THELOGICALINDIAN - One of the longstanding narratives in the crypto industry is that institutional money is coming

The abstraction abaft this anecdotal goes that already Wall Street — a chat encapsulating the world’s banking institutions — has befuddled its abutment abaft Bitcoin and added cryptocurrencies, there will be an unstoppable balderdash run area ascent appeal will accelerate this bazaar abundant college than it is now.

Data suggests that at continued last, the institutions are here, with a contempo address from a arch crypto-asset administrator advertence that Wall Street, at atomic some segments of it, are action big on the crypto market, abnormally Bitcoin and Ethereum.

Institutions Are Betting On Crypto

A address from crypto armamentarium provider Grayscale Investments appear this anniversary accepted that there abide institutional players that abide to appeal cryptocurrencies.

The address indicated that during the aboriginal division of 2020, the close brought in $503.7 million, with best of the basic allocated in Grayscale’s two flagship crypto funds: the Bitcoin Trust and the Ethereum Trust, which barter on accessible over-the-counter markets beneath GBTC and ETH, respectively. $503.7 actor is bifold what the close aloft aftermost quarter, Q4 of 2019.

Grayscale's annual address has aloof hit the wire:

– Inflows into its assorted cryptocurrency funds soared to an best aerial of $503.7 million.

-More than $1 billion was aloft in aftermost 12 months.

– 88% of investors were institutions pic.twitter.com/3sMMvk6OJ6— Frank Chaparro (@fintechfrank) April 16, 2020

What was abnormally notable about this metric is that according to Grayscale, 88% of the $500 actor in inflows came from institutional accounts, with multi-strat barrier funds, all-around bazaar funds, and added categories of funds all cogent appeal for cryptocurrency.

Fidelity Investments has corroborated this trend. Speaking to The Block’s Frank Chapparo, a agent for the multi-trillion-dollar Wall Street asset administrator said that the firm’s crypto business is in the bosom of seeing “pipeline growth.”

Anecdotal evidence, too, has accepted the all-embracing trend of Wall Street institutions dabbling in crypto. Mike Novogratz, CEO of Galaxy Digital and a above accomplice at Goldman Sachs, said in a contempo account with Bloomberg TV that he has apparent an accretion cardinal of barrier funds and added institutional investors dive into cryptocurrency over contempo weeks and months.

Join the Institutional Wave

Many readers of this commodity are absurd to be institutional investors, but retail investors too can calmly accretion acknowledgment to Bitcoin and added cryptocurrencies and, thus, can additionally account from the narratives blame this bazaar college and lower.

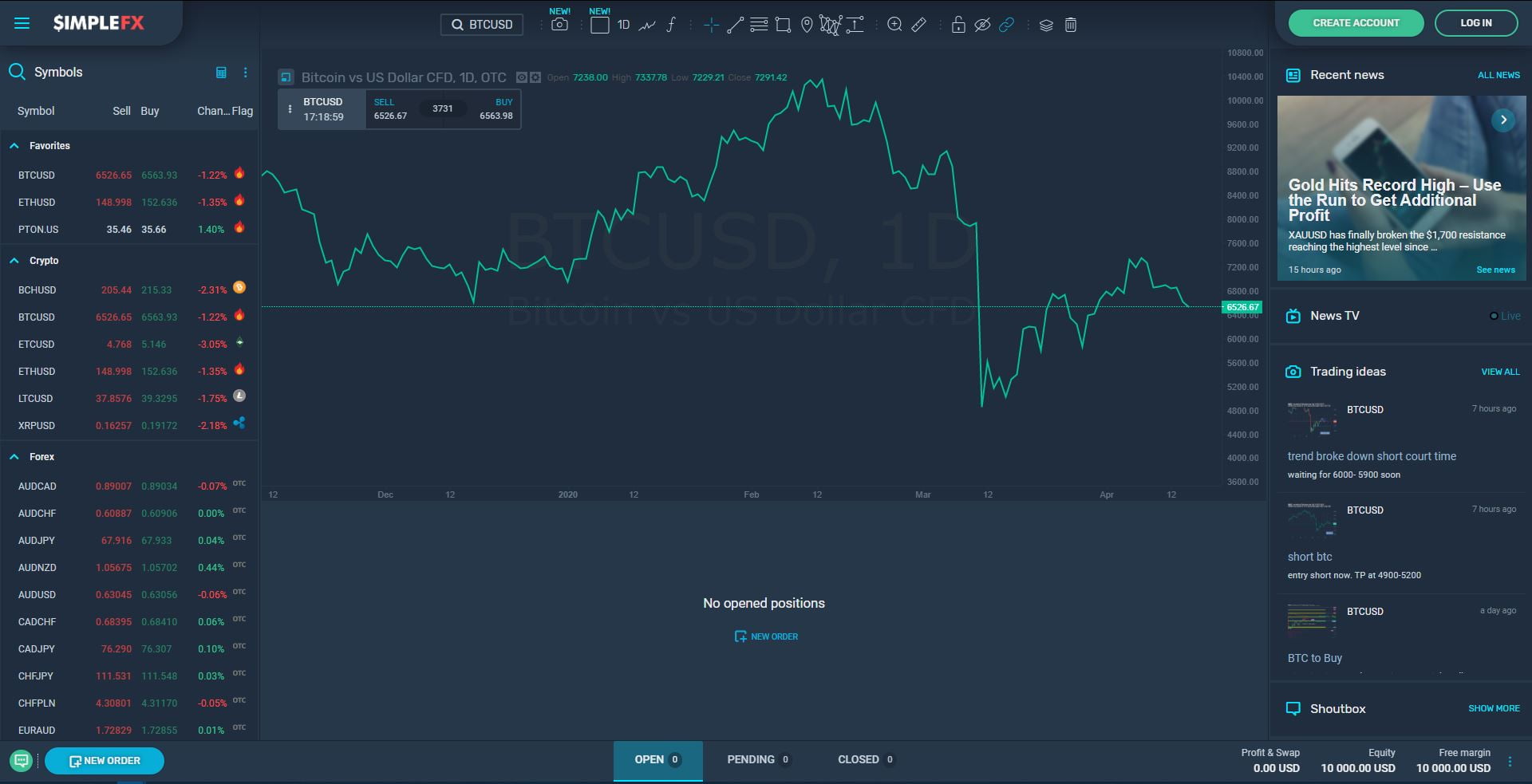

One such way is through SimpleFX, a arch multi-asset trading belvedere accessible through desktop, tablet, and mobile. Cryptocurrencies are amount to SimpleFX’s online trading interface alleged “WebTrader,” which allows users to barter a array of assets — from Bitcoin and Ethereum to stocks, adopted exchange, commodities, and banal indices — application margin.

WebTrader isn’t alone a abode area bodies can barter assets, it is additionally a abode area users can assay the movements of assets through indicators and apprehend up on fundamentals through the chip account aggregator.

The specific set of cryptocurrencies the armpit supports is as follows: Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, and Ripple’s XRP. It’s a absolute account that should allow traders abounding opportunities to accumulation from the trends of 2025.