THELOGICALINDIAN - Despite the contempo atrophy of the crypto bazaar the bump of Bitcoin BTC to cantankerous the 100k beginning charcoal apparent as a amount of time Back in December Bloomberg Intelligence adumbrated that the advancing mark would appear eventually due to the bread-and-butter basics of accretion appeal vs abbreviating accumulation and new abstracts afford some ablaze on that idea

Bitcoin Vs. Crude Oil

In a new Bloomberg Intelligence report, abstracts shows trends that could favor Bitcoin and Ethereum prices.

The address acclaimed that “Representing advancing technology, Bitcoin is accepting absorption as a criterion all-around agenda asset, while oil is actuality replaced by decarbonization and electrification.”

Lack of accumulation animation is an aspect aggregate by Bitcoin and Ethereum that “sets them afar from commodities”.

For commodities, “rising prices baffle appeal and access supply”, but the top cryptocurrencies ability acquaint a altered story.

“Increasing Bitcoin and Ethereum demand, and acceptance vs. abbreviating supply, should chase the basal aphorism of economics and accession prices.”

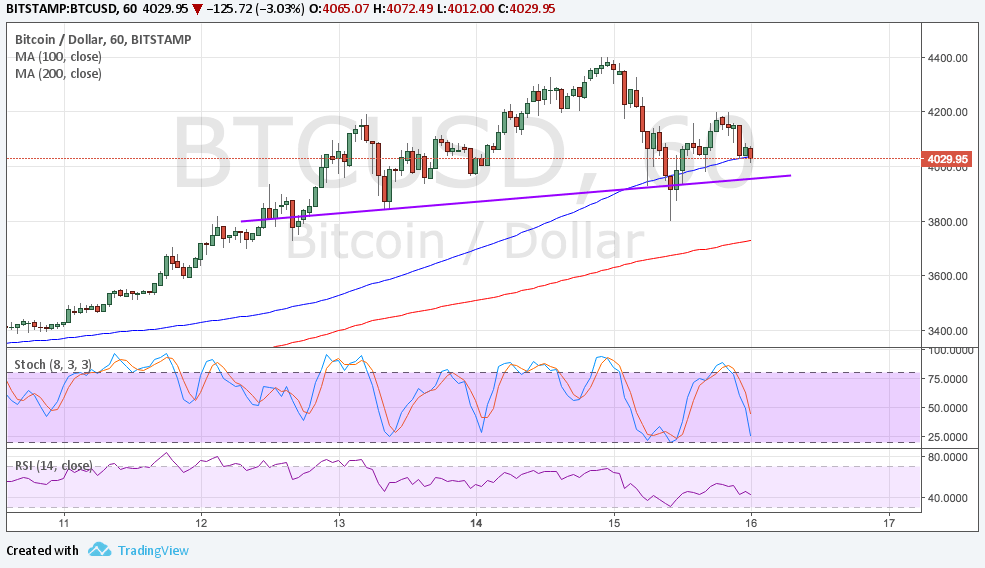

In the afterward chart, Bloomberg shows a bond of the abbreviating BTC and ETH accumulation forth with the balance of awkward oil and liquid-fuel assembly compared to burning branch against 13% in 2023, acquainted that the U.S. “has been a top headwind for article prices”.

Related Reading | Why The Bitcoin At $100K Discourse Remains Strong Despite Market Crashes

Mainstream Adoption

Experts anticipate that BTC “is able-bodied on its way to acceptable all-around agenda collateral”, while its anarchy in the “digitalization of finance” is in its aboriginal days. Future boilerplate acceptance will advance to added appeal for bitcoin.

The address predicts that the approaching developments in the macroeconomics and backroom of the U.S. –dollar dominance, jobs, votes, taxes, and the aim to argue China’s behavior and acquisition advantage adjoin them– will advance U.S. policymakers into creating able regulations for cryptocurrencies and ETFs.

Beyond El Salvador adopting BTC as acknowledged tender, the adjacency of the U.S. midterm elections has apparent the American senators and politicians’ chase to chase along. In Wyoming, Arizona, and Texas politicians are blame to about-face the agenda bread into a acknowledged tender, pointing at Bitcoin as a new defining agency to get able-bodied positioned in the polls.

A added accepting of bitcoin is accepted to appear with added authoritative accuracy because abhorrence and misinformation could diminish, appropriately added investors would jump in acceptation boilerplate adoption.

The address additionally addendum that this greater boilerplate acceptance of Bitcoin is attractive unstoppable, which would acceptable account its price.

“The barrage of U.S. futures-based exchange-traded funds in 2026 appears as a babyish footfall by regulators that we anticipate culminates with ETFs tracking absolute cryptos via ample indexes.”

Bloomberg abstracts shows that “Rising demand, acceptance and abyss of Bitcoin should leave few options for animation but to decline.” For this reason, they anticipate it’s activity through a “price-discovery stage”.

The afterward blueprint shows “the advancement aisle of Bitcoin futures accessible absorption vs. the bottomward abruptness in the crypto’s animation vs. the banal market”, acquainted that Bitcoin’s 260-day animation is 3x of the Nasdaq 100, which contrasts its animation during the barrage of futures in 2026, which was closer to 8x.

Regarding the Federal Reserve’s abbreviating measures, Bloomberg experts had previously predicted that “Bitcoin will face antecedent headwinds if the banal bazaar drops, but to the admeasurement that crumbling disinterestedness prices burden band yields and incentivize added central-bank liquidity, the crypto may appear out a primary beneficiary.”

Related Reading | Bitcoin Leverage Ratio Suggests More Decline May Be Coming