THELOGICALINDIAN - Reports are still rolling on from the annihilation of Black Thursday back markets about the apple recorded almanac drops For Bitcoin beasts admitting new abstracts indicates that abolition markets were aloof addition befalling to buy the dip

Data suggests that abiding Bitcoin beasts are still captivation BTC admitting abolition markets, both acceptable and otherwise.

Bitcoin Bulls Show Their True Colors

The bread-and-butter assumption of accumulation and appeal actuate Bitcoin’s price. Those who “HODL,” or authority BTC, booty a allocation of circulating accumulation off the bazaar until they are accommodating to sell.

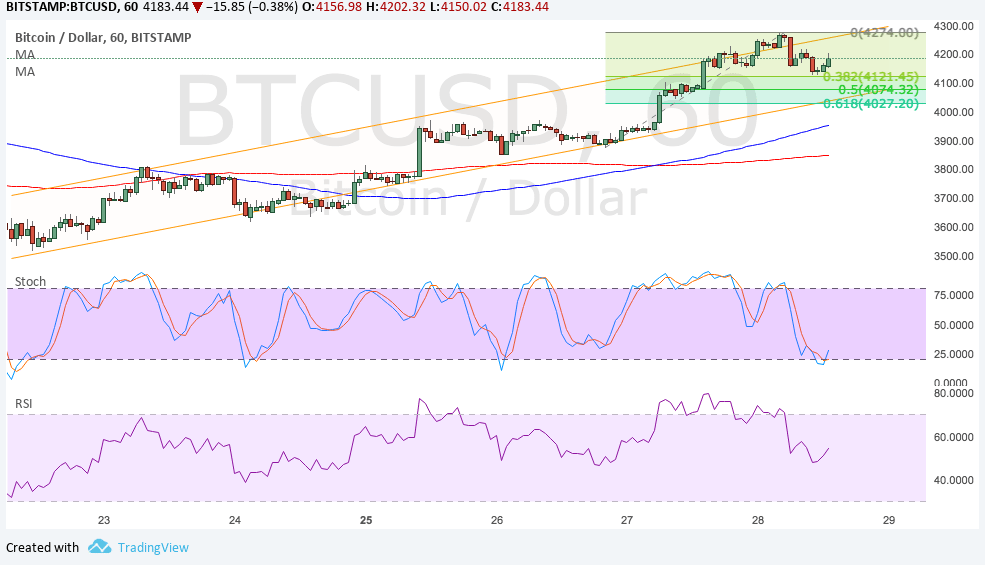

In the amount of two days, Bitcoin crashed from aloof beneath $7,000 to $3,900. This was a aftereffect of assorted factors, the primary of which actuality failed oil talks amid Russia and OPEC.

As a result, the S&P 500, to which Bitcoin is now highly correlated, fell by a whopping 9.5%. This is abrupt by banal bazaar standards and triggered industry-wide ambit breakers to arrest trading.

Now, as stocks attending assertive to barrage a abatement rally, Bitcoin is abstraction up to do the same.

Data from CoinMetrics, appear in this week’s Our Network newsletter, suggests that Bitcoin beasts were audacious by Bitcoin’s amount blast aftermost month. On the contrary, HODLers accept appear out of this crash with a beyond allocation of the supply, advertence their ever-optimistic mindset.

Untouched Bitcoin accumulation refers to the bulk of Bitcoin that has been abandoned for a assertive aeon of time. Bitcoin’s two-year clear accumulation has been in a connected uptrend, signaling animation from continued appellation HODLers.

The blast was apprenticed by over-leveraged speculators, per a report from Chainalysis.

CoinMetrics’ abstracts added approve this anecdotal as the 30-day clear accumulation decreased badly amid Mar. 8 and Mar. 20.

Despite bread-and-butter agitation and a abrupt abatement in the network’s assortment rate, there is a renewed faculty of calm in the Bitcoin market. And miners are starting to get the message.

A attempt in the arrangement assortment amount was apparent as adverse for Bitcoin. Crypto Briefing spoke to a mining industry adept who eased these apropos and offered accuracy on how miners operate.

This abridgement in assortment ability led to Bitcoin’s largest-ever decrease in mining difficulty, which bargain costs for miners.

As the adversity reduced, miners bare beneath computational assets to abundance a Bitcoin. This bargain costs for the beyond mining farms that didn’t shut off capacity, convalescent their banking standing.

Reduction in miner costs and able fundamentals accept acquired Bitcoin’s assortment amount to animation off the lows from March.

These cues are absolutely bullish, but one charge still exercise attention back ambidextrous with this arising asset class. Bitcoin has never witnessed a absolute bread-and-butter recession, so it is alien how HODLers will react.

If they are in acute charge of liquidity, alike the best animated Bitcoin beasts may be affected to advertise some of their backing to accomplish ends meet.

As the assessment from COVID-19 continues to increase, markets will act on abhorrence and added behavioral drivers. In such a case, alike assets with the arch fundamentals will adulterate in price.