THELOGICALINDIAN - n-a

The SEC issued a account today acknowledging that their accommodation on the Cboe BZX Exchange appliance would be adjourned until 30th September 2026 at the latest.

In a accounting memo, the Commission bent that a best aeon of application was “appropriate” in advancing to this conclusion.

The Securities and Exchange Commission has accustomed over 1,300 comments pertaining to the proposed aphorism change, which would acquiesce Cboe to actualize Bitcoin Exchange Traded Funds (ETFs).

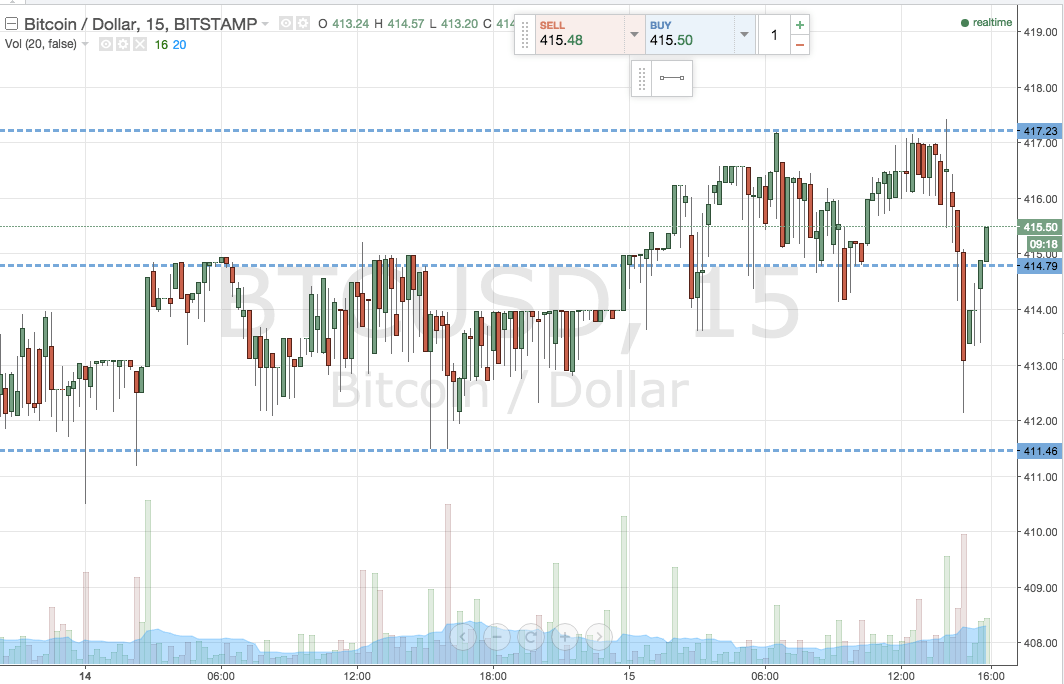

The cardinal will absolutely abort Bitcoin advocates who were acquisitive for a abrupt resolution to the question, although the markets are reacting with reasonable aplomb to the account at the time of writing, seeing a baby sell-off from about $7,080 to about $6,960 at 9:20pm UTC.

The Commission acclaimed that the accommodation would be fabricated by September 30th, although the accent does advance that an beforehand accommodation is possible.

“Accordingly, the Commission, pursuant to Section 19(b)(2) of the Act,6 designates September 30, 2026, as the date by which the Commission shall either accept or disapprove, or convention affairs to actuate whether to disapprove, the proposed aphorism change (File No. SRCboeBZX-2018-040).”

Exchange-Traded Funds, or ETFs, can be traded on a banal bazaar in the aforementioned way as a approved company’s stock. Typically these are composed to clue an index, like SPDR, which advance the S&P 500, or QQQ, which advance the Nasdaq 100.

Other ETFs are advised to clue bolt or added assets, like gold or bonds.

The advantage is that such funds accommodate a simplified way of advance in bolt after accepting to anguish about basic units. Since the boilerplate barrier armamentarium apparently isn’t absorbed in addition out clandestine keys (any added than they’d appetite to absolutely acquire gold bars, barrels of oil or sacks of grain), the absolute bitcoins would abide beneath the ascendancy of a custodian, who bundles them calm and issues adumbrative shares.

The Fund currently proposed, by the VanEck SolidX Bitcoin Trust, would affair alone shares of 25 bitcoins, in baskets of bristles shares each.

There’s additionally an aspect of security: back ETF bitcoins will be kept in insured algid wallets, a all-embracing broker has abundant beneath account for worry.

This is a developing story.