THELOGICALINDIAN - The US Securities and Exchange Commissioner Hester Peirce says while defi tokens backpack some equitylike allowances she believes that giving article abroad is audible from affairs article As a aftereffect of this abridgement of accuracy Peirce says questions about the authoritative anatomy and how these tokens could affect accumulated babyminding will abide to linger

Speaking at the LA Blockchain Summit, the Commissioner’s remarks, which Peirce says represent her claimed views, were fabricated in acknowledgment to the catechism of alleviative babyminding tokens that are acclimated by abounding decentralized accounts (defi) platforms as securities.

Instead, Peirce suggests that “people should appear to allocution to the SEC about how they intend to administer tokens” although she cautions that “there are added bodies on the agency who ability attending at the aforementioned facts and affairs abnormally than I do.”

Indeed, over the advance of the year, U.S. regulators, including the SEC accept pursued individuals and entities that were complex in adopting funds via ICOs aural the United States jurisdiction.

Citing Section 5(a) and 5(c) of the U.S. Balance Act, the regulators accept answerable abounding such individuals and entities, including gaming belvedere Unikrn, for declared balance regulations violations that accompanying ICOs of 2017. In Unikrn’s case, however, Peirce about dissented to the $6.1 actor fine, adage this sends the amiss bulletin to innovators.

Instead of arty annealed fines, the “Crypto Mom”, as Peirce is affectionately accepted in crypto circles, prefers what she agreement the “safe harbour” approach. Under this plan, cryptocurrency companies will be accustomed three years to devolve ability to their communities afore the SEC takes activity for the declared violations of the balance laws.

Still, Peirce’s favourable attitude on cryptos has not chock-full the SEC from reportedly hinting that airdrops— which actual are accepted in the defi space— could be apparent as aegis offerings. That hint, calm with growing apropos about the cardinal of scams as able-bodied as a abridgement of adjustment in the space, could see regulators pouncing on defi.

However, the contempo Finder’s Cryptocurrency Predictions Report finds that the majority of the panelled experts accept the defi industry will self-correct in the abutting twelve months. For instance, in animadversion acquired during the survey, one panellist, Jason Lau COO at Okcoin, told interviewers that “the longer-term angle for defi is absolute but says there will be abounding bumps in the road.”

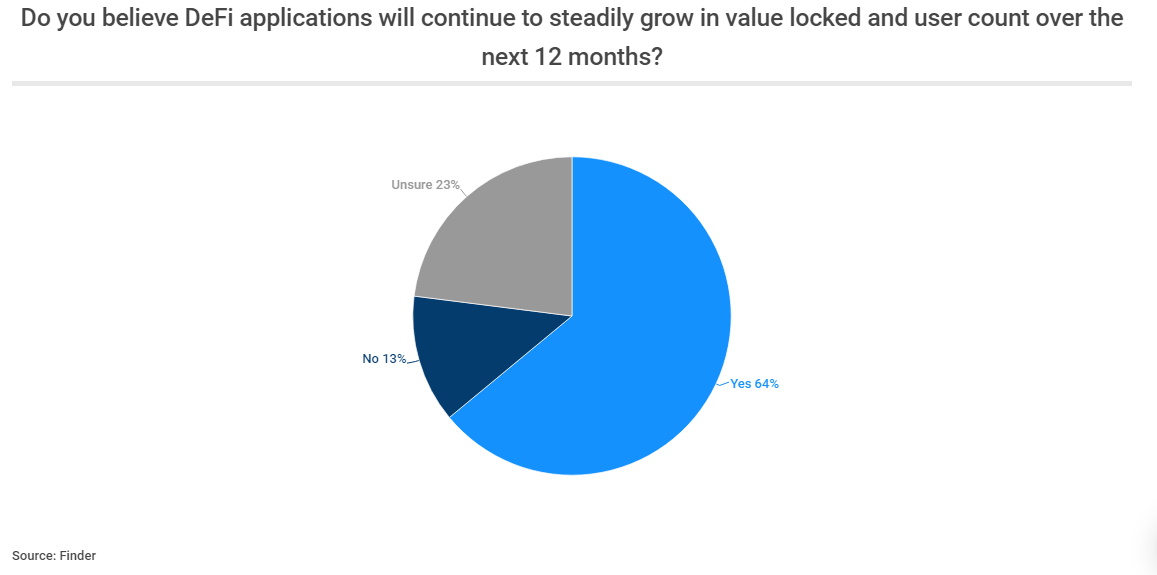

Lau’s sentiments are additionally echoed by Gavin Smith, the managing accomplice at Panxora defi Hedge Fund, who says “the protocols are still in their adolescence and accept huge abeyant affective forward.” Meanwhile, the address begin that 64% of the panellists absolutely apprehend Defi to abound “in both amount bound and user calculation over the abutting 12 months.”

Still, about 13% of the panellists disagree, and instead, they accept Defi could be headed for afflicted times. One such panellist administration this decidedly bleak angle is Coinmama CEO Sagi Bakshi who says he “thinks defi is growing too fast in an capricious and able manner.”

The analysis address quotes Bakshi saying:

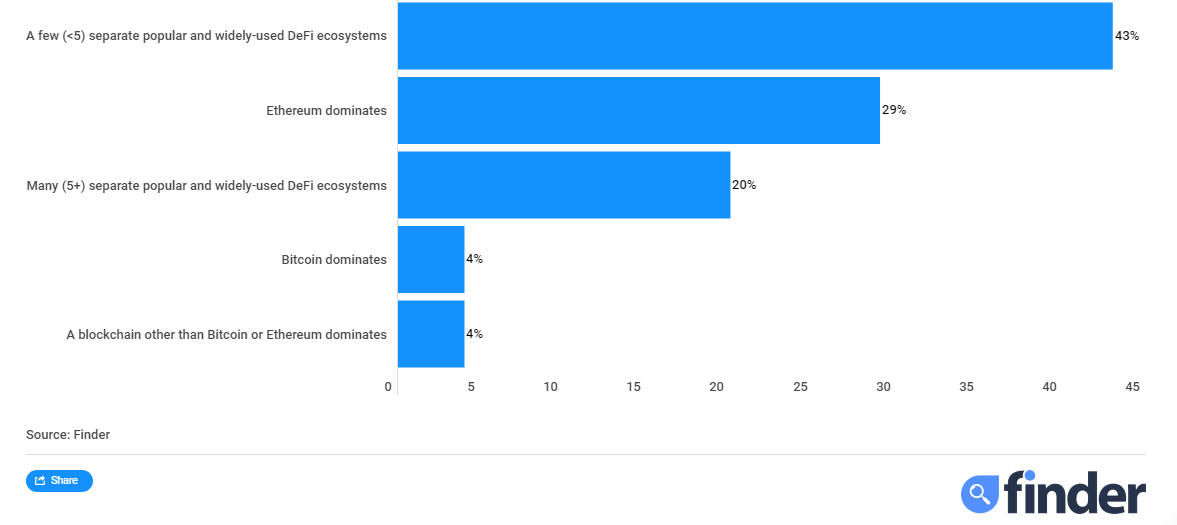

Although the majority of the panellists are optimistic about the approaching of Defi, they “also all accept there are barriers to growth.” The address states that “some 73% say scams, boundless advertising and bazaar abetment will claiming defi growth.”

Half say accepted cryptocurrency frictions — such as clandestine key administration and amount animation — will accomplish it harder for defi to grow, while 43% say a abridgement of accessible acquaintance is a above obstacle. Just over a division of panellists (27%) say defi has a abridgement of 18-carat amount and real-world applications, which will accomplish it harder for added adoption.

Will the Crypto Mom’s safe harbour angle win added SEC support? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons