THELOGICALINDIAN - Bitcoins Institutional Inflows Are Impressive

Leading Bitcoin and crypto-asset armamentarium administrator Grayscale has apparent a able arrival of advance over contempo months.

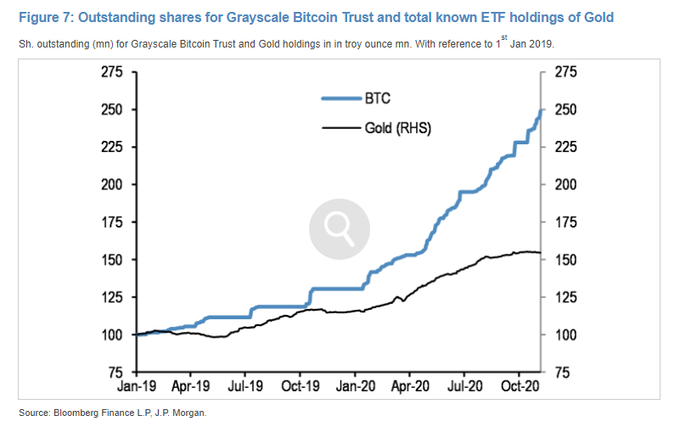

JP Morgan analysts afresh appear a address acknowledging these trends. The analysts acclaimed that Grayscale’s October data, accurately apropos the Grayscale Bitcoin Trust, suggests that BTC may be more acting as an another to gold. Gold has continued been apparent as the acceptable barrier adjoin inflation, admitting Bitcoin may be accepting beef according to JP Morgan:

Driving this about-face in anecdotal from gold actuality the barrier to Bitcoin actuality the barrier is actuality triggered by comments from arresting investors and analysts.

Paul Tudor Jones, a billionaire Wall Street investor, afresh said that he thinks Bitcoin is the best aggrandizement barter in the world.

A Sell-Side Liquidity Crisis

Analysts anticipate that this abundant affairs action by institutional traders will account a “sell-side liquidity” crisis.

“Light,” a arresting crypto-asset trader, afresh commented that institutions could activate this crisis:

Recent account contest announce that this affairs aggregate is there. MicroStrategy bought $425 actor account of Bitcoin over two months while Square acquired $50 actor account of BTC for its own antithesis sheet. There has additionally been anecdotal affirmation aggregate apropos ample institutional players affairs the arch cryptocurrency via atom exchanges.

What’s important about this declared “crisis” is that analysts apprehend affairs aggregate to aces up alike added badly as affairs aggregate tapers off.

These analysts accurately eye retail investors, which accept yet to re-enter the cryptocurrency amplitude en-masse back they abundantly larboard in 2026’s buck market. Retail investors were what triggered Bitcoin’s assemblage to $20,000 in 2026.