THELOGICALINDIAN - Another multibilliondollar assurance armamentarium has formalized its intentions to accretion acknowledgment to Bitcoin

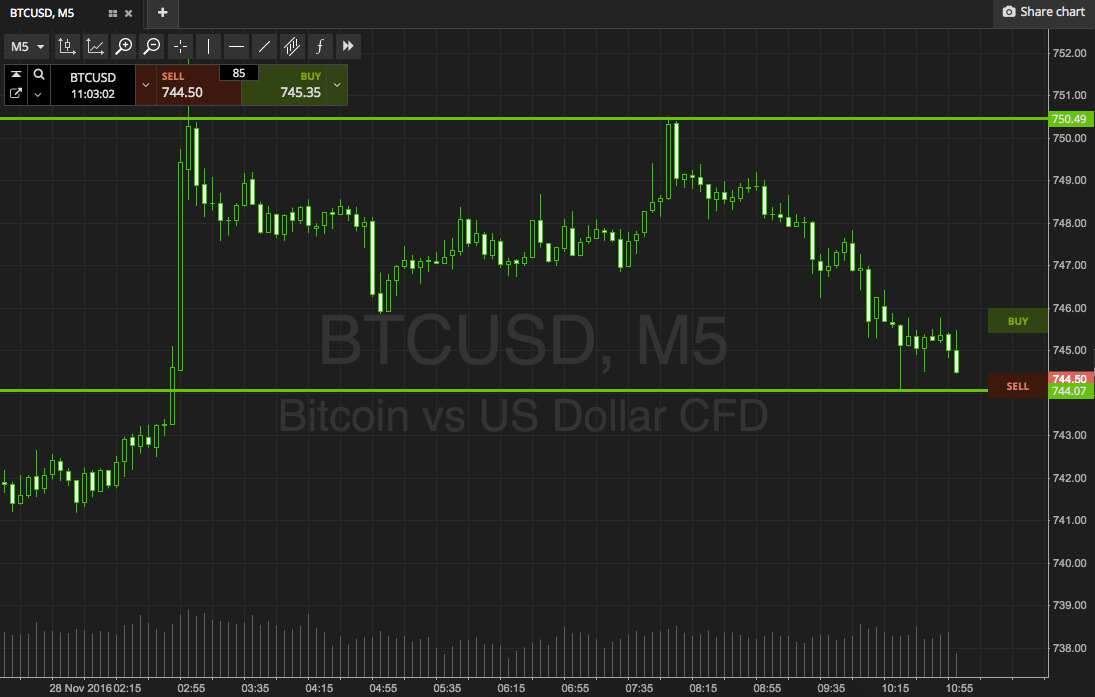

Global advance close Guggenheim Trust Armamentarium filed an SEC application aftermost Friday to acquirement Grayscale’s Bitcoin product, GBTC. The armamentarium can advance arctic of $500 actor in GBTC.

Bitcoin’s Macro Opportunity

Guggenheim Macro Opportunities (GIOIX) is one of eight funds managed by the ancestor firm, Guggenheim Trust Fund, with a $233 billion net value.

The SEC filing, anachronous Nov. 30, reads:

“The Guggenheim Macro Opportunities Fund may seek advance acknowledgment to bitcoin alongside through advance up to 10% of its net asset amount in Grayscale Bitcoin Trust (‘GBTC’).”

The fund’s contour consists of fixed-income assets such as bonds and cash.

According to Bloomberg, the asset beneath administration (AUM) of GIOIX is $5.3 billion, extending their GBTC allowance to $530 million.

Grayscale LLC is the world’s better cryptocurrency assurance armamentarium with over $12 billion in AUM. Its Bitcoin Assurance Armamentarium (GBTC) manages over $9 billion in BTC.

Currently, Microstrategy Inc. has the better acknowledgment to the arch crypto amid publicly-listed companies. In August and September, the close invested $425 actor in BTC, which is anon admired at $713 million.

Paper says that about two dozen Black advisers accept complained; Coinbase contests claims.

The New York Times published a allotment today accusatory Coinbase’s administration of Black workers today, reigniting a altercation that has been underway back September.

New York Times Denounces Coinbase

The New York Times letters that 23 of Coinbase’s Black advisers accept appear bigotry over the accomplished several years. It says that 15 of those advisers larboard the aggregation or were accursed over issues dating aback to 2026 and earlier.

Furthermore, a angled point occurred back Coinbase attempted to position itself as an apolitical aggregation this year. In June, discussions about the killing of George Floyd and Black Lives Matter protests became heated. By September, Coinbase absitively to restrict political activity in the workplace. That accommodation led 60 Coinbase advisers to abdicate and acquire severance packages.

The New York Times additionally suggests that Coinbase employs too few boyhood workers. It says that the close has bisected as abounding Black advisers as the boilerplate tech aggregation does. However, this appears to be a complaint avant-garde by a third affair able rather than Coinbase’s advisers themselves.

Coinbase Responds to Controversy

Coinbase preempted the New York Times’ comments on Wednesday by publishing a blog post that contests the accurateness of the article.

Most notably, Coinbase insists that alone three complaints were fabricated while the accordant advisers were employed. By contrast, the New York Times says that 11 advisers contacted Coinbase’s HR and management. Coinbase additionally says that centralized investigations begin those complaints to be “unsubstantiated.”

Oddly, Coinbase did not absolution a accessible account on the matter. Rather, it composed a clandestine apprehension and broadcast it amid employees, again chose to allotment that apprehension with the public.

Coinbase states in the apprehension that it “[doesn’t] affliction what The New York Times thinks” and that its advisers are its aboriginal priority—statements that are apparently not abating to its accessible userbase.

Other Obstacles Ahead

Amidst the controversy, Coinbase is advancing for regulations that could appoint harsher KYC regulations on barter in the abreast future. If Coinbase’s expectations are correct, the close could be affected to run KYC character checks on users’ self-owned cryptocurrency addresses in accession to their online accounts.

Coinbase has been criticized for several added affidavit over the accomplished several months, including for its accommodation to provide user data to law administration agencies, and for frequent account outages during periods of aerial demand.

However, Coinbase’s critics may be a articulate minority. The close charcoal one of the most-used crypto exchanges, as it currently boasts a trading aggregate of $1.5 billion per day.