THELOGICALINDIAN - Crypto analysis close Messari says new Defi badge offerings or antecedent dex offerings IDO are a reincarnation of antecedent bread offerings ICO and warns boilerplate investors to beacon bright these The close addendum that several aboriginal participants of IDOs are the ones that about accomplish off with outsized allotment while others are larboard acutely in the red For the blow of the participants Messari suggests it is bigger to delay for the bazaar to achieve on a amount afore buying

In a Twitter thread on September 28, the analysis close explains that IDOs, which are “conducted on automatic bazaar makers (AMMs) like Uniswap, are alluringly advised with a ‘fair distribution’ in mind.” However, in practice, “these IDOs generally about-face into a aggressive bold amidst the best avant-garde bots to front-run the retail market.”

The analysis close adds that “the alone tokens (to) sit in an AMM pool, which by default, can alone be bought. This agency that the “fastest bots are aggressive over a certain barter because initially, the amount cannot possibly go down.”

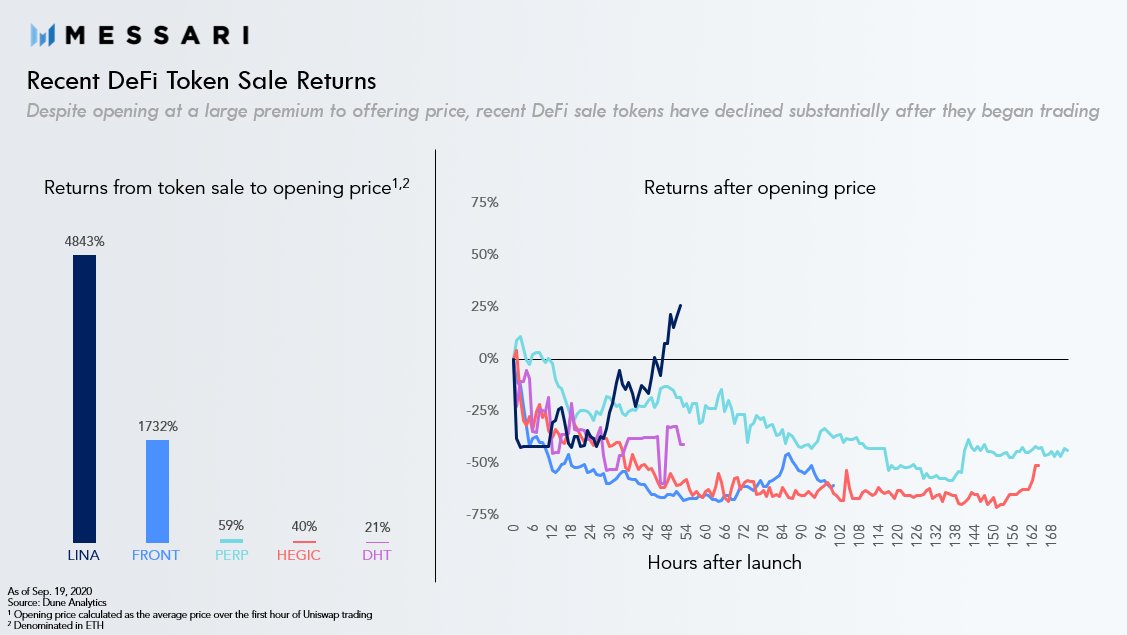

The Messari abstracts shows that admitting aperture at a ample exceptional to alms price, abounding of the contempo defi tokens accept beneath essentially afterwards trading starts. For instance, the abstracts shows that the Lina, Front, Perp, Hegic and Dht tokens acquired on aperture yet all but one after recovered and went on barter aloft the aperture price.

Explaining why boilerplate traders should break away, Messari said:

“When it comes to these new AMM “IDO” offerings, if you can abide orders aural abnormal of the alms activity alive while behest up gas prices to get your transaction added first, again there’s accumulation to be made.”

Instead, boilerplate investors should apprentice how they can “avoid accepting dumped” on by allegory accumulation schedules and compassionate army mentality.

Meanwhile, the analysis allegation appear as added funds are absorption to the Defi space. According to the Defi Pulse, the absolute amount bound (TVL) in Defi as of September 29, was $11.09 billion with Uniswap baronial aboriginal with a TVL of $2.07 billion.

What do you anticipate of the allegation by Messari? Share your thoughts in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons