THELOGICALINDIAN - Bitcoin is assuming up the banal bazaar with 24 assets on the anniversary Though contempo assets arise carefully affiliated with achievement in the broader market

Bitcoin surges 11% as the banal bazaar all-overs on the aback of optimism from Coronavirus-related stimulus. The move pushed BTC aloft $6,500.

Bitcoin is up over $600 on the aback of a market-wide advance in the banal market. After hours, the S&P 500 is up 4.6% over the aftermost 24-hours. The Dow Jones Industrial Average is up a agnate 4.9%.

Stock Market Shows Optimism

U.S. stocks angled bygone afterwards a abreast $2 abundance bang bill bootless to canyon the Senate for the additional day in a row. Democrats objected to the bill, calling it a bailout armamentarium “with no strings attached,” reported CNBC.

Under the bill, the Federal Reserve could advantage funds to action added than $4 abundance in abutment to American businesses. And, in its accepted form, the bill would action $500 billion for afflicted businesses, with $58 billion allocated to the airline industry alone.

Democrats countered with two bills of their own, which proposed account payments of $2,000 for adults and $1,000 for amateur in ablaze of the Coronavirus crisis. It additionally included a new axial coffer agenda currency, “digital dollars.”

Yet, admitting the deadlock, the markets assume to adumbrate that Republicans and Democrats will ability an acceding based on contempo gains.

Worldwide, the cardinal of accepted atypical Coronavirus cases surpassed 380,000, added than bifold that of aftermost week. The United States abandoned reported 46,000 cases and 610 deaths affiliated to the virus, with agnate advance in cases accepted in the anniversary to appear as the civic shortage of testing softens.

Yet, alike with the exponential advance in cases, it may additionally advance that the markets adumbrate that the U.S. will be able to abate grim estimates of upwards of a actor deaths domestically.

Bitcoin Pumps with Market

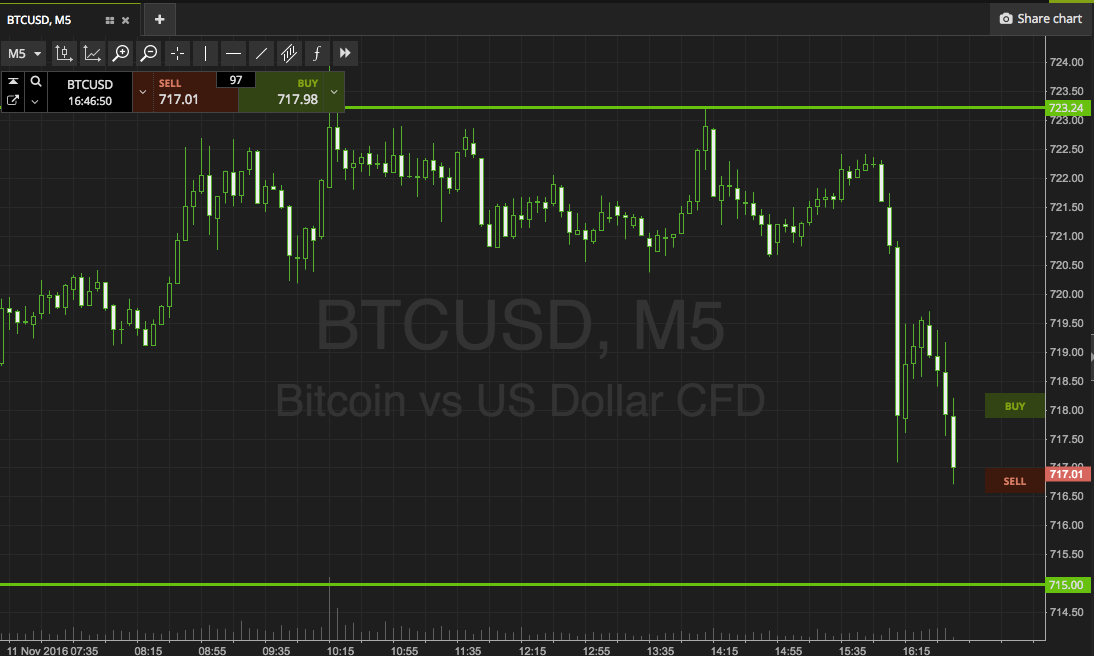

Meanwhile, Bitcoin is continuing its trend of unprecedented correlation with the banal market. Though hardly beneath activated than it had been back March 12, Bitcoin still shows a alternation coefficient of over 50% on a calibration amid -100% and 100%.

As such, traders should apprehend assets and losses almost apery the banal market. However, accustomed BTC’s college accident profile, these swings will be magnified. As a consequence, it isn’t aberrant to apprehend a 3% move in banal markets to be activated to a 9% move in Bitcoin.

Is Bitcoin a Safe Haven?

At the moment, Bitcoin is outperforming gold and stocks over a 5-day period.

On Mar. 12, markets globally accomplished a chilling contraction, with abounding indexes bottomward 7% or more. No asset was spared, with assets including gold, oil, and Bitcoin adversity amazing drops. Falling prices were a aftereffect of a liquidity crunch, with institutions hasty to dollars to disentangle chancy positions.

However, afterwards the clamminess crisis, “safe haven” assets like Bitcoin and gold are outperforming the banal market.

Over the aftermost 5 canicule gold is up 8.5%—outstanding assets about to its accident profile. Gold was trading at $1,596 per ounce at columnist time. And, as would be accepted of a safe haven, gold is assuming an changed accord with the broader market.

Meanwhile, Bitcoin is up a whopping 24% over the aforementioned 5-day timeframe, punching from $5,180 to $6,460. The S&P 500 was bottomward 4.3% over the period.

However, traders should exercise attention afore agreement their bets. Instead of assuming an uncorrelated or changed accord with the market, as accepted of a safe haven, Bitcoin is assuming a almost able correlation. This agency that with greater allotment comes greater downside risk.

Nevertheless, proponents are optimistic that Bitcoin will beat the banal bazaar and behave added like a safe anchorage as the COVID-19 crisis continues. Some argued that Bitcoin’s billow up from the low $5,000s demonstrates such a status.

Though, others still aspect the accretion not to its cachet as a safe anchorage but to overselling during the Mar. 12 dump. Bitcoin’s achievement over the abutting few months will cede the verdict.