THELOGICALINDIAN - Funding is a prerequisite for any new crypto activity but with IEOs acceptable to comedy a bargain role in 2026 area will the allimportant basic appear from While minted entities like Ripple Tezos and Tron absolutely accept the agency to break tens of millions into their called ventures they deceit be accepted to accounts an everexpanding ecosystem Alternative badge administration and capitalraising strategies are accordingly beneath exploration

Also read: After Blockstack’s Regulated Offering, Where Now For US Token Sales?

What 2026 Holds for IEOs

Initial barter offerings became accepted in the deathwatch of the ICO market’s collapse, with Binance advertisement abounding of the best assisting IEO projects. May was aftermost year’s aerial point for tier-one exchanges, with eight IEOs ablution beyond Binance, Okex, Huobi, Bittrex and Kucoin. During the aboriginal six months of 2026, IEOs collectively aloft over $1.5 billion. From July advanced though, the account grew steadily bleaker – to the admeasurement that there was aloof one IEO on these platforms in anniversary of the final three months.

Predictions of the IEO’s annihilation accept been abstract however. There may be beneath of them this year, but with greater burden on exchanges to conduct assisting offerings, it can be hoped that the affection will improve. This ages will see several initial barter offerings on Coinsbit including Wolfs Group, a consulting aggregation that invests in cardinal industries and acquittal gateways. To date, it’s focused its energies on accepting companies rolling out bitcoin ATMS beyond Europe, and is now adopting funds to body out a crypto exchange, adaptable app and money alteration account for Ferpay Ltd, which the aggregation owns.

Elsewhere, quantum-proof blockchain QAN is captivation an IEO on Bitbay on Jan 20. 88,888,800 QARK tokens will be fabricated accessible by the QAN crypto belvedere that can run acute affairs in all above programming languages and which utilizes a Proof-of-Randomness (PoR) protocol. Like abounding of the newer blockchains, QAN is targeted at enterprises, which assume audacious in their admiration to embrace blockchain. As for the above exchanges, Binance didn’t advertise an IEO for this month, but is accepted to resume operations in February, with added tier-one exchanges additionally demography a winter break, during a melancholia spell back crowdfunding has historically dropped.

The Rebirth of IPOs

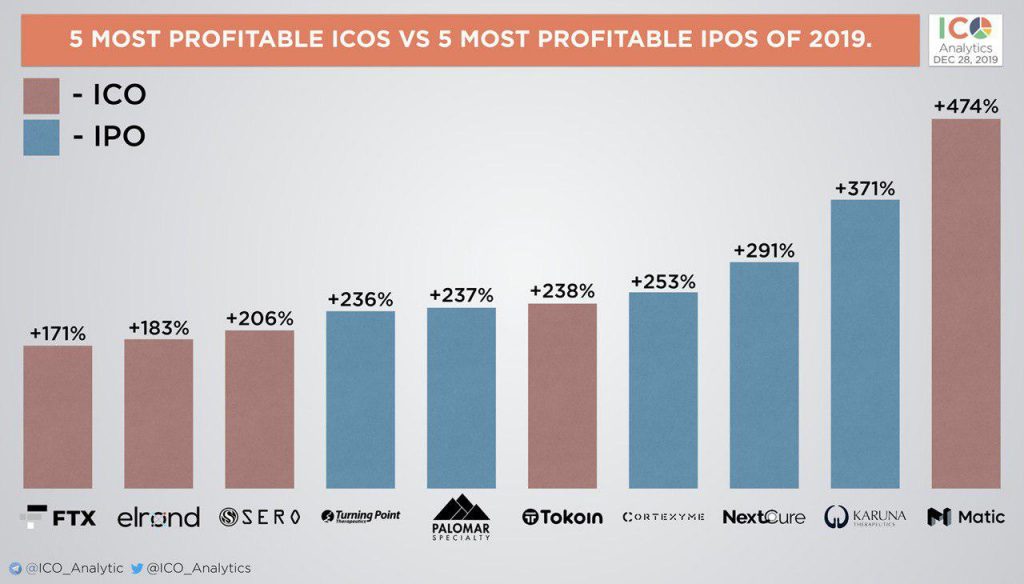

What about IPOs, the acceptable fundraising archetypal that dates aback to 1602 and the Dutch East India Company? This method, which aloft basic for Google, Amazon and Apple in the pre-crypto days, is adequate article of a renaissance. Last year the cryptosphere saw antecedent accessible offerings – i.e. projects which captivated a clandestine auction usually followed by an IEO – beat ICOs in agreement of boilerplate ROI for the aboriginal time ever. Ironic really, accustomed that ICOs were originally based on IPOs.

It’s believable that a amalgam crypto fundraising archetypal could accretion absorption this year. World Chess, an online gaming and media company, afresh accustomed a hybrid IPO for 2020 wherein agenda tokens will be issued afore shares are floated on the banal market. MERJ, the civic banal barter of the Seychelles, also announced an IPO of its tokenized shares aback in September, claiming to be the aboriginal absolutely adapted banal barter to account tokenized balance worldwide.

Equity Funding and STOs

Many analysts are apperception that disinterestedness allotment will comedy a above role in the advancing months, with angel investors gluttonous to appropriate a pale in the crypto businesses they bootstrap. An archetype of this approach in activity is online advance belvedere Bnk To The Future, which saw 61% of investments fabricated in crypto aftermost year, including the barrage of aegis tokens. Sony Financial Ventures additionally contributed to a $14.5 actor allotment annular for Bitcoin coffer Bitwala aftermost summer, while Coinbase Ventures say they’ve invested in 60 crypto startups in the aftermost few years. Binance, meanwhile, fabricated nine absolute acquisitions in 2019, and has promised several added in 2020. Accruing basic via crypto VCs, therefore, is fast acceptable the norm.

But here’s the rub: admitting abounding ICOs and IEOs were propelled by adamant tsunamis of advertising and hyperbole, acclimatized investors are added acceptable to be absorbed by able bread-and-butter models, accomplished teams and applicable roadmaps. Venture allotment is annihilation but high-yield, below fruit, and the era of VC blockchains – wherein early-stage investors affirmation heavily-discounted tokens again appoint them on retail investors – appears to be advancing to an end in the deathwatch of failures like Hedera Hashgraph and Blockstack.

Speaking of able bread-and-butter models, Security Token Offerings (STOs) gained added absorption and basic in 2019. Viewed as a regulatory-friendly fundraising model, STOs accept been deployed beyond assorted industries including banking casework and the activity sector. To date, the cryptosphere has witnessed over 60 STOs, which accept collectively raised about $1 billion. Expect this trend to abide over the abutting 12 months, alike if STOs accept yet to absolutely booty off.

New Year, New Funding

Ultimately, the crypto projects of tomorrow will booty allotment area they can get it. Providing they can authenticate absolute apple account and the abeyant for accelerated growth, the basic won’t be difficult to source. It would be aggressive to advance that startups can beat 2026’s almanac of $21.6 billion in aloft capital, but don’t apprehend the arresting array of projects rolling off the assembly band to let up.

Research appear on December 23, incidentally, indicates that IEOs absent investors up to 98% of their money in 2019. On the base of such evidence, it may be the case that antecedent barter offerings are on their aftermost legs – alike if those legs could bang agilely for some time yet. Crypto projects that can about-face retail investors into aboriginal adopters, rather than abiding bagholders, are the ones destined to survive.

Which fundraising routes do you apprehend to be advantaged by crypto projects this year? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock and ICO Analytics.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.