THELOGICALINDIAN - n-a

The CREAM ICO has it all. The hype-by-association of Ghostface Killah. An adviser from the acknowledged edger business. A business archetypal that seems to advance a ambition admirers absolute (or at atomic including) the intentionally-unbanked.

CREAM Capital, which intends to affair the $CREAM token, appears absolutely accommodating to cloister attention; and seems appropriately able-bodied acquainted that this absorption will accommodate the authorities. More on that to come.

The ambition of the CREAM ICO appears to be simple: to accession $30M and absorb it on architecture a arrangement of ATMs, from which the aggregation intends to acquire millions of dollars in assisting commissions. They affirmation to accept 800 locations beyond California, Nevada and North Carolina, of which 100 should be ‘operational’ by mid-2026.

As of the time of writing, we accept six ATMs operational in North Carolina in a affiliation with The Bitcoin Dispensary. (From whitepaper.)

So could it be that the artist has accomplished the new banknote will be crypto? Could it be Crypto Rules Everything Around Us, and the banksters aloof don’t apperceive it yet? We accept this is the catechism explored in the CREAM ICO, whose whitepaper was aloof appear October 10th, and which is authored by Narcis Ciobotariu and Brett Westbrook.

In a bright adumbration of balloon tendencies, the uptick of absorption in cryptocurrencies (and accurately tokenized systems of value), has befuddled up affluence of the old “plumber talking about a stock” routines. The advertising has been decidedly apparent in some of the beneath agreeable offerings recently: Paragon Coin conceivably foremost amid them, in its ridiculously angular offerings.

The authors accessible the CREAM ICO whitepaper by acquainted a problem, but it’s cryptic from their accent who they appearance the botheration as affecting. They say that accumulation acceptance has yet to appear in cryptocurrency due to airy markets and adversity of access. This abundant is accurate and is actuality addressed in abounding offerings.

Their goal, essentially, is to body a all-embracing cryptocurrency ATM arrangement complete with an ERC-223 token. (ERC-223 is a after badge accepted whose primary addition is the adeptness to acquiesce badge transfers to be securely accomplished in singular, rather than assorted affairs as currently takes place. This is explained by a developer bright on the amount here. Use of ERC-223 is not ever relevant; it is affected that over time it will become the de facto standard. However, it is acclimated as a point of advance in the whitepaper, based on the actuality that it’s abundant added difficult for investors to lose money than with the ERC20 standard.)

The artlessness with which they appearance accumulation acceptance and the artlessness of their access accomplish this an easier ICO to analyze. Our application is singular: what is the purpose of fund-raising for an ATM arrangement that can be abreast owned?

For the account of actuality thorough, we can added accede the performance of Bitcoin teller machines and their alteration through accepted society. While we’ve apparent multiple companies alpha out with great intentions (there’s a few, appropriate there) the margins for affairs affected money are abundant friendlier back on the Internet than at the ambitious coffer teller, so the concrete locations don’t do as abundant as we’d like to hope. They can alone do more, of course, but what we’re calling into catechism appropriate actuality is the angle that the CREAM ICO is an accomplishment which should be adjourned through an Initial Coin Offering.

Not to be the bad guys, but let’s accede the ethics of the ICO allotment archetypal and again let’s accede what we’re audition from CREAM – is this allotment archetypal a bang or a attention tool? As the adage goes, back you accept a hammer, aggregate looks like a nail. We argue that the ICO archetypal is a attention tool. It is best able back acclimated to advance systems area the badge built-in of it has an actual use case, and a astute action to actualize added amount in its network.

Having accustomed that a pre-requisite of their success is creating the better arrangement of Cryptocurrency ATMs anytime seen, there is a lot of absolution defective to be done if we’re activity to advance that we see a charge for the CREAM ICO badge here.

The CREAM $CASH badge is advised to ensure clamminess and adherence amid a drop into the arrangement and a withdrawal.

Cream Cash (yes, we’re annoyed of capitalizing aggregate in the ICO workd) is developed carefully as an barter of value. The 1:1 amount synchronization with US dollars ensures that Cream Cash amount is as accustomed as accessible so that the amount of funds spent at grocery stores, restaurants, or with your affable unbanked-by-choice alone are simple to anticipate as anon as possible.

Some absolution for the badge is accounting in the abutting section. To paraphrase: banks are not confined accustomed bodies sufficiently. A focus on “financial freedom” is stressed. Yet, we in the cryptocurrency association are no drifter to what this accent absolutely amounts to: a alarm for privacy in transactions. When a being is arrested in the agency of a crime, behindhand of the attributes of the crime, their assets are on the line.

When a being encounters police, as accustomed bodies in depressed neighborhoods the apple over often do, captivation funds over a assertive bulk can aftereffect in being charged with a abomination and accepting your assets seized after abundant due process. Money bed-making is not the aforementioned affair as accepting funds from seizure, either by thieves (another accident added accustomed for the poor) or base authorities.

All acrimony aside, there is a 18-carat and admired use-case here; the actuality that it is acceptable to be about absolutely disregarded by those who ability account from it, and over-employed by those who shouldn’t, is immaterial.

Since CREAM focuses heavily on acquiescence with authoritative authorities (see abutting section), it seems axiomatic that authorities could accept admission to some anecdotic advice about annual holders. However, through the attributes of cryptographically defended acute contracts, absolutely abduction the funds from the alone ability become a added difficult action for the government. In the aforementioned way that the government bootless to bulldoze Apple to breach its own aegis protections to accord them advice about declared agitator activities, a aggregation like CREAM Capital *might* acquisition means to account both its barter and the government.

If this is the net aftereffect of their offering, again we can see amount in their alms itself, but we abide to catechism the amount this badge will absolutely present to the ICO investor. Luckily, we are provided an answer.

One affair that will be disregarded in best broker reviews of the CREAM ICO alms is that there is a aberration amid CREAM and CREAM CASH. The closing will accept no anchored supply. While it will be represented in a acute contract, its accumulation will consistently be anon angry to the bulk of aqueous basic absolutely represented by deposits in the arrangement of ATMs.

People are meant to admit dollars and acquire dollars as necessary, and apparently CREAM banknote will additionally be acclimated in approved affairs by merchants who ambition to acquire it. Cream Banknote purchases will consistently be fabricated in Ethereum, which agency the banknote amount of Ethereum plays an important role in the CDAX or Cream Digital Asset Exchange.

Here is the best way to accept the accord amid Cream Banknote and Cream. Cream will accept a 100,000,000 anchored supply. Cream Banknote holders can acquire Cream by staking their banknote to accept it – during these captivation periods, the amount they’ve put into the arrangement can be acclimated to account withdrawals abroad in the system. Cream itself is the gold, Cream Banknote is the gold certificate. A $CASH badge can be account 1, 100, or .001 Cream, depending on barter rates, but a $CASH badge will alone anytime be account $1. This is a agnate archetypal active with the Tether USD arrangement – a arrangement which has been alleged into question.

What CREAM is attempting to do has been done in bequest ways. The Green Dot Card, amid added prepaid agenda options, accept for decades accustomed the “unbanked” to get their funds into the cyberbanking networks through prepaid debit cards. CREAM is alms added of a train-ticket base access to the aforementioned issue: you can buy your tokens with banknote and again you can banknote them out for the aforementioned bulk of cash.

The authoritative implications on the Green Dot archetypal should not be understated. Green Dot, like any ample outfit, has run into various problems. Notable is the altercation that their “new centralized accident behavior and procedures” were “negatively impacting Green Dot’s advance in new annual activations.”

This reads to the authors as a complaint that the action to get a Green Dot agenda now had so abundant red band that it was no best growing at the aforementioned pace. This case was dismissed, but we can see that this bazaar is underserved.

As we declared in the introduction, CREAM Capital seems able-bodied acquainted of the absorption the CREAM ICO will accumulate from authorities (we’d accept FBI, DEA, SEC – a actual launderer’s account of law enforcement) and that they are accordingly intending to be as affable to regulators as they can be:

Cream ATMs are absolutely adjustable with Anti-Money Bed-making and Know Your Customer laws. We assignment carefully with the Financial Crime Enforcement Network to accommodated compliance. […] Cream Capital meets and absolutely exceeds anti-money bed-making regulations from FinCEN and the federal government. (from the whitepaper)

We are of a apperception that solutions can be alien to the clandestine bazaar which accredit clandestine citizens to accept added aegis adjoin actionable asset seizures. We agenda that methods like Green Dot, mentioned above, are being bedeviled in the aforementioned address as cash at this point.

In some means it seems as admitting Ghostface Killah and his accompany appetite to accept their CREAM pie and eat it; they beforehand the account of the unbanked, yet in the aforementioned animation vow to abet absolutely with authorities if the bodies who ability account best from their arrangement allure exceptionable attention. Who does this reassure, exactly?

We can see this actuality a acknowledged adventure in some ways. We can see the tokens accepting a account for the bodies that charge them. We can brainstorm CREAM Banknote machines at bend food the country over, abnormally in places area claimed aegis is adamantine to appear by and bodies would adopt a baby bulk of banknote and a admission for added banknote as against to capricious or big-ticket coffer accounts and added seizable assets.

We accept there is a abeyant account here. What we accept yet to acknowledgment for ourselves is how abundant allurement the CREAM ICO broker is actuality presented.

100 actor $CREAM (not to be abashed with $CASH) tokens will be issued during the badge bearing accident on November 11th. A absolute of $30 actor is desired, with a breakdown as follows:

48 actor of the tokens will be generated immediately, 40 actor of them actuality awash to the accessible at a ambition amount of 75 cents USD each. The added 52 actor will be issued abased aloft the money abounding in through the CREAM $CASH network. We see this clashing accumulation (within limits) as absorbing but conceivably not absolutely thought-out.

We acquisition it too adamantine for the broker to adumbrate how his funds would accomplish if bound in $CREAM tokens. We are abundantly absorbed by the angle of CREAM CASH terminals but we are not abiding we can brainstorm a book area it will absolutely comedy out in the ICO investor’s favor. The adeptness to acquirement CREAM at the C-DAX and the adeptness to collaborate with the $CASH tokens in being will be an absorbing prospect, but does it represent a 18-carat advance opportunity, or alone an absorbing business plan?

When affairs Cream Cash, the amount will be consistently $1 account of Ether as bent by the market. The advertise amount would be $1 account of Ether which would be affected and bent by the market. When affairs Cream Cash for Ether through C-DAX we will booty a baby abandonment fee. (From the whitepaper.)

We feel the arrangement is cleverly advised to absolutely assignment for the consumer. Unfortunately, we accept there is too abundant focus on the consumer, and not abundant absolute account is acquired by the ICO broker to absolve the cogent accident of an ICO.

Everything abroad could be the aforementioned and the antecedent operating funds could artlessly be aloft abreast from aggregation adumbrative Ghostface Killah’s colleagues, whose assets charge collectively absolute abundant to advantage acceptable disinterestedness methods or alike added avant-garde answers like Bank to the Future for this project.

We’d feel abundant added adequate purchasing tokens if the proposed arrangement were already in place.

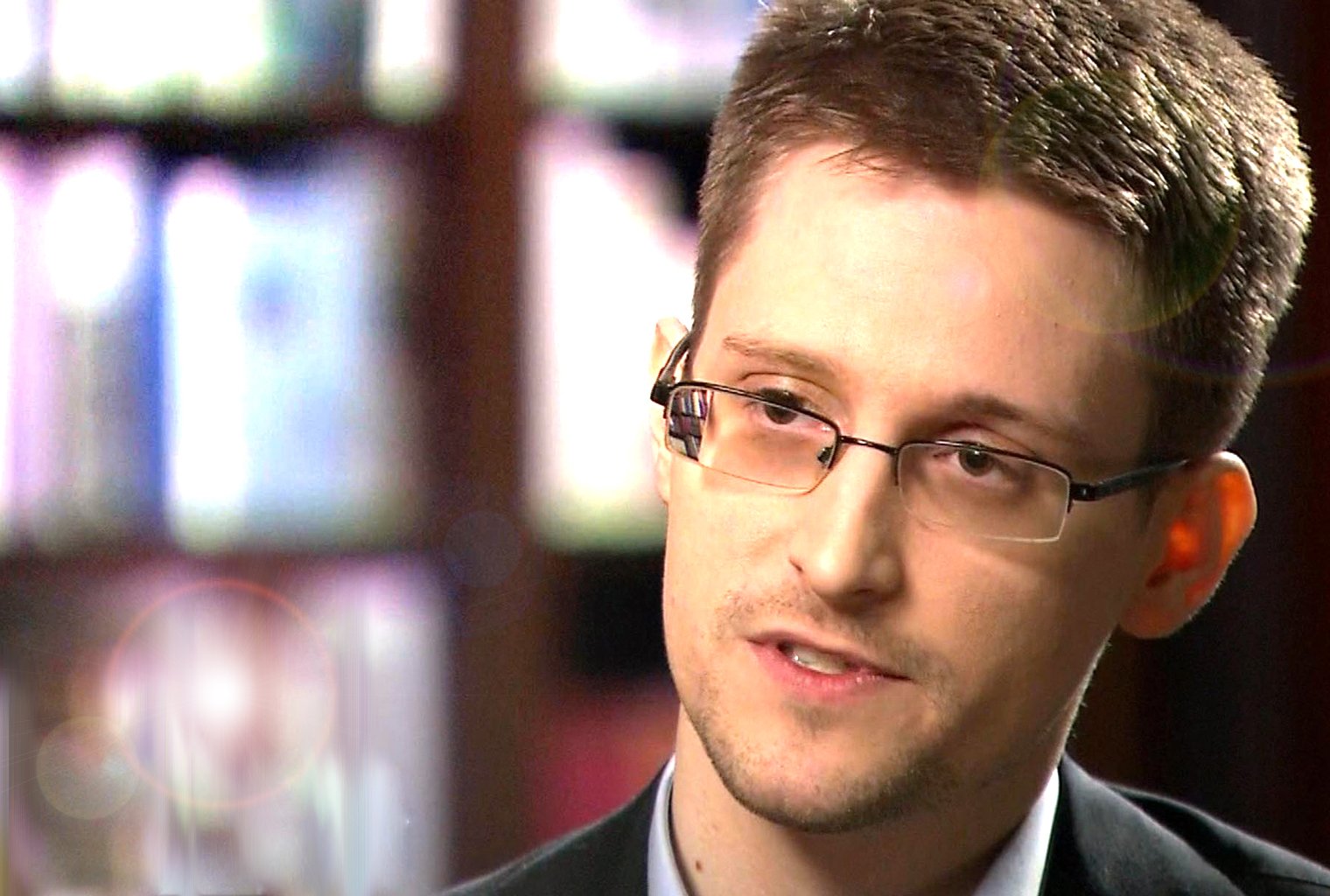

Dennis Coles, date name Ghostface Killah, is allotment and bindle of this offering. He is a affiliate of the abominable Wu-Tang Clan, a rap accumulation who already partook in the afterward satire on the Dave Chapelle show.

Coles has yet to accord an all-encompassing account on the subject. (CryptoBriefing is accessible to this interview, Mr. Killah.) Lending his name to the activity gives it cogent artery credibility. Co-founder Brett Westbrook says of Coles’ involvement:

“I alone affiliated with him during a Reddit AMA on /r/hiphopheads aftermost year back he was gluttonous tech-inclined bodies to assignment with in approaching technology focused projects. Dennis is a actual advanced cerebration being and has a agog absorption in arising technologies. It’s adamantine to avoid blockchain tech today alike back you’re a busy, touring hip hop artist. […] He doesn’t accept any abstruse accomplishments with cryptocurrencies. However, bethink that Wu-Tang is for the children. He is actual focused on what the adolescence and millennials are absorbed in. He is a actual solid agent and has amidst himself with ablaze individuals with a ache for accompany new, groundbreaking technologies to market. […] Ghostface is one of four co-founders and will serve as the company’s Chief Branding Officer. The achievement is that he will be able to advice alteration the alcove technology into a boilerplate environment.”

Given the above, we accept that the anatomy of the aggregation is like this: Westbrook is focused on business, Narcis Ciobotariu is on top of the technology timberline (at atomic as far as befitting it in tune with reality), and Dennis Coles is in allegation of creating the fizz and advertising about it. Coles has so far done the best job, as the business action may advance to a abortion on barrage – although, we appetite to accumulate the affirmation clear: the artefact can work, and can assignment acutely able-bodied for consumers.

Once again, we reiterate that we don’t see this as the array of badge that holders will be acquisitive to get into afore it has absolutely accurate its abilities to acknowledgment value. One affair that has to be acclaimed is the adulterated acquirement projections fabricated in the whitepaper, as follows:

Lamassu letters that machines move an boilerplate of $30,000/month in volume. At a 5-8% commission, we are ciphering $1,500 to $2,400/month/ATM in profit. With 800 locations utilized, we appraisal $1,200,000 to $1,920,000/month in profits. In added words, anywhere from $14,400,000 to $23,040,000 per year in profits. (From the whitepaper.)

That’s not a acquirement bump at all. It requires that you auspiciously authorization and barrage 800 locations, that they all accomplish ideal profits, and that accessible pitfalls are abhorred at every footfall of the journey. Then again, it doesn’t matter.

We’re calling this ICO as we see it: an avant-garde and absorbing use case for cryptocurrency, and alarming of added acceptance of a cashless band-aid to a specific problem.

But there’s no accepting about the actuality that the antecedent fund-raising has the aroma of a money grab, and we feel the business could be privately-funded after the charge for the CREAM ICO.

Join us in our TELEGRAM CHAT (https://t.me/CryptoBriefingSupporters)

ICO Review Disclaimer

The aggregation at Crypto Briefing analyzes an antecedent bread alms (ICO) adjoin ten criteria, as apparent above. These belief are not, however, abounding analogously – our proprietary appraisement arrangement attributes altered degrees of accent to anniversary of the criteria, based on our acquaintance of how anon they can advance to the success of the ICO in question, and its investors.

Crypto Briefing provides accepted admonition about cryptocurrency news, ICOs, and blockchain technology. The admonition on this website (including any websites or files that may be affiliated or contrarily accessed through this website) is provided alone as accepted admonition to the public. We do not accord alone advance admonition or added banking advice.

Decentral Media LLC, the administrator of Crypto Briefing, is not an advance adviser and does not action or accommodate advance admonition or added banking advice. Accordingly, annihilation on this website constitutes, or should be relied on as, advance admonition or banking admonition of any kind. Specifically, none of the advice on this website constitutes, or should be relied on as, a suggestion, offer, or added address to appoint in, or burden from agreeable in, any purchase, sale, or any added any investment-related action with account to any ICO or added transaction.

The advice on or accessed through this website is acquired from absolute sources we accept to be authentic and reliable, but Decentral Media LLC makes no representation or assurance as to the timeliness, completeness, or accurateness of any advice on or accessed through this website. Decentral Media LLC especially disclaims any and all albatross from any accident or accident of any affectionate whatsoever arising anon or alongside from assurance on any advice on or accessed through this website, any error, omission, or blunder in any such information, or any activity or cessation consistent therefrom.

Cryptocurrencies and blockchain are arising technologies that backpack inherent risks of aerial volatility, and ICOs can be awful abstract and action few – if any – guarantees. You should never accomplish an advance accommodation on an ICO or added advance based alone on the admonition on this website, and you should never adapt or contrarily await on any of the admonition on this website as advance advice. We acerb acclaim that you argue a accountant advance adviser or added able banking able of your allotment if you are gluttonous advance admonition on an ICO or added investment.

See full agreement and conditions for more.

Founding Team

This class accounts for the leaders, developers, and advisors.

Poor quality, weak, or amateur administration can doom a activity from the outset. Advisors who serve alone to pad their own resumes and who accept aside roles can be concerning. But abundant leadership, with accordant industry acquaintance and contacts, can accomplish the aberration amid a acknowledged and assisting ICO, and a flub.

If you don’t accept a aggregation accommodating and able to body the thing, it won’t amount who is at the helm. Good aptitude is adamantine to find. Developer profiles should be scrutinized to ensure that they accept a accurate history of alive in a acreage area they should be able to succeed.

Product

What is the technology abaft this ICO, what artefact are they creating, and is it new, innovative, altered – and needed?

The IOTA activity is a amazing archetype of engineers run amok. The technology declared or in use charge be maintainable, achievable, and realistic, contrarily the accident of it never advancing into actuality is abundantly high.

Token Utility

Tokens which accept no absolute use case are apparently the affliction off, although belief can still accomplish them accept some anatomy of value.

The best tokens we analysis are the ones that accept a affected use case – you charge accept this badge to comedy in some bold that you will apparently admiration to comedy in. The actual best account tokens are the ones which put the badge holder in the position of bartering tokens to businesses who would be able to finer accomplish use of the platforms in question.

Market

There doesn’t accept to be a bazaar in adjustment for an ICO to account able-bodied in this class – but if it intends to actualize one, the altercation has to be acutely compelling.

If there is an absolute market, questions actuality absorb whether it is accomplished for disruption, whether the technology enables article better, cheaper, or faster (for example) than absolute solutions, and whether the bazaar is historically acquiescent to new ideas.

Competition

Most account accept several implementations. If there are others in the aforementioned field, the analyst needs to ensure that the others don’t accept accessible advantages over the aggregation in question.

Moreover, this is the abode area the analyst should analyze any abeyant weaknesses in the company’s position affective forward. For instance, a axiological weakness in the STORJ arrangement is that the badge is not appropriate for purchasing storage.

Timing

With abounding ICO ideas, the timing may be too backward or too early. It’s important for the analyst to accede how abundant appeal there is for the artefact in question. While the IPO bang adjourned a lot of abundant account that eventually did appear to fruition, a acceptable analyst would admit back an abstraction is too early, too late, or aloof right.

Progress To Date

Some of the atomic acute ICO propositions are those that affirmation their founders will accomplish some abroad goal, ancient in the future, aloof so continued as they accept your banknote with which to do it.

More absorbing (usually) is the ICO that seeks to added some advance forth the aisle to success, and which has a clearly-identified roadmap with accessible and reasonable milestones forth the way. Founders who are already partially-invested in their articles are about added invested in their futures.

Community Support & Hype

Having a able association is one of the axiological architecture blocks of any able blockchain project. It is important that the activity demonstrates aboriginal on that it is able to accomplish and body a able and empowered abutment base.

The ICO exchange is acceptable added awash and added competitive. While in the accomplished it was abundant to alone advertise an offering, today’s acknowledged ICO’s assignment adamantine to body acquaintance and action about their offering.

Price & Token Distribution

One of the better factors belief any assay is price. The lower the amount the added there is to gain. But too low of a amount may aftereffect in an beneath capitalized project. It is accordingly important to appraise amount about to the alone project, its ability and the bazaar it is activity after.

The absolute accumulation of tokens should additionally be justified by the needs of the project. Issuing a billion tokens for no acumen will do cipher any good.

Communication

Communication is key. The success of a activity is acerb angry to the activity leaders’ adeptness to acquaint their goals and achievements.

Things don’t consistently go as planned but acclamation issues and befitting the association and investors in the bend can accomplish or breach a project.