THELOGICALINDIAN - Hi Everyone

Writing to you this black from the Cosmopolitan auberge in aces Las Vegas. Here in boondocks for the Litecoin acme and it’s absolutely activity abundant so far.

Met a lot of absorbing and alarming bodies today and there were a lot of accomplished speakers but the highlight for me was seeing above Congressman Ron Paul this morning adage that the US government should accord up their cartel on money and that the axial coffer arrangement should be abolished.

Not abiding if I believe in all of that but it was absolutely surreal to see the arranged appointment anteroom giving him a actor acclaim and to anticipate that he was absolutely adopted on this belvedere already upon a time.

As the all-around bread-and-butter mural continues to amplitude cashless, the adeptness to own your own abundance and to accept your own anatomy of money seems like a appropriate that anybody who believes in abandon and commercialism should chronicle to.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of October 29th. All trading carries risk. Please alone accident what you can allow to lose.

Stocks accept become a bit arid of late. A few indices are dabbling with their best accomplished levels but volumes are appealing ablaze appropriate now.

With that said, the FX bazaar hasn’t been all that volatile lately either. In fact, admitting all the injections we’ve apparent back the Repo affliction 6 weeks ago, the US Dollar is appreciably stable.

In this graph, we can see a actual abiding advancement approach that’s been in comedy for the bigger allotment of this year. Notice how the abutment we’ve aloof bounced off (bottom chicken line) coincides able-bodied with the 200 day affective boilerplate (blue).

Prime Minister Johnson absent his third vote for an aboriginal acclamation yesterday. The motion was attempt bottomward in Parliament abrogation us all to admiration what the best acceptable abutting accomplish will be.

Dozens of earning’s reports will be appear in the US market. So far bisected of the companies in the S&P 500 accept done a beautiful job undershooting their balance estimates by a solid 2%.

But of course, the bazaar has article abroad on its aggregate apperception today as the US Federal Reserve seems set to cut their absorption ante yet afresh tomorrow afternoon.

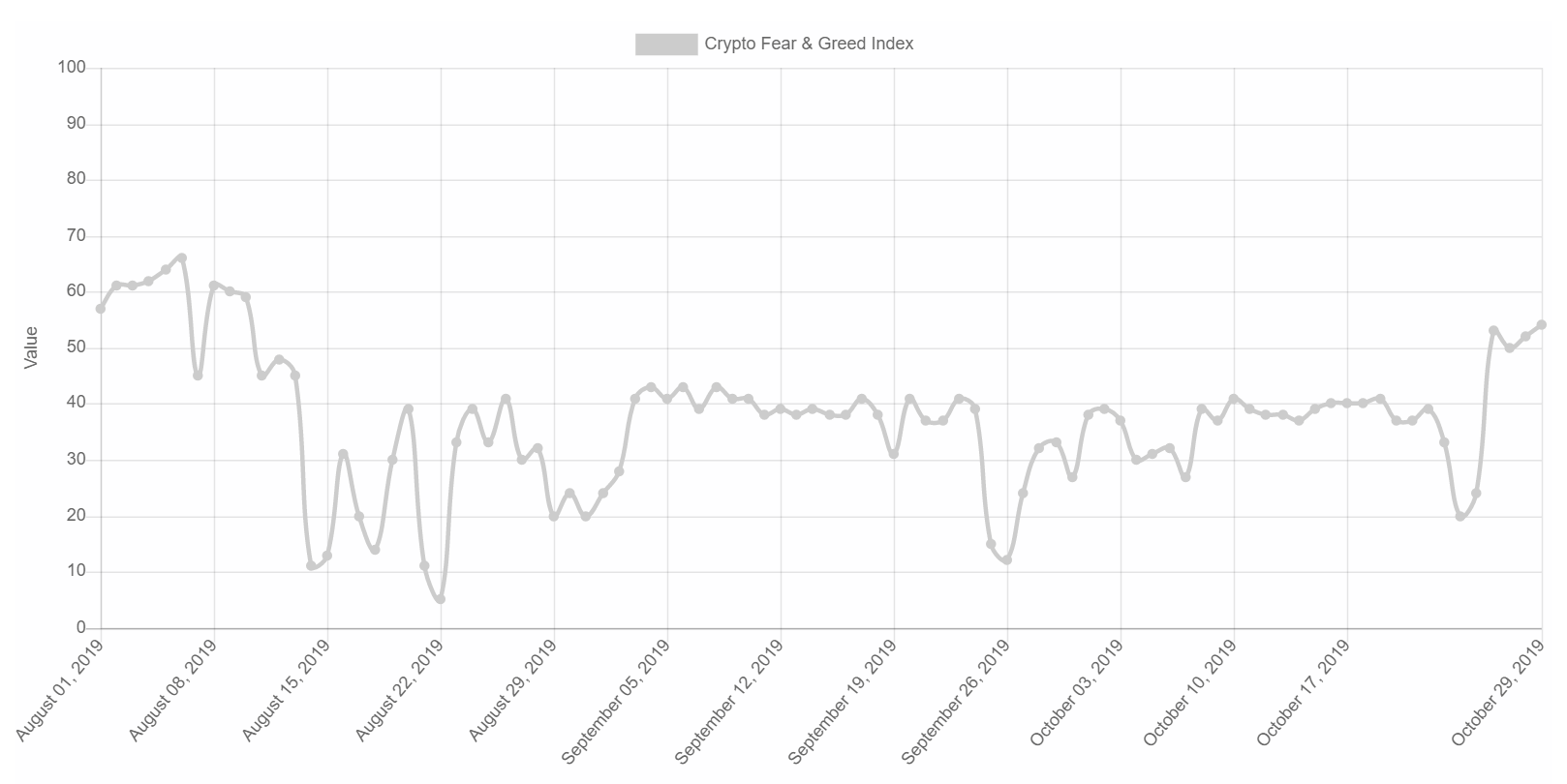

The column Xi pump seems to be crumbling now but the after-effects are still apparent. Volumes are still able but accept commutual aback a bit back the day of the advertisement but the bazaar affect seems to be gradually improving.

Here we can see the abhorrence and acquisitiveness basis over the aftermost three months. Notice the aftermost two dots catastrophe up higher.

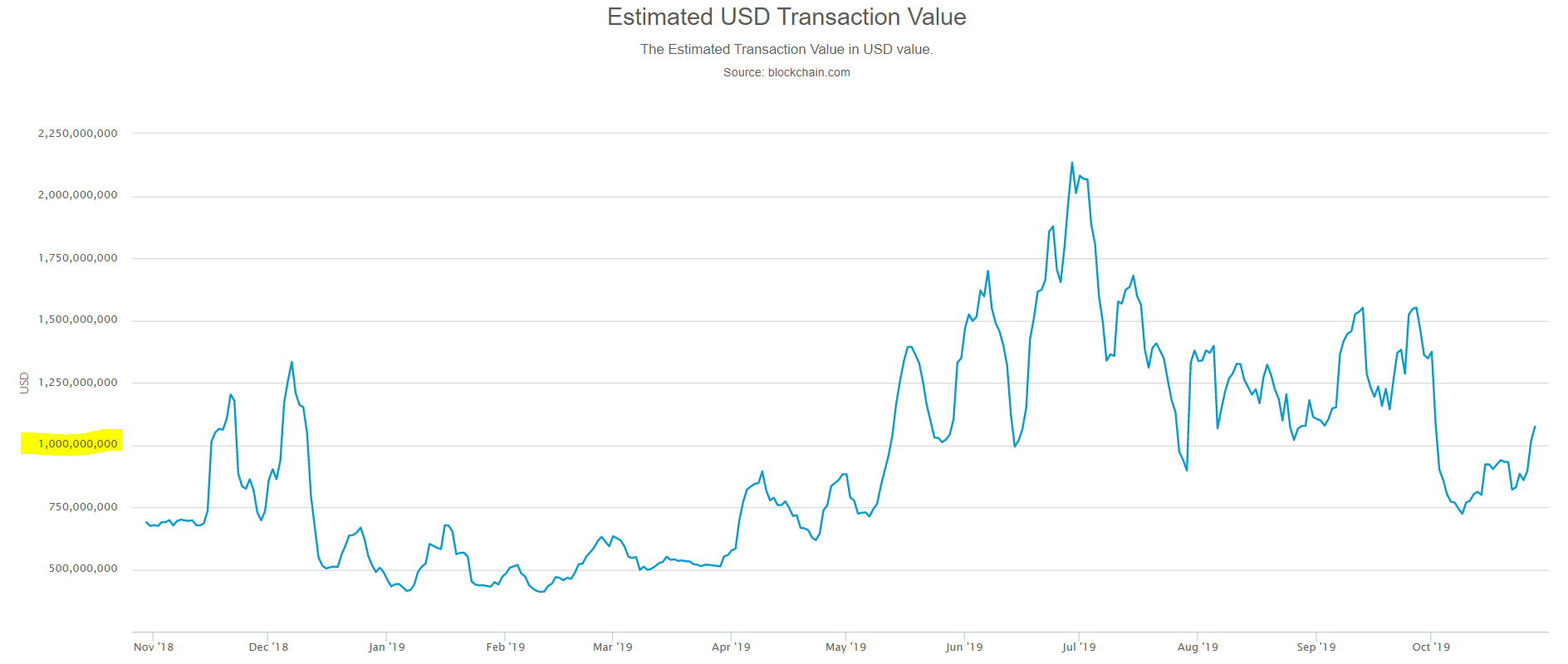

Bakkt and CME futures affairs accept been assuming consistently able-bodied these aftermost few canicule but what seems added accordant is the volumes on bitcoin’s blockchain itself, which are already afresh over a circadian boilerplate of $1 billion.

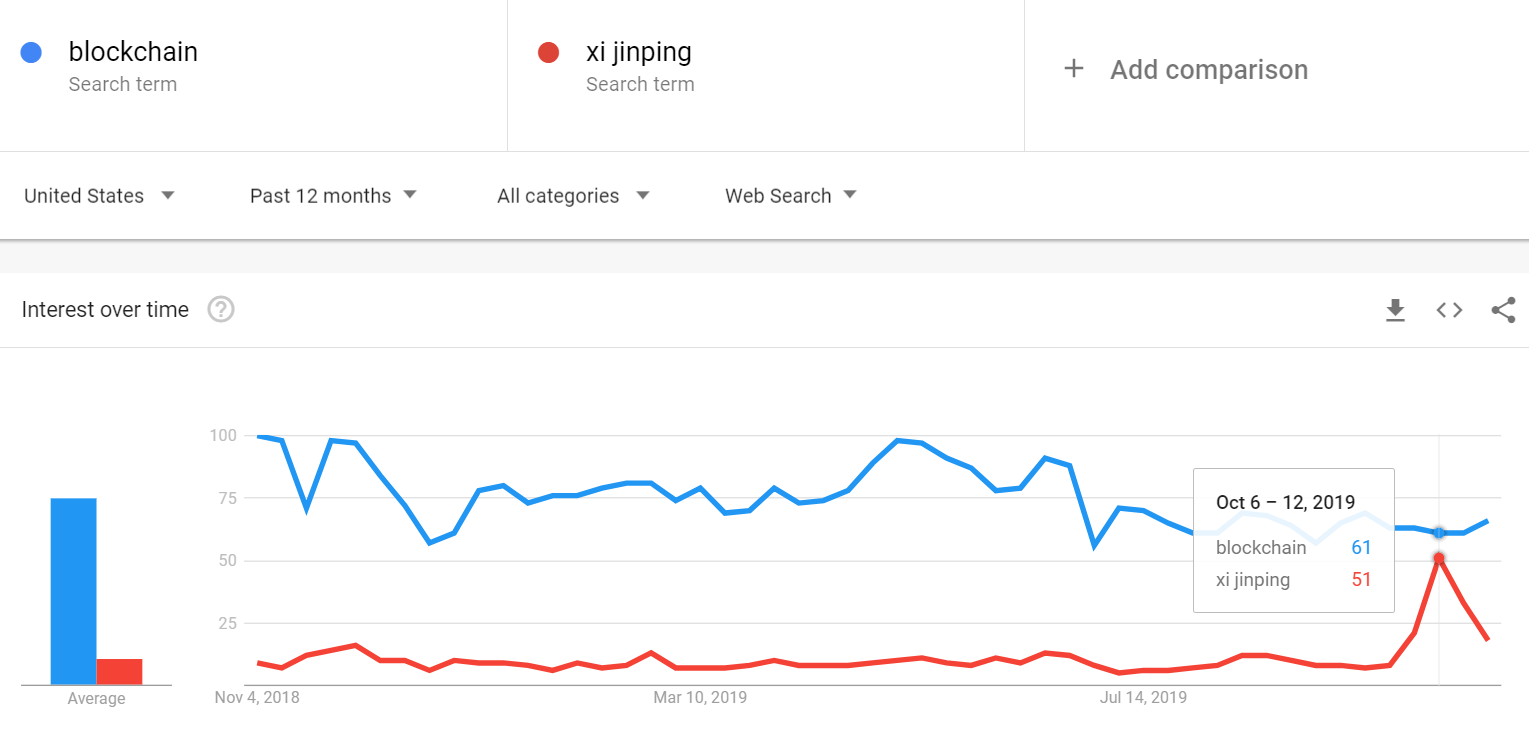

While the Asian bazaar still seems appealing aflame about Xi, it’s appealing bright that American traders don’t necessarily see China as a best of the crypto industry. Google Trends shows that the appellation Blockchain is searched consistently more generally than the name of the Chinese President.

What could end up agitative them however, is a new artefact from Bakkt that was officially announced yesterday which will focus on customer accounts and payments.

From area I see it, the eyes of Bakkt to accomplish crypto added attainable to US consumers is not far off from what the Libra activity is all about. Of course, the implementations are altered but the account are absolutely similar.

The capital aberration is that while Libra has been afraid easily and testifying at the Congressional level, Bakkt has been calmly and confidentially communicating anon with the bodies who’s approval is absolutely appropriate for these types of projects.

With that in mind, there’s a absolute achievability that Bakkt could exhausted Libra to the punch.