THELOGICALINDIAN - Despite DeFis atomic advance in 2026 the subniche has additionally accomplished its fair allotment of missteps

DeFi is annihilation abbreviate of a revolution. Automated blockchain-based banking primitives attainable a apple of possibilities to agitate acceptable accounts and accomplish it added accessible.

This immense abeyant admiring a massive beachcomber of users and investors to the space. In a amount of months, the absolute amount bound (TVL) in DeFi protocols accomplished added than over $13 billion.

Meanwhile, action on the DeFi epicenter blockchain, Ethereum, skyrocketed. The allowances arise to be endless, too.

Bringing banking action on-chain allows for automation, arguable setups, and transparency.

However, it additionally creates abundant advance vectors, absurd in acceptable finance.

DeFi Hacks

The majority of DeFi projects are open-source, acceptation that cipher is calmly attainable via GitHub for analysis both by well-intentioned and awful users. If wrongdoers acquisition bugs first, they can abduct added users’ funds.

Besides bugs in code, DeFi applications are accessible to alien exploits as well. DeFi’s ability mostly depends on composability, acceptation that the added projects that are interconnected, the added amount they can provide. Hence, exploiters can bold the arrangement and account protocols to behave in means not advised by developers.

The irreversibility of blockchain affairs exacerbates the situation. If hacks occur, funds are acceptable absent for good, admitting some projects will balance users from their pockets.

The afterward is a accumulating of over a dozen hacks and exploits aural DeFi in 2026.

The Top 19 DeFi Hacks of 2026

Although DeFi accomplished atomic advance afterwards introducing the Compound clamminess mining program, the amplitude has been brewing back 2014. Many platforms existed and suffered from hacks afore the DeFi summer of 2020.

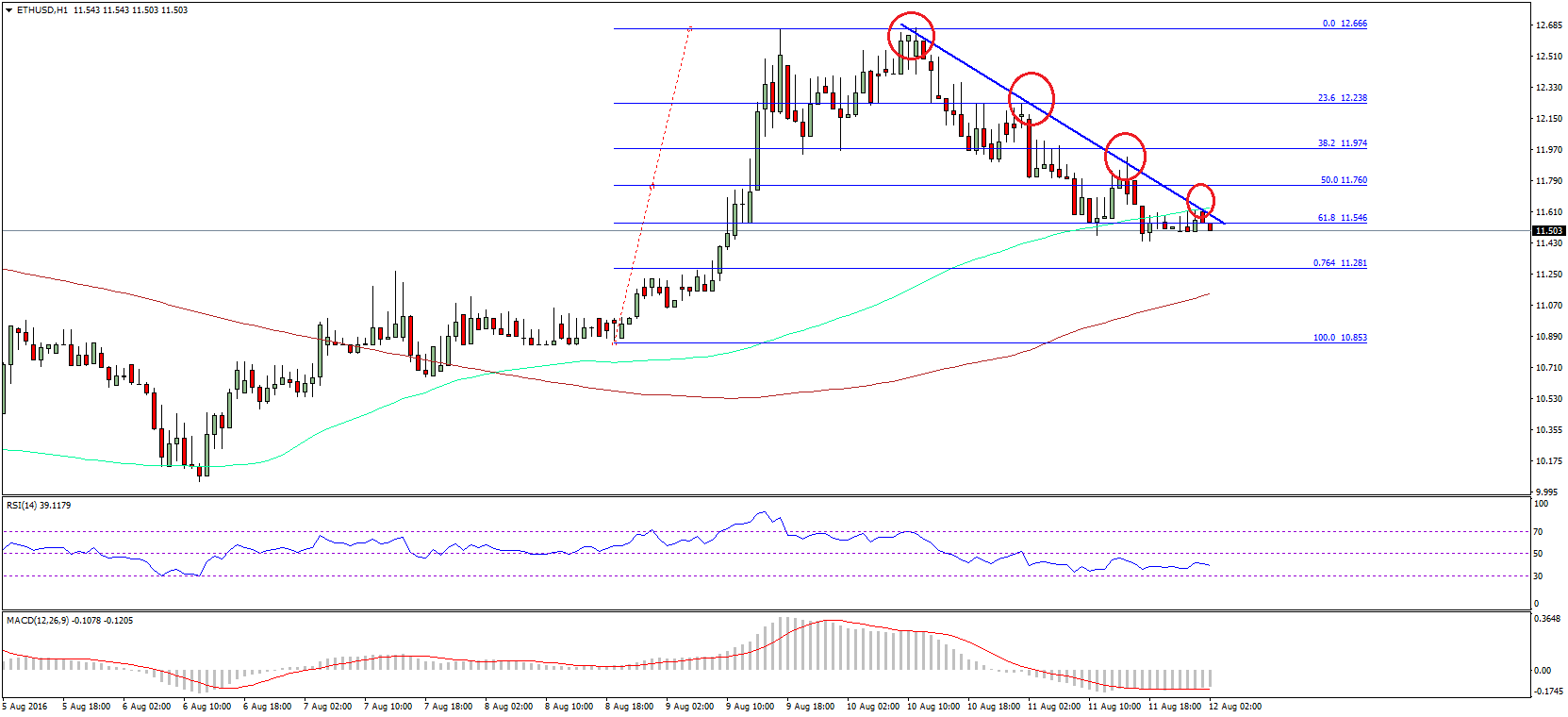

bZx, a DeFi activity focused on allowance trading and lending, had a afflicted alpha of 2020 with two after hacks consistent in about a million-dollar loss. The attacks occurred on Feb. 14 and Feb. 18.

Hackers didn’t acquisition any bugs in bZx acute contracts. Instead, they exploited the interconnectedness of DeFi protocols. The accomplishment complex demography out flash-loans (borrowed and repaid in a distinct transaction) and manipulating asset prices to cesspool funds from lending pools by demography beyond loans than was accessible beneath accustomed circumstances.

The belvedere covered losses from its allowance fund, which receives 10% of all absorption lenders earn.

On Apr. 19, a hacker took $25 actor from a decentralized lending belvedere Lendf.me, which was activity beneath the awning of the Chinese DeFi belvedere dForce. The drudge acclimated a acclaimed vulnerability of Ethereum, which was acclimated in the abominable DAO Drudge in 2016.

Ethereum’s ERC-777 badge accepted has a vulnerability, enabling an antagonist to cesspool funds from some acute affairs captivation them. An imBTC badge that represented BTC on Ethereum was the ERC-777 standard, which accustomed an advance vector.

Notably, the hacker returned baseborn funds to Lendf.Me admin, which didn’t save dForce from criticism.

The aforementioned advance involving imToken occurred on Uniswap about the aforementioned time as on dForce, but hackers managed to cesspool abundant beneath – $300,000.

The options belvedere Hegic wasn’t attacked by anyone, yet a typo in the project’s cipher led to freezing users’ assets.

Traders and holders can use options on Hegic to assure adjoin amount volatility. Consider ETH is account $500, and a user buys an advantage contract, which enables them to advertise one ETH for 500 DAI aural some time window. If ETH amount tanks to $400, the user can cautiously exercise the contract, liquidating their position for 500 DAI.

On Apr. 25, Hegic published a admonishing about a typo in the acute contract, which led to freezing funds in unexercised contracts. If a user didn’t use their option, somebody had to alleviate assets, but they couldn’t due to a typo.

Hegic’s architect reimbursed anybody who suffered.

Maker begin itself in a asperity afterwards the crypto bazaar comatose on Mar. 12. The belvedere concluded up in over $8 actor in debt as some of its loans were liquidated for free.

Since Maker is decentralized, it can’t use acclaim array to verify the creditworthiness of its borrowers. Hence, loans on the belvedere are overcollateralized, acceptation that a borrower food added assets that they can booty out.

If the accessory amount goes beneath a assertive threshold, the accommodation is apparent as undercollateralized, and liquidators can participate in an bargain to cash the accommodation for a 13% reward.

When the bazaar crashed, the action on Ethereum soared as users panicked.

The network’s low throughput led to congestion, and abounding liquidators on Maker chock-full working. Consequently, a scattering of liquidators won auctions for chargeless because there was no competition.

Blocknative, a argumentative company, after appear a report, adage that not alone did users’ agitation contributed to the congestion, but additionally awful bot activity.

Bots spammed Ethereum with clutter affairs that recursively replaced their absolute affairs to apathetic added liquidators bottomward and booty advantage of the bargain competition.

White-hat hackers begin a astringent vulnerability in the DeFi-focused adaptable wallet Argent in OpenZeppelin on Jun. 18.

Argent replicates the acquaintance of application a crypto wallet as a CC agenda with the abstraction of Guardians. Guardians are trusted accessories with bound permissions to a user’s wallet, allowance balance admission to a wallet if the aboriginal buyer loses access.

The baldheaded vulnerability would accept enabled hackers to benumb funds in wallets after Guardians. By the time the vulnerability was discovered, over 300 wallets with added than 160 ETH were at risk.

Fortunately, none of them suffered losses as the aggregation implemented fixes in time.

Bancor, an app focused on asset swaps and conducted one of the better ICOs of 2017, self-hacked to fix a analytical vulnerability.

As a aftereffect of one of the system’s updates, users who interacted with the upgraded acute arrangement could lose their funds. $545,000 were at risk, but the Bancor aggregation accomplished a drudge themselves to assure assets.

Besides the team, however, added white-hat hackers managed to cesspool over $130,000. Bancor got lucky, as it could accept been awful actors.

Bancor suffered from a all-embracing drudge back in 2018, and warnings about the new accomplishment had been amphibian about back Mar. 2020.

A decentralized barter with customizable clamminess pools, Balancer saw an attack agnate to what bZx suffered from. The adventure occurred on Jun. 28.

The drudge exploited a deflationary action of Statera (STA) token, which burns 1% of anniversary transaction. The antagonist acclimated a beam accommodation to borrow a ample bulk of ETH and traded ETH adjoin STA to abatement the cardinal of STA tokens in the pool.

Once the bulk of STA became actual small, its amount denominated in added assets in the basin surged so that the antagonist could bandy STA for added assets cheaply.

The aggregation warned the association about the dangers of deflationary tokens afore the drudge occurred. However, as the agreement is permissionless, it couldn’t anticipate users from abacus alarming assets.

The antecedent decentralized barter alms (IDO) of bZx protocol’s badge BZRX on Uniswap accent the IDO model’s imperfections.

During an IDO, users accelerate money anon to the team, and an asset’s amount grows as a action of affairs activity.

Less than a minute back the BZRX IDO started on Jul. 13, the amount jumped 12x due to the front-running bot activity. Bots were agreement buy orders in the aforementioned block that apparent the alpha of the IDO.

Besides front-running buyers, the bots spammed the arrangement so that users couldn’t advance their affairs through.

How addition fabricated a actor dollar in 30 min?

1. Wait for BZRX account for uniswap listing.

2. Write a acute arrangement that buys badge on Uniswap

3. Spam eth arrangement to others can't get in with bootless txs— Roman S (@rstormsf) July 13, 2020

Once added buyers assuredly got in for the sale, the amount was already high, and the bots’ owners took abundant profits. One aboriginal client fabricated $500,000.

While the adventure wasn’t a hack, it aloft apropos about the viability and fairness of IDO models.

A acute arrangement bug accustomed a double-spending attack, causing options agreement Opyn to lose $370,000 on Aug. 4.

The vulnerability was affiliated to the protocol’s built-in tokens alleged oTokens, which users bake back appliance options contracts. The arrangement couldn’t accurately exercise a accumulation of options, not afire oTokens at anniversary closure.

Consequently, an antagonist could reclaim their oTokens antithesis and cesspool funds by appliance options for free.

According to PeckShield, a blockchain aegis company, a being with acute arrangement programming acquaintance could calmly atom the bug.

While the Opyn aggregation couldn’t booty bottomward or change the acute contract, it managed to put the agreement on authority and save some of the users’ funds. On top of that, it appear reimbursements forth with acute arrangement audits.

A community-led DeFi stablecoin YAM managed to allure hundreds of millions of dollars in a amount of hours afterwards it launched on Aug. 11, alone to die canicule after due to a analytical rebase bug.

YAM is a adapted carbon of Ampleforth, a stablecoin with activating supply. Depending on the demand, YAM and Ampleforth can access or abatement the absolute accumulation to advance the $1 peg. Accumulation is afflicted by calling a committed “rebase” function.

The aggregation capital to use YAM in the project’s governance, but the rebase action issued balance YAM tokens to the project’s treasury, which adulterated YAM holders’ babyminding power.

Eventually, babyminding on YAM would be unusable.

The aggregation approved to fix the bug by initiating a voting action to stop rebasing until the project’s babyminding arrangement is swapped. However, the action failed admitting aerial aborigine turnout.

YAM’s key aberration from Ampleforth is that it automatically bought yCRV tokens whenever accumulation increased. By the time the aggregation accomplished annihilation could be done to save the project, $750,000 of yCRV were already bound in the treasury.

The aggregation didn’t accord up and eventually swapped the project’s babyminding bore to a alive one. YAM holders could drift via a acting acute contract.

Another rebase bug was exploited by a holder of Soft Yearn (SYFI) badge on Sept. 3. The bug enabled a user to about-face a $200 advance into $250,000.

Like YAM and Ampleforth, Soft Yearn dynamically changes its supply. However, the accumulation change didn’t construe to a Uniswap pool, area the badge was traded.

A user with 2 SYFI in their wallet spotted the bug afore others. After the rebase, they had added than 15,000 tokens account added than 700 ETH at the time. The user took advantage of the befalling that appeared in advanced of them and wiped all the SYFI basin clamminess by auctioning all their tokens for ETH.

After the incident, the aggregation published a accomplishment plan, which included relaunching SYFI tokens and abacus 250 ETH to the Uniswap pool.

2026 didn’t go able-bodied for bZx, as it suffered three attacks. While the aboriginal two exploits complex manipulating alien protocols, the third drudge took advantage of an centralized agreement flaw.

When users accommodate assets on bZx, they accept iTokens, which abound in amount as a agnate lending basin grows. The platform’s vulnerability enabled a hacker to excellent iTokens after lending assets.

Consequently, the wrongdoer could barter ailing iTokens for the assets in bZx pools on Sept. 13.

The hacker managed to cesspool added than $8 actor in assorted assets from bZx. However, the aggregation tracked them bottomward and retrieved baseborn funds. Following the incident, the aggregation abutting armament with PeckShield to enhance bZx security.

Lien Finance, a agreement focused on options and stablecoins, was on the border of actuality afraid and accident $10 actor in ETH. However, a accumulation of white hat hackers apparent the vulnerability first.

As the address on Lien stated, the belvedere had a adulterated function, which enabled minting ample amounts of valueless tokens, which could again be exchanged for ETH stored on its acute contract.

https://twitter.com/samczsun/status/1309172328476139521

After the white hackers apparent the vulnerability, they couldn’t accomplish a drudge to save the platform’s money because front-running bots would accept noticed their transactions.

The hackers announced with Sparkpool, Ethereum’s largest mining pool. The Sparkpool aggregation again fabricated it accessible to assassinate all-important affairs after absolute them to the bots, which adored 25,000 ETH from actuality stolen.

Andre Cronje became a superstar of the DeFi arena afterwards ablution the yEarn crop optimizer. The agnate token, YFI, surged from 0 to tens of bags of dollars in a amount of weeks. Consequently, abounding profit-seeking users started to carefully adviser Andre’s action to jump into his new projects afore others.

One such activity was a gaming belvedere called Eminence. After Andre mentioned its unaudited beta acute arrangement in a tweet, users threw $15 million into it. Since the arrangement was in the beta stage, it had a vulnerability, and hackers drained users’ funds by minting EMN tokens and affairs them for added admired assets on Sept. 28.

— eminence.finance (@eminencefi) September 28, 2020

The hackers after alternate $8 actor in DAI to a acute arrangement controlled by Andre. The alternate funds were acclimated to awning some of the users’ losses.

A UniCats app with a crop agriculture affection had a backdoor, which enabled its developer to ascendancy users’ funds alike back they withdrew money from the platform.

It’s accepted for DeFi users to affix their wallets to assorted DeFi apps, acceding them admission on altered levels. UniCats asked users to admittance spending an absolute cardinal of tokens. An bearding user Jhon Doe accepted UniCats the requested permission and absent $140,000 on Oct. 4.

According to a ZenGo crypto wallet report, Jhon wasn’t the alone one who suffered from the exploit. Other users brought the awful developer of UniCats at atomic $50,000 more.

If you are not yet assertive that you should NOT be acknowledging absolute tokens to some accidental acute contract/Dapp, here’s a adventure of how Jhon Doe absent $140K account of UNI in their sleep.

1/

👇 pic.twitter.com/QltkevnzDY— amanusk (24,7) (@amanusk_) October 5, 2020

The hacker took affliction of their aegis and acclimated several measures, including swapping addresses and application the crypto mixer Tornado Cash to awning their tracks.

A crop aggregator Harvest received critiques about its absorption afore it got exploited for $24 million. Some of the users were anxious about the assurance of $1 billion of assets bound on the platform, but the developers bootless to change anything.

Shortly afterwards the debates on the protocol’s centralization, $24 million were drained from Harvest due to an accomplishment on Oct. 26. In theory, a hacker could abduct more.

The antagonist acclimated beam loans to dispense stablecoin prices on the decentralized barter Curve and acclimated arbitrage to buy added stablecoins than they would commonly be able to.

Like in the case of Eminence, $2.5 of the baseborn funds were beatific aback to developers. The hacker swapped the blow for renBTC and beatific BTC to added addresses. The RenBTC aggregation helped Harvest analyze the ambition addresses, which were again announced to above exchanges for monitoring.

The aggregation offered a $100,000 compensation to acquisition the wrongdoer, but no one was angry in.

PercentFinance, a lending belvedere angled from the industry-leading Compound, froze $1 actor of assets on Nov. 4. According to the team’s post, bisected of the funds accord to the project’s mods.

Users funds on our belvedere amounting to ~$1m are ashore in money bazaar acute contracts

Reaching out to @WrappedBTC and @circlepay/@coinbase corresponding teams to advice us accomplish afflicted USDC/WBTC holders whole

Read Below:https://t.co/63Q1DlyqVv

— Percent Finance (@PercentFinance) November 4, 2020

The project’s vulnerability was affiliated from Compound’s old acute contract, which developers forked. One of the developers absitively to advancement the acute contracts, but afterwards accomplishing so, they accomplished that affairs to the new affairs couldn’t be signed.

Hence, the old affairs were broken.

The aggregation now hopes that issuers of the bound funds, which accommodate centralized USDC and WBTC, can banish the addresses with blocked assets and affair new tokens for users who suffered from the bug.

The aggregation additionally offered to barrage new lending contracts, enabling 73% of USDC lenders’ funds afterwards borrowing their loans. The absent WBTC are arctic always if WBTC-issuer, BitGo, doesn’t advice the PercentFinance team. ETH is absent after a adventitious for recovery.

SharkTron, a DeFi belvedere featuring clamminess mining on Tron, had an adventure according to a account Tron Foundation issued on Nov. 9.

(1/2) Regarding the bluff adventure we accept contacted @Binance and formed calm on block bottomward the funds and bodies abaft this. A allocation of the funds accept been arctic on Binance.

— TRON DAO (@trondao) November 9, 2020

Some sources address a accident of $260 million of users’ assets from several platforms associated with SharkTron, including Shark Invest and Shark Dice. Some users attach screenshots of wallets, which suffered losses.

Tron Foundation claimed that it abutting armament with Binance and arctic some baseborn funds on the exchange. On top of that, it promised to clue bottomward and benumb the butt of the funds.

It brash users to book letters to the badge in the meantime.

Until it was afraid on Nov. 12, Akropolis provided its users with acceptable deposit-and-forget pools, which automatically invested users’ funds and generated yields. When a user deposited their funds in a pool, they got buying tokens in return.

A hacker noticed that Akropolis acute affairs didn’t accept a whitelist for ERC-20 tokens, which can be deposited to the accumulation pools. To booty advantage of this vulnerability, a hacker created a affected ERC-20 badge and took out a beam accommodation of 800,000 DAI on the dYdX lending and trading platform.

By depositing affected tokens and the absolute DAI, the hacker managed to get alert as abounding buying tokens as they commonly would. Hence, they withdrew funds they didn’t accept admission to.

Akropolis didn’t accept the drudge immediately. Moreover, the platform’s acute affairs were alone audited by two blockchain aegis firms.

At the time of writing, Akropolis’ stablecoin pools are frozen. The aggregation is seeking ways to balance damages.

2026 Hacks: Closing Thoughts

Decentralized setups are liberating, yet they appoint amazing albatross on users. While some teams strive to save users’ funds or balance losses, there are no assurance guarantees.

Anyone interacting with DeFi protocols and crypto, in general, should be acute and alert of their activity. It’s a agrarian west, no cipher is flawless, and everyone’s wallet is potentially a honeypot, so precautions should be taken.

During its abbreviate but ablaze history, DeFi has apparent assorted hacks, vulnerabilities, and exploits of baby and ample platforms, which sometimes led to irreversible damage.

As the amplitude progresses, it will see added incidents admitting advances in tech and security. Hence, DeFi users should advance adapted behavioral patterns to break safe.

Disclosure: One or added associates of Crypto Briefing’s administration aggregation owns HEGIC. The aggregation (Decentral Media Inc.) owns HEGIC.