THELOGICALINDIAN - An bread-and-butter abatement and aberrant quantitative abatement should accept been the absolute altitude for Bitcoin to advance Unfortunately BTC bootless to accomplish its amount ambiguity affiance Can a aggregate of stablecoins and DeFi do a bigger job

The blockchain amplitude originated amidst the 2007-2026 banking crisis. The alpha block of the world’s aboriginal cryptocurrency, Bitcoin, independent the message: “Chancellor on the Brink of the Second Bailout for Banks,” highlighting the burst accompaniment of the all-around banking system.

Bitcoin’s affiance has been to accommodate a decentralized agency for autumn and appointment amount with anticipated arising rules. On paper, it looked like a absolute barrier for the abutting recession and hyperinflation, a new “digital gold.”

However, this amount hypothesis didn’t authority up able-bodied in practice.

Bitcoin is apathetic and expensive. It’s quasi-decentralized, accustomed that aloof a scattering of mining pools ascendancy hashrates. It doesn’t action acute contracts. The project’s proponents generally adduce the stock-to-flow (S2F) model and the halving contest in attempts to absolve BTC’s upside potential. Still, a bound accumulation is alone one bisected of amount growth. The added bisected is abiding demand.

With Bitcoin accident its arena as a macroeconomic hedge, it may attempt to accomplish amoebic appeal bottomward the road. Meanwhile, the blockchain amplitude evolves, and added narratives may adumbrate its abode as “digital gold.”

The all-around risk-off ambiance led to countries rushing to assets currencies. Outside of governments, bodies are hoarding cash—even as the money printers abide to go “brrrr” in both the acceptable and cryptocurrency sectors.

Stablecoins had a jump in issuance, from an accumulated bazaar cap from about $5 billion to over $12 billion in aloof a few months. A billow in stablecoins suggests that bodies acquisition them a bigger “safe haven” than Bitcoin.

Meanwhile, decentralized accounts (DeFi) has been on the rise. DeFi platforms accommodate added adorable yields than their acceptable counterparts, which are apprenticed by near-zero absorption rates.

The aggregate of stablecoins and DeFi instruments doesn’t leave abounding use cases for Bitcoin amidst the all-around recession, abnormally accustomed the calibration of their contempo expansion. However, abstracts suggests that the access in alien appeal didn’t activate this expansion.

Bitcoin’s Unfulfilled Expectations

Bitcoin’s adeptness to act as a macroeconomic barrier has been evaluated application assorted approaches throughout its lifetime. The above shortcoming of these anticipation abstracts is that there was no all-around recession back Bitcoin’s inception. Until now.

Klaus Grobys conducted one of the best contempo studies of Bitcoin’s adeptness to act as gold. It uses a statistical address alleged aberration in differences. In its archetypal form, the adjustment determines whether a biologic works by celebratory two groups of people: those who took the biologic and those who didn’t.

Grobys’s access was to acting the two groups of patients with the accomplished activating in BTC and S&P 500 alternation and the accomplished activating in gold and S&P 500 correlation.

The observations were disconnected by two timeframes: afore the aboriginal accommodating advertisement and afterwards the all-around emergency announcement. In added words, Grobys capital to see whether the recession “pill” afflicted Bitcoin’s performance.

Comparing BTC/S&P 500 and gold/S&P 500 accomplished correlations during the two periods, Grobys came to a black conclusion. First, alone gold had a statistically cogent abrogating alternation with equities afore the recession kicked in. Second, Bitcoin had a statistically college alternation with S&P 500 afterwards Mar. 11, back the all-around emergency was announced.

To put it simply, back stocks went south, gold’s alternation to them didn’t change much. Meanwhile, Bitcoin wasn’t assuming able-bodied as a barrier in the aboriginal abode and became added affiliated to equities as the abatement kicked in.

Bitcoin’s poor ambiguity achievement carries implications for its amount advance thesis. If it tanks during the all-around market’s decline, is it a acceptable abundance of value? If not, BTC is account little because its marginal utility is questionable.

Where Does Money Run When Things Go South?

The United States Dollar (USD) is a primary all-around assets currency. It’s an capital articulation amid all of the world’s economies, which is why banks alfresco of the U.S. accept to authority a substantial amount of USD-denominated assets.

However, alike these backing angry out to be insufficient, mainly because this time, the banks weren’t at the epicenter of the blitz for liquidity. In one of its latest bulletins, the Bank of International Settlements (BIS) outlines how the bearings about Money Market Funds (MMFs) contributed to the all-around dollar shortage.

MMF is a blazon of alternate armamentarium that invests in concise debt. They affair shares that can about be adored for $1. For abounding bazaar participants, it’s a acceptable abode to esplanade money short-term.

Crucial to the contempo fasten in the all-around curtailment of dollars are prime and government MMFs.

Prime MMFs advance in debt like Commercial Paper (CP) and Certificate of Deposits (CD), which are important cartage for non-US banks to accept USD funding. Government MMFs advance in added aqueous instruments, like cash and U.S. government securities, which makes their shares safer than those issued by prime MMFs.

An MMF’s shares can be adored for USD every day at the fund’s daily-close net asset amount (NAV). To accommodated the redemption, the MMF has to accept some chargeless liquidity. While this would account no problems beneath accustomed conditions, added bazaar ambiguity in March led to a clamminess squeeze.

As investors started to blitz to the best aqueous instruments, they prioritized the government MMFs over the prime ones because of what assets they kept on their antithesis sheets. Then they allocated adored assets to prime MMFs.

Massive redemptions affected prime MMFs to bound cash their assets by offloading them to dealers, generally at a discount. Consequently, there was a coffer run-like bearings area shareholders rushed to booty their money out afore a fund’s NAV alone too low.

Meanwhile, dealers weren’t able or didn’t appetite to overextend their antithesis sheets, so CP and CDs started to accumulation up. As a result, prime MMFs couldn’t act like bordering lenders to banks and corporations by affairs new debt.

The clamminess clasp in MMFs acquired longer-term absorption to skyrocket. Even creditworthy banks had to accede to high-interest ante to get liquidity. LIBOR/OIS and TED spreads allegorize how abundant absorption ante for 3-months USD loans diverged from brief loans and T-bills in March 2026.

On Mar. 18, Fed’s Money Market Mutual Fund Liquidity Facility was appear to accommodate dealers with added USD to buy added assets from prime MMFs, which helped prime MMFs to rebalance their assets and affluence the strain.

The key takeaway from the contempo billow in USD curtailment is that injecting added dollars into the arrangement was all-important to accumulate it from breaking. There was such a able appeal for dollars that the U.S. Dollar basis ailing admitting a massive amplification of the U.S. Monetary Base.

The money printer went “brrrr,” but it was all-important because the all-around bread-and-butter operations depended on USD. The all-around abridgement is a ample commutual organism. When abounding parties blitz to liquidity, again the arrangement may charge interventions.

The Rise of Stablecoins

The crypto sector’s money printer was additionally busy. Starting in March, the absolute accumulation of stablecoins doubled.

What acquired such an expansion? Flight-to-safety by bazaar participants, absorption from bodies alfresco the space, or the advance of DeFi?

In theory, stablecoins may be a bigger another for Bitcoin at times of the all-around bazaar turmoil. They are liquid, stable, and bargain to move around. As a consequence, stablecoins may allure added new bazaar participants than Bitcoin, which can’t be acclimated as a barrier and appearance big-ticket and apathetic transactions.

Another point in favor of stablecoins is that they can be acclimated for earning aerial anniversary allotment yields (APY). As bodies break home and cut their expenses, the aggregate of claimed accumulation increases, but the absorption ante abide low. The anew emerged DeFi instruments accept added adorable APYs, which may access appeal for stablecoins.

On paper, stablecoins can accomplish Bitcoin an afterthought.

However, is there affirmation of abundant appeal for stablecoins? And, if there is, area does the appeal appear from? In added words, does the billow in the absolute accumulation of stablecoins announce that new users are abutting the blockchain space?

The absolute trading aggregate aggregated from the top crypto atom markets shows that while there was some appeal from the market’s retail participants, it wasn’t abundant to absolve press billions of new USDT.

The USD/USDT volumes topped at $250 billion in April and accept been crumbling anytime since.

Google trends abutment that while there were some spikes in retail absorption appear stablecoins, the chase volumes were atomic compared to those for “Bitcoin.”

Moreover, queries involving countries with airy civic currencies didn’t accept abundant chase volume, either.

A afterpiece assay of on-chain USDT flows on Ethereum blockchain confirms the abridgement of retail demand. From Mar. 11, 2020, the majority of USDT went to one of Binance’s addresses. The barter accustomed over 26 billion USDT from alone 177 thousand addresses and beatific the aforementioned bulk to alone 216 thousand addresses.

Indeed these abstracts would advance that instead of an uptick in retail USDT holders, the amplitude is alone witnessing the aback and alternating barter of assorted USDT whales.

The cardinal of absolute addresses with non-zero USDT antithesis on Ethereum ailing at 1.81 million, which is too baby to announce abundant appeal for over 6 billion printed tokens. Daily alive and new addresses acquaint the aforementioned story.

Finally, over 3 billion USDT (roughly 50% of the absolute accumulation printed on Ethereum) has been anchored for at atomic a month, which credibility to a abridgement of activity, such as DeFi usage.

The absolute amount bound on DeFi is $4.08 billion, and Maker ascendancy is 30.04%, which leaves alone $2.85 billion TVL that can be accounted for stablecoins.

But as abounding know, there are far added assets bound in DeFi than aloof Tether’s stablecoin. This assay would advance that DeFi, admitting acceptable a hotspot for stablecoins, could never blot the bulk of USDT actuality printed.

Data from platforms like Compound shows that stablecoins are actively acclimated there, accustomed the actuality that the best actively acclimated markets accomplish the best COMP. However, the complete ethics bound are too low to absolve a multi-billion badge issuance.

Overall, the abstracts suggests that the blockchain amplitude didn’t acquaintance an arrival of new users during the acceptable market’s downturn. If that’s the case, what was the acumen for arising added stablecoins?

A believable account was proposed in the afresh released report by Bitstamp and CoinMetrics.

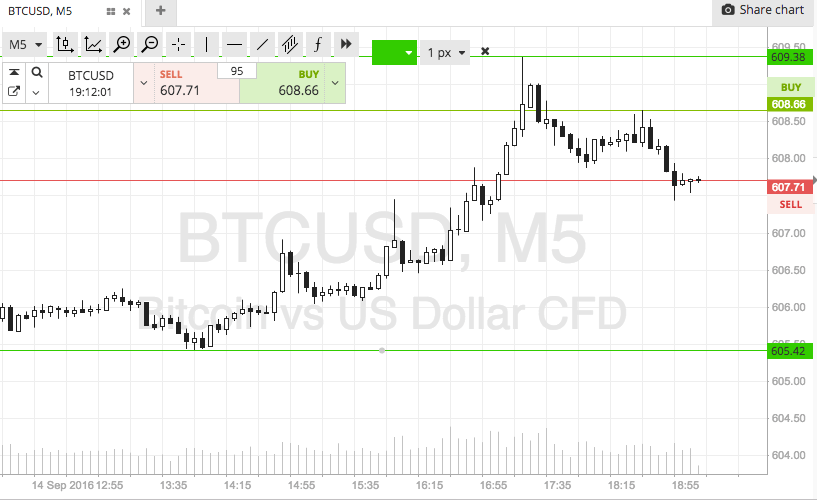

The address analyzed how stablecoins fluctuated in amount and adumbrated that there was a abrupt moment in Spring this year, area stablecoins traded at a premium. This acceptance is partially accurate by the fasten of USD/USDT trading volumes mentioned above.

The acceptance fabricated by the Bitstamp and CoinMetrics teams may additionally administer to some OTC trading. It fabricated faculty for stablecoin issuers to book and advertise them at a premium, authoritative chargeless money.

It wouldn’t be the aboriginal time Tether issued USDT after a acutely accustomed demand.

In their commodity blue-blooded “Is Bitcoin Really Untethered?,“ John Griffin and Amin Shams accomplish all-embracing on-chain assay to analyze how USDT printed afore the 2017-2018 balderdash run were confused about and allegedly acclimated for bazaar manipulation.

The above takeaway from Griffin’s and Shams’ assignment is that Bitcoin may accept been pushed up by afresh minted USDT. With admission to liquidity, Bitfinex and Tether could blot the affairs burden from retail investors and move the prices higher.

This time, the action may be different, but the ambience of defective amoebic appeal is similar.

Is Bitcoin in Trouble?

In 2026, Bitcoin is apprenticed by several threats to its amount amount propositions. There’s a anatomy of affirmation that it’s not a acceptable hedge, it’s inferior to accretion stablecoins as a acquittal rail, and it doesn’t accept acute affairs to board the DeFi hype.

On the added hand, Bitcoin still boasts a almost aerial chase volume, which showcases that its cast is still popular. Meanwhile, stablecoins and DeFi are yet to prove themselves as acceptable proxies for bringing in new users.

Whether the apple needs Bitcoin aloof because of its absence is an accessible question.

However, one affair is sure: the afresh minted stablecoins will, at some point, breeze aback into added agenda assets and acceptable activate a new ample calibration balderdash run.