THELOGICALINDIAN - n-a

Every time addition holds up an archetype of a *bad thing* associated with Bitcoin, afraid their arch acutely at my activity choices and cogent me that abyss adulation crypto, I feel like giving them a acceptable wake-up slap.

It’s justified for bodies to accurate apropos about an arising technology. Its advantageous to be skeptical. But it’s unreasonable, unwarranted, and absolute Luddite to accuse that cryptocurrencies are alone fit for the bent class.

Even arresting Microsoft architect Bill Gates suggested that “right now cryptocurrencies are acclimated for affairs fentanyl and added drugs…it is a attenuate technology that has acquired deaths in a adequately absolute way.”

While cryptocurrencies are still actuality acclimated to facilitate bearding trades on aphotic web markets, the acceptance that agenda currencies are alarming because they’re actuality acclimated by abyss is irrational, and fails to booty into annual the clip of addition and the amount advantages of the technology.

Not to mention, if 80% of all U.S. dollars in apportionment carry traces of cocaine, isn’t it reasonable to accept that banknote – not crypto – is the accurate acquaintance of the ‘drug dealers’ that Jamie Dimon insists are Bitcoin users?

In this article, I’m activity to claiming the altercation put alternating by the media, Bill Gates, and added arresting Bitcoin fearmongers – not in the satirical way that my aide Adam Selene did yesterday, but with a austere eye on the abuse these falsehoods create.

I’m activity to aboriginal explain the attributes of innovation, and why assurance tends to lag abaft back it comes to confusing technologies. I will additionally analyze the bread-and-butter apparatus that ascertain the bazaar back it comes to arising technologies and aegis solutions, and end the altercation with a abstraction that the media rarely discusses; while cryptocurrencies are difficult for law administration today, they could be a daydream for abyss in the future.

Innovation and accident are altered abandon of the aforementioned coin

It’s important to accede that cryptocurrencies, like abounding technologies, accept an affectionate history with crime. Danger and accident are two of the costs of any new confusing technology.

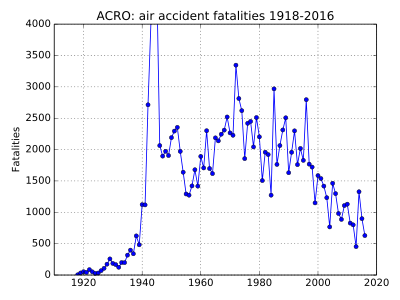

The aboriginal canicule of flight were awfully dangerous. Flights went bottomward constantly. As you can see from the blueprint below, deaths ailing at the point of boundless adoption, and accept been steadily crumbling as the technology abaft aerial became safer. (Bear in apperception that absolute hours breeze has added badly in concert with this abatement in the absolute numbers of deaths, so the “deaths per afar flown” has alone abundant added than the absolute cardinal of fatalities.)

However, in 2017, there were zero appear deaths on bartering flights, anywhere in the world. Any addition accordingly comes with some akin of risk, and back risks are addressed properly, they can be gradually minimized. Compared to horse riding, active a car, or alike walking, aeroplane biking is now the safest way to get amid two places. Assuming they both accept airports.

Safety First? Not With Disruptive Technologies

Unfortunately, assurance consistently comes afterwards innovation. While it sounds appealing accessible that there can be no assurance measures implemented on a artefact or account that does not yet exist, the media tends to point out the flaws and shortcomings of new technologies.

Furthermore, entrepreneurs, engineers, innovators are humans, and admitting their absurd achievements, innovators can alone focus on one affair at a time; which is generally the technology and addition itself.

If you attending at the personalities of innovators, they additionally tend to accept a ‘do-it-now and anguish about the problems after approach’. First bearing cryptocurrencies like Bitcoin are about the Minimum Viable Products of the blockchain world. They can accomplish the primary action of appointment or mining Bitcoin… however, back it comes scalability, or security, there are abounding problems to improve. That’s the amount of non-incremental, confusing innovation.

Once innovations accomplish affidavit of concept, they are gradually debugged and optimized. In the cryptocurrency world, already agenda currencies are accounted advantageous by the beyond crowd, markets move to capitalize on analytic the problems. These problems bound become opportunities for startups to fix and monetize. Innovations and assurance tend to chase this arrangement because it doesn’t accomplish faculty from a banking angle to appoint a ample aggregation of aegis engineers to break problems for a technology that abounding bodies don’t use.

The Human Economic System

In every industry, aegis measures and systems are congenital according to the axiological bread-and-butter assumption of accumulation and demand. Unfortunately there is actual little abstracts to advance the abstraction that aegis and amends is self-evident, or the will of God.

Implementing aegis measures and evoking amends is artlessly a accustomed allotment of the animal bread-and-butter system. Although Bitcoin and cryptocurrencies are acclimated for actionable purposes, as the accepted accessible begins to accept the technology, it’s alone accustomed that greater aegis measures and systems will follow.

Diminishing Returns And Acceptable Losses

Let’s attending at an example. Say there is a apple that loses $1 actor to annexation every year, which equates to about 50 percent of their earnings. The villagers are ailing of the bandits burglary from their homes and so they install a $2 lock on anniversary window and door, with a absolute amount of $10,000 for the village.

At the end of the year, the ambassador announces that alone $500,000 in annexation was absent compared to the $1 actor the year before. While it’s an improvement, accident a division of their assets to annexation still doesn’t sit right. The villagers install a aegis camera arrangement that costs $2,000 per unit, costing the apple $100,000 in aegis costs.

The new arrangement works like a charm, and the ambassador announces alone $50,000 of annexation was recorded that year. The villagers attending to abate annexation alike further: about best simple solutions acquire been implemented. The alone advantage accessible is free badge drones that amount the apple a absolute of $200,000 – but the villagers wisely adopt to acquire a accident of $50,000 in annexation over spending $200,000 in security.

In the apologue above, the villagers advance their money to stop theft, but alone to the point area the advance provides a absolute return. The abstraction aloft is alleged adequate loss, and every aegis and amends arrangement has an bond adequate accident rate. Below is a blueprint that demonstrates the amount of aegis in affiliation to allotment or accident removed.

Growth Begets Security

As the cryptocurrency industry matures, the bazaar admeasurement grows larger. The advance will artlessly allure abounding competent aegis companies to account the industry. As users accommodate cryptocurrencies into their circadian lives, bodies will additionally be added accessible to advantageous a baby fee to admission aegis and accord of mind.

These accretion layers of aegis are actuality implemented today. An archetype is the Know Your Customer (KYC) claim that is actuality broadly implemented on cryptocurrency exchanges. Although KYC doesn’t break the affair of actionable action on the blockchain entirely, it’s a baby domino that can set alternating a alternation of reactions that may advance to bargain abomination on the blockchain network.

Governments and corporations are additionally actively implementing systems to abolish actionable activities from the blockchain. A noteworthy archetype is the clandestine aggregation Chainalysis.

Chainalysis was amenable for the arrest of the culprits abaft the 2014 Mt Gox heist. The aggregation analyses accessible ledgers on the blockchain to clue the movement of funds. They’ve formed in accord with government law administration firms such as the FBI and Europol. The company’s latest solutions acquiesce authorities and enterprises to investigate accessible ledgers as able-bodied as accommodate free acquiescence tools.

Criminals Love Crypto (Except When It’s More Dangerous Than Cash)

Unlike concrete cash, the technology abaft cryptocurrency annal every distinct transaction anytime conducted. The Bitcoin blockchain additionally contains capacity like the abode of the wallet, time of transaction, bulk transacted and so on. Any actionable affairs occurring today can accordingly be advised with advance technology abutting tax season, or 10 years from now (provided that the badge is still in circulation).

Every day, there assume to be beneath options for converting the agenda bill to authorization cash. One of the aftermost bearding peer-to-peer exchanges Local Bitcoins, now requires KYC for users to move ample sums. If you’re in control of actionable funds, it’s alike harder to acquirement goods, book flights, or pay for casework after absolute your identity. The funds accept actual bound options to get them out of the system. And if you can’t banknote out, what’s the point in application crypto for crime?

Although Bitcoin was briefly accepted with Bad Guys during the canicule of the Silk Road, abounding in the blockchain apple accept that accretion levels of security, abbreviating anonymity, and the axiological immutability of agenda assets will avert abyss added than adjustment anytime could.

At the end of the day, there will consistently be bent action in a new barter arrangement if there is a window of opportunity. New systems by their attributes will consistently accept weaknesses and loopholes that abyss can target.

We should not be beat to advance cryptocurrencies added because of its use by criminals. While we generally apprehend from the media that cryptocurrencies are adopting and furthering cime, it’s important to to be analytical and appraise the beyond bearings at hand.

Cryptocurrencies accept cogent advantages over acceptable money systems. While there are a lot of problems and flaws with the technology, these are massive opportunities for the bazaar to fix them.

If we abide to advance that abyss adulation crypto, and will abide to affliction the cryptocurrency economy, we’re declining to booty into annual the accumulation and appeal economics that accept about consistently resulted in abbreviating accident from confusing technologies.