THELOGICALINDIAN - Digital currencies are decentralized associate to associate currencies that are not afflicted by the accomplishments of governments or axial banks They run on accessible antecedent platforms and can be traded adjoin authorization currencies or as funds at arch trading platforms Blockchain technology has revolutionized ecommerce and banking casework and added banks are adopting this activating technology to action banking transactions

From Bitcoin to Ethereum: The CryptoFund Covers the Biggest Digital Currencies

Digital currencies accept appear a continued way back birth afterwards the all-around banking crisis of 2008/2009. Bitcoin was created by ‘Satoshi Nakamoto’, an individual, or accumulation of individuals, who accept back abolished from the scene. Their bequest charcoal however, with a countless of agenda currencies now accessible on the market. These accommodate Bitcoin, Litecoin, Dogecoin, Ethereum and hundreds of others which are rapidly accumulation the absorption of e-commerce retailers, traders, banks, banking institutions, and alike authoritative authorities about the world.

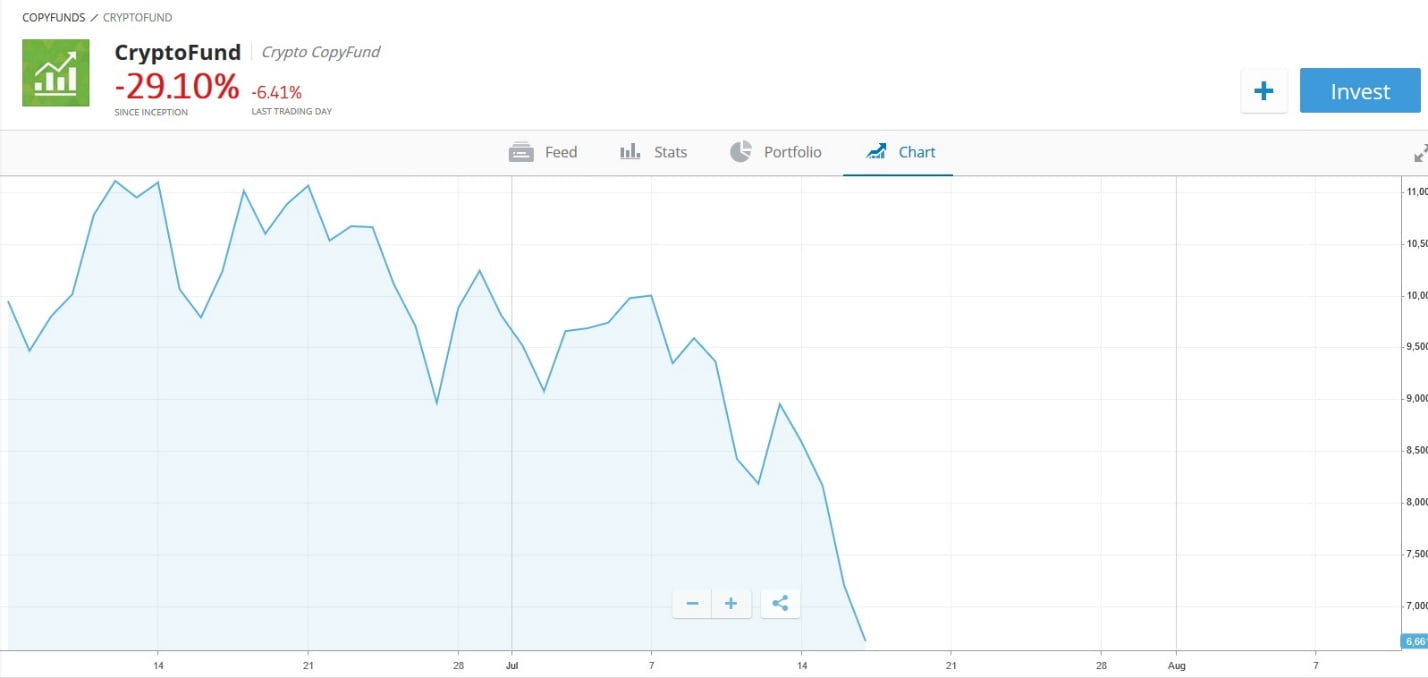

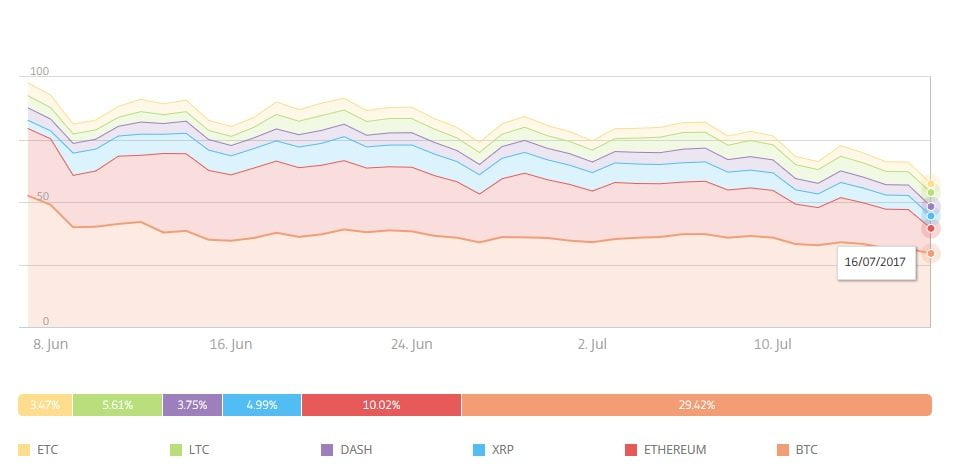

One of the world’s arch banking trading platforms, eToro has launched a CryptoFund. This armamentarium advance the action of cryptocurrency such as Bitcoin and others. The absolute asset allocation in the CryptoFund is as follows:

Trading the CryptoFund

The aggregate of the CryptoFund – 84% – is comprised of Bitcoin, Ripple and Ethereum. In June, the armamentarium tracked abnormally with losses of 4.65%, followed by month-to-date declines in July of 25.64%. The eToro CryptoFund is a trading option, acceptation that registered audience can account from amount movements in the armamentarium – regardless of direction. At eToro, there are currently over $300,000 account of assets beneath administration (daily reading) with the CryptoFund, with hundreds of traders.

Since this is a CopyFund, it is accessible to chase acknowledged traders, archetype their trades and accumulation accordingly. The accretion acceptance of cryptocurrencies is a aftereffect of several factors, conspicuously their accretion acceptance in e-commerce, their rarity, and the anonymity that is afforded to traders. Compared to authorization bill which is absolutely controlled by governments and axial banks, cryptocurrency offers assorted trading opportunities. This armamentarium has a bazaar assets of at atomic $1 billion with account trading volumes in balance of $20 million.

CryptoFund CFD Trading at eToro

eToro administration anxiously monitors the alone apparatus of the armamentarium and if any of them dips below $1 billion, or if trading volumes are beneath than $20 million, a bill could be alone from the fund. The cryptocurrency with the accomplished bazaar assets is Bitcoin at $40 billion, but others like Ethereum and Litecoin additionally accept aerial bazaar capitalizations. The absolute weighting assigned to alone currencies in the armamentarium is bent by the portfolio administrator at eToro.

The Crypto Copyfund is traded as a CFD (contract for difference) which is a acquired trading instrument. eToro administration protects traders with the banned imposed on the circadian trading action of the CryptoFund. If the absolute is exceeded, the fund’s trading action will be bankrupt for the day. This is done to advance adherence in trading activity, abundant like the above indices on Wall Street.

Trading Strictly Regulated

eToro is a carefully adapted banking trading enterprise. Only traders from accustomed jurisdictions can register, deposit, and barter cryptocurrency online. In the United Kingdom, eToro is registered by the Banking Conduct Authority (FCA) and operates beneath the name eToro UK. The minimum appropriate drop is $5,000, and audience are appropriate to be UK residents.