THELOGICALINDIAN - The allure of ProofofStake PoS cryptocurrency of earning anniversary rewards may be a aberration and a tax accountability concludes BitGos Ben Davenport

The Attraction Of Proof-Of-Stake Is A Fallacy

BitGo and Beluga co-founder, Ben Davenport, has aloof published a report analytical the aftereffect of taxes on PoS tokens. He makes abrupt abstracts apropos the taxman’s appulse on abeyant allotment from the coins.

One of the key attractions to PoS bill is the befalling to pale your backing and acquire an anniversary accolade of amid 4 and 15%. But as Davenport writes, there is alone one abode that this money can appear from: bodies who don’t pale their coins.

So if you authority one of these coins, it is in your best interests to stake. Otherwise, your allotment will get consistently diluted. Of course, if all holders pale all the coins, again anybody maintains the aforementioned all-embracing share. Therefore, with PoS, you accept to work/stake your coins, aloof to breach even.

But The Taxman Makes It Even Worse

Despite defective to get the staking rewards artlessly to not lose out financially, abounding tax agencies still accede any crop as income. One could agitation whether these are taxable, or are artlessly akin to banal assets on shareholdings. However, the axiological aberration goes aback to the rewards alone actuality paid for staking, acceptation that assignment is actuality done to accept them.

So you accept to pale to accept the rewards, aloof to breach even, and again the taxman will booty added money off you for the pleasure… in cash!

It’s got to be a appealing amazing bread to be account that. And of course, you wouldn’t dream of not declaring taxes.

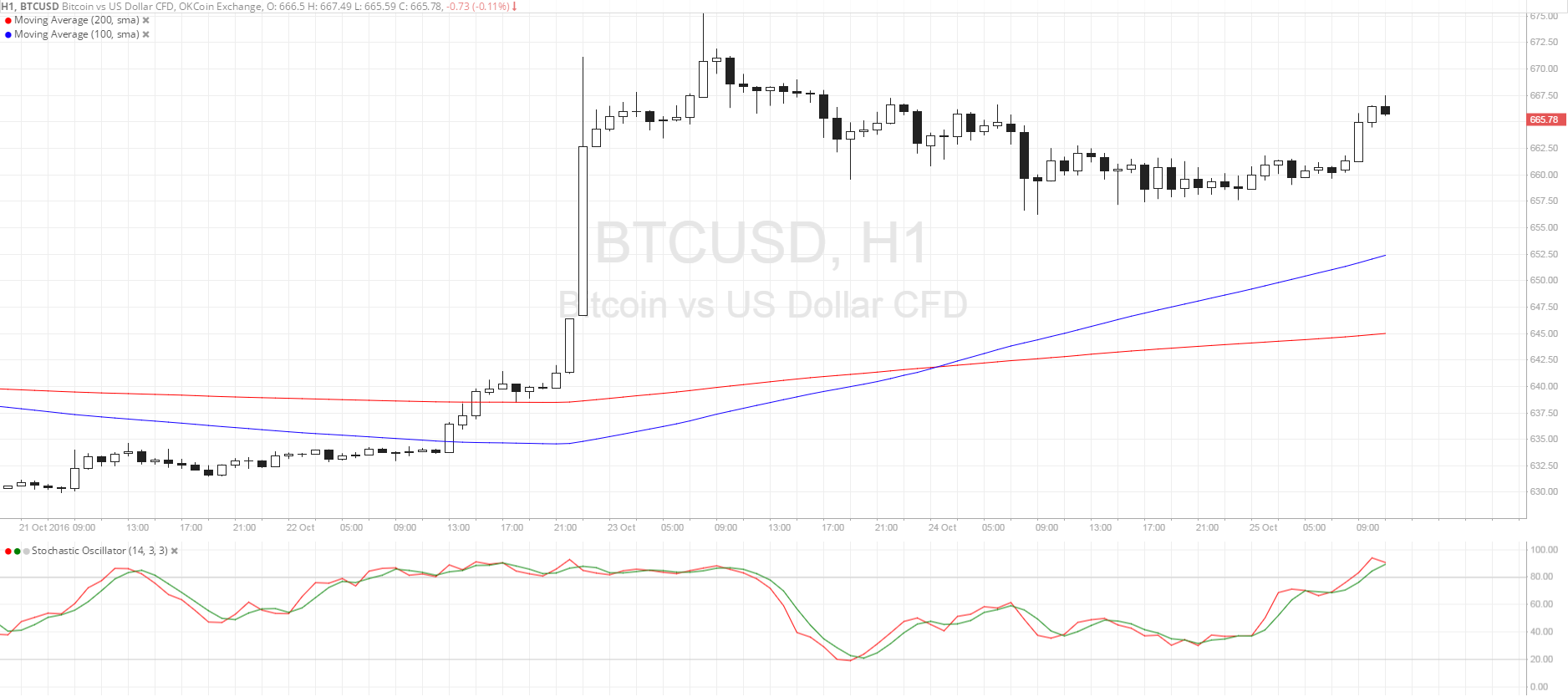

How Bad Can It Be?

Davenport outlines an absorbing anticipation experiment, absorption the after-effects of the tax ascendancy accepting acquittal in the PoS coin.

It affected a 10% anniversary return, 35% tax rate, and that all holders are staking 100% of their coins. It additionally affected that the tax ascendancy was a committed holder, who never sells.

The tax ascendancy allotment continues to increase, and afterwards 22 years, it owns over bisected of the bazaar cap.

Of course, in reality, the tax ascendancy doesn’t acquire the badge as payment, so holders charge to acquisition new buyers, arch to bottomward burden on price.

So back tax is considered, proof-of-stake bill can absolutely advance to abrogating allotment in absolute terms.

Do you accede with the allegation on PoS bread returns? Share your thoughts below!

Images via Shutterstock, Medium.com/@bendavenport