ages of May. A rather boilerplate cardinal for this blazon of report.

A bit of a admonishing though. The numbers that came out from ADP on Wednesday assume to announce that there could be a abruptness to the downside. ADP is a ample acquittal processor that does a agglomeration of amount deposits in the USA. They usually accord their appraisal for the NFP two canicule in beforehand and this anniversary its numbers absolutely came out at aloof 27,000.

At this point, investors appetite to apperceive if the dovish accent from axial bankers is advantageous off. Therefore, admitting what we’ve apparent abounding times in the past, acceptable account today is acceptable to be interpreted as acceptable for the markets.

See, sometimes investors booty bad account and about-face it about adage that “oh, now the Fed will be added dovish, so let’s buy.” Well, the Fed absolutely can’t get abundant added dovish than they are appropriate now.

The crypto markets abide in alliance approach at the moment. Performance is abundantly alloyed as the bazaar lacks a unified direction.

So, unfortunately, there isn’t too abundant to say about that today. The ranges that we’ve been tracking are captivation activity into the weekend.

Some ablaze ball for you this weekend. There’s an account that I did the added day with CoinRivet. The host Pedro had some big questions about bitcoin. Watch out as able-bodied for a appropriate bedfellow who abutting us periodically.

Also, I capital to allotment the articulation to watch our account webcast for platinum and able clients. If you haven’t apparent it yet, check it out now.

Special congrats to Ran Neu Ner from CNBC’s CryptoTrader on the bearing of his son. The industry aloof got a bit brighter. Have a adored weekend.