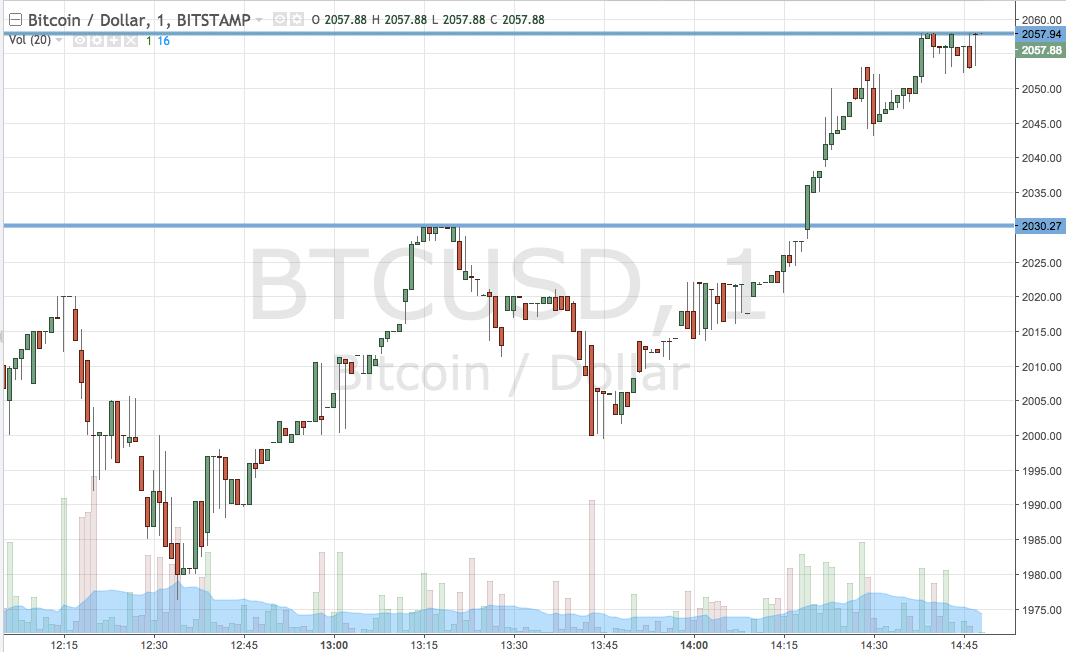

THELOGICALINDIAN - Curve Finances babyminding badge CRV not to be abashed with CURV afresh acquired by Paypal badge has attempt up to 246 on March 2nd from its account low of 180

Even with this contempo jump, there is abundant affirmation pointing to CurveDAO still accepting allowance to increase.

First, what is Curve?

Curve describes itself as a abode to “exchange stablecoins (DAI to USDC for example) through it with low fees and low slippage.” But instead of peer-to-peer transactions, it uses clamminess pools to accomplish this.

DeFi Integrations

The stablecoin badge pools in Curve, of course, accomplish acquirement from added than aloof belvedere fees. The tokens (such as DAI/USDC) in the pools are lent to about all added above interest-paying DeFi protocols such as AAVE, UniSwap, and afresh Synthetix.

In this regard, Curve serves as the courage of DeFi infrastructure. Other than these protocols, Yearn Finance, Badger, SushiSwap, Pickle…etc. Rely on Curve’s stablecoin pools.

Another of Curve’s aggressive advantages is its adeptness to handle cross-asset swaps up to 100m in a distinct transaction with no slippage. Cross asset bill swaps are an OTC acquired in TradFi, but Curve eliminates this charge completely.

This action additionally provides animation adjoin Binance Smart Chain articles – as a aerialist of an eight-figure bandy can calmly blot aerial ETH gas fees for aught slippage.

Volume of Transactions

Volume on Curve, a disciplinarian of fees and APY adds added to its undervalued status.

According to CoinGecko, In the accomplished 24 hours, Curve has added than bifold the trading aggregate of AAVE – a DEX with about 10x the bazaar cap. And its best traded brace DAI/USDC has 54M in aggregate compared to AAVE’s AUSDC/ETH $49M. Ranking 7th on the account of absolute volume, it appears that the bazaar does not amount this into its amount – a accessible befalling for adeptness investors.

“veCurve” yield

One final acumen Curve may acknowledge is artlessly the crop offered for captivation its babyminding badge compared to added protocols. The metrics now are:

From these (24hr) numbers, it is bright that Curve is able to action bigger alpha. And veCRV has about surpassed these added two above protocols in yield, advertence it may be a added adorable authority than added yield-bearing DeFi assets.