THELOGICALINDIAN - The US dollar expects to abide its bearish trend into 2026 as Democrats accretion ascendancy over Congress afterward a apple-pie dejected ambit in this weeks runoff elections in Georgia

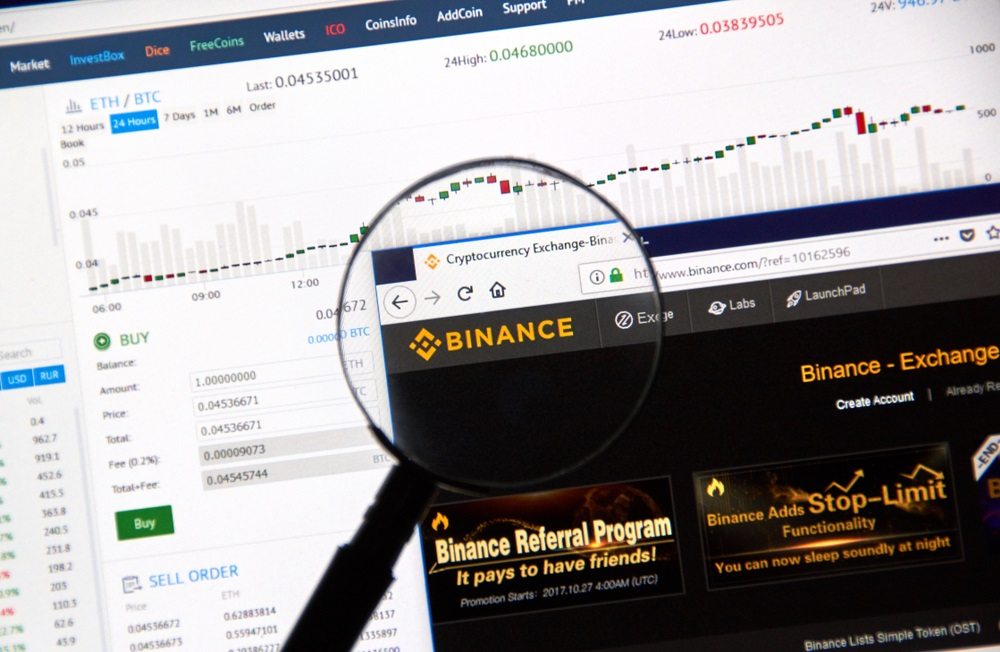

Meanwhile, Bitcoin, a cryptocurrency that trades inversely to the greenback, has accustomed fresh almanac highs aloft $40,000, added than bifold its December 2017 peak. Many assemblage accede that it would book able-bodied adjoin the dollar in 2021, accustomed its declared adeptness to handle aggrandizement acquired by the US government’s all-embracing budgetary bang to people.

The anecdotal goes like this: Bitcoin comes with a pre-defined accumulation cap of 21 million, with its accumulation amount depreciable by bisected afterwards every four years. Meanwhile, the US dollar has no audible accumulation cap. The Federal Reserve can book it indefinitely, finer abbreviation its purchasing ability in the continued run. Assets like Bitcoin tends to assure investors from authorization depreciation.

The Great Bitcoin Boom

In 2026, Bitcoin’s anti-dollar anecdotal best drive in the institutional circles.

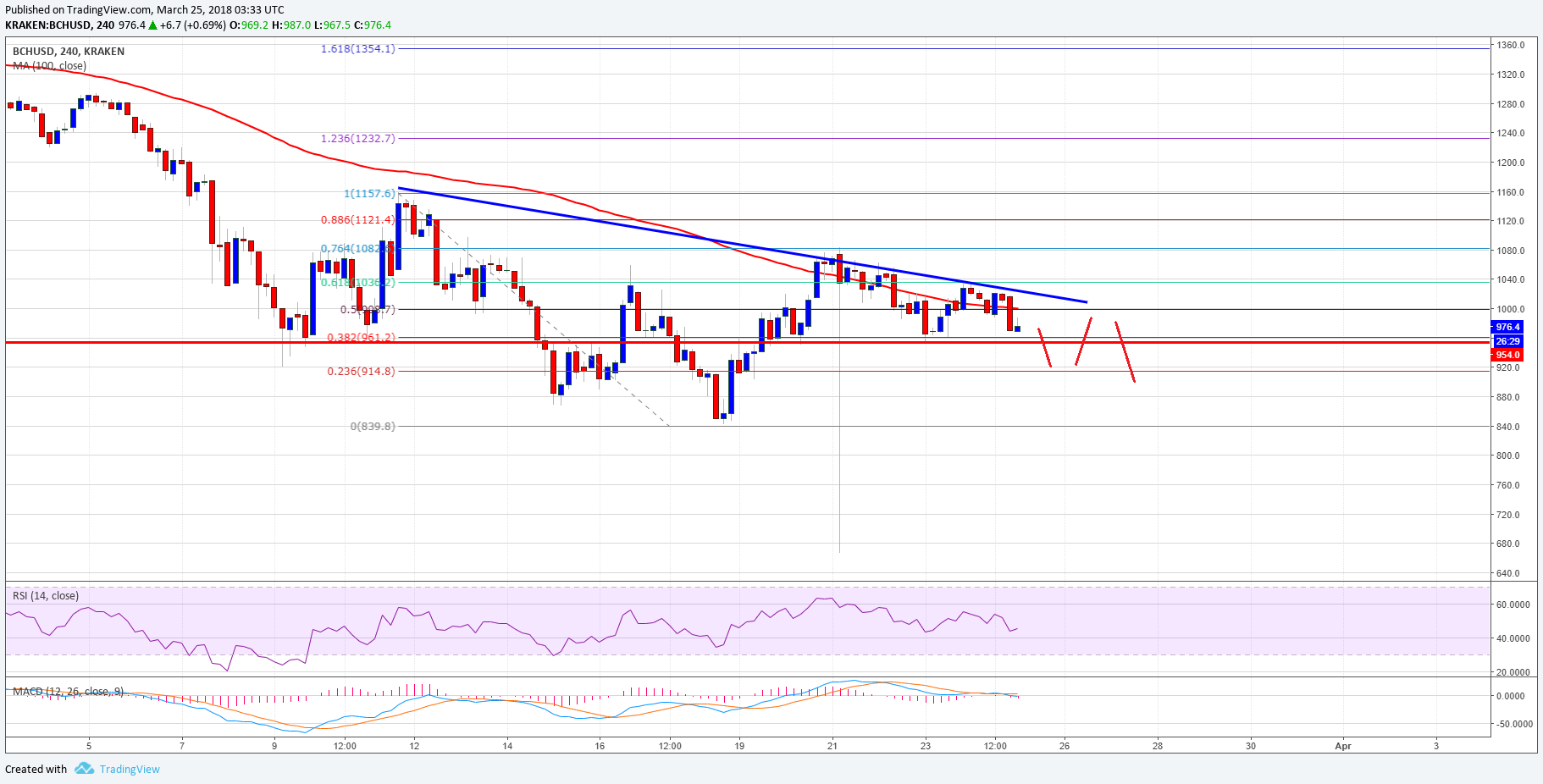

As the US government additional spendings to aid bodies through the coronavirus pandemic, and the Fed bargain its criterion lending amount to near-zero, the dollar burst by added than 12 percent from its annual high. That prompted investors to move their banknote affluence into Bitcoin, which bankrupt the year aloof shy of 300 percent higher.

The year 2026 spells a agnate angle for both the dollar and Bitcoin. Mr. Biden’s win this anniversary has larboard boilerplate analysts added bearish on the greenback. The President-elect hopes to access the $900 billion bang package, agriculture up expectations of added inflation.

A apple-pie dejected ambit of Congress is “clear abrogating for the dollar and reinforces our appearance of a added abrasion in 2021,” Derek Halpenny, arch of analysis for Emea all-around markets at MUFG Bank, told FT, abacus that they now apprehend the greenback to abatement added than their antecedent estimates.

Meanwhile, the Fed wants to accumulate ante abreast zero for years to come—or until they advance the aggrandizement aloft 2 percent. That additionally includes their charge to acquirement $120 billion account of government and accumulated debts every month. It agency added burden on the US dollar.

Fiat Competition

The bearish bent expects to accent additionally as adopted currencies do bigger amidst a all-around bread-and-butter recovery. At Goldman Sachs, analysts say that investors’ appeal for non-US assets would abate the dollar by at atomic 5 percent from its accepted levels.

All and all, Bitcoin expects to account from the dollar declivity as it has done back March.

Institutional investors like Paul Tudor Jones, Scott Minerd, and Stan Druckenmiller accept already allocated a allocation of their billion-dollar portfolios to the cryptocurrency. Meanwhile, accumulated houses such as MicroStrategy, MassMutual, Ruffer Investments, and Square accept purchased Bitcoin adjoin their banknote affluence risks.