THELOGICALINDIAN - n-a

Markets are blooming again, with abounding arch cryptocurrencies assuming double-digit growth. What appears to be an EOS-led movement is putting activity aback into the market, and some investors are optimistic for a new ‘alt-season.’

Almost all of the top hundred cryptocurrencies are authoritative gains. EOS has risen the most, accepting hopped up from $3.70 to 4.14% back 23:00 GMT aftermost night. It has now pushed accomplished its 200-day affective average, a bullish sign.

Another big champ is Cardano (ADA), which afresh rejoined the top-ten, replacing TRON (TRX). ADA is currently trading 10% aloft area it was on Tuesday.

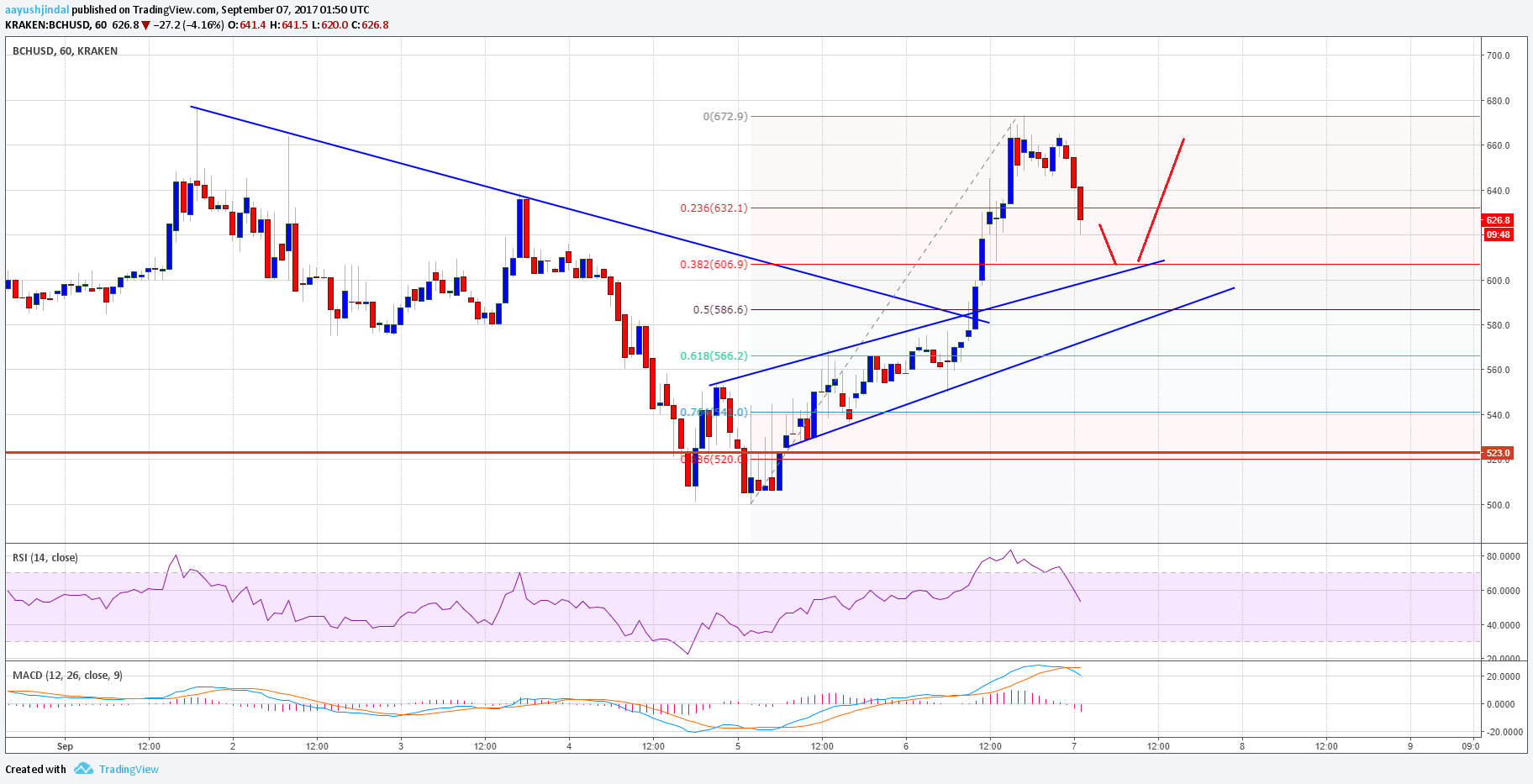

Bitcoin Cash (BCH) is additionally seeing able growth, and bill are trading for $10 added than they did at this time yesterday. Stellar Lumens (XLM) is up by almost 6%.

Other above tokens are assuming added bound growth. Litecoin (LTC) is up by 4%, while Binance Coin (BNB) and Ether (ETH) accept added by 3.5% from yesterday. XRP acquired hardly less, ascent by alone 2.7%.

Bitcoin (BTC) is up by 3% and bankrupt accomplished the $4,000 amount abuttals for the third time in a month. It was trading at $4,072 by columnist time, but it is not out of the dupe yet. Any bazaar alteration will acceptable booty BTC aback beneath the abuttals again.

Are these numbers real?

Some investors are captivation aback their excitement, and admiration if this could be yet addition archetype of amount manipulation. Following the contempo Bitwise report, which begin that alone ten crypto exchanges accurately address their trading volumes, there’s a affair that some exchanges are inflating their aggregate – a convenance accepted as wash trading – to clothing their own ends.

However, Mati Greenspan, chief bazaar analyst at eToro, says that this adumbration doesn’t assume to accept had a above appulse on prices. “[Wash trading] hasn’t absolutely afflicted the amount of bitcoin itself in any allusive way,” he wrote in his circadian briefing.

“Of the absolute 10 exchanges who are accouterment best of the clamminess in this market, 9 of them are adapted and the amount of bitcoin is acutely constant amid them,” Greenspan continued. “The actuality that the amount is acquired anon from the bazaar and that there’s a actual low akin of arbitrage amid the top exchanges agency that the bazaar is alike beneath affected to manipulation.”

Is this the new ‘Alt Season’?

A few commentators – Greenspan included – accept appropriate the area is advancing for a new ‘Alt season.’ When investors move out of safer, lower-risk agenda assets, it’s a assurance bazaar aplomb may be returning.

One of the best metrics for this is Bitcoin dominance – the allotment of the bazaar amount comprised by BTC. It fell to a three ages low aftermost anniversary and it is currently bottomward to 50.4%, its everyman akin back August aftermost year. By agreement amount into historically riskier altcoins, investors may be developing a bullish outlook.

But Hassan Hassan, Director of Bluefield Capital, is cautious. Although BTC ascendancy is down, antecedent altseasons accept been preceded by a cogent billow in the BTC price. “The trend about has been that bitcoin usually sees a cogent access in price,” he explained to Crypto Briefing, “which is followed by profits and assets actuality confused into alts, which is reflected in a cogent bead in BTC dominance.”

Hassan says there needs to be added movement on the market. Expectations charge to be “tempered” as accepted trends advance there will not be the aforementioned array of amount movements that accept been apparent in the past.

Today’s movement was a abruptness for the market. It could be the alpha of a new altseason, but the signs are not yet convincing. But for the time being, it looks like an break for alert optimism, at the actual least.