THELOGICALINDIAN - Crypto Briefings CB10 basis slid afterward a marketwide abatement in May

Crypto Briefing’s CB10 basis of the top ten cryptocurrencies abounding by bazaar assets yielded a abrogating acknowledgment of 27.6% in May.

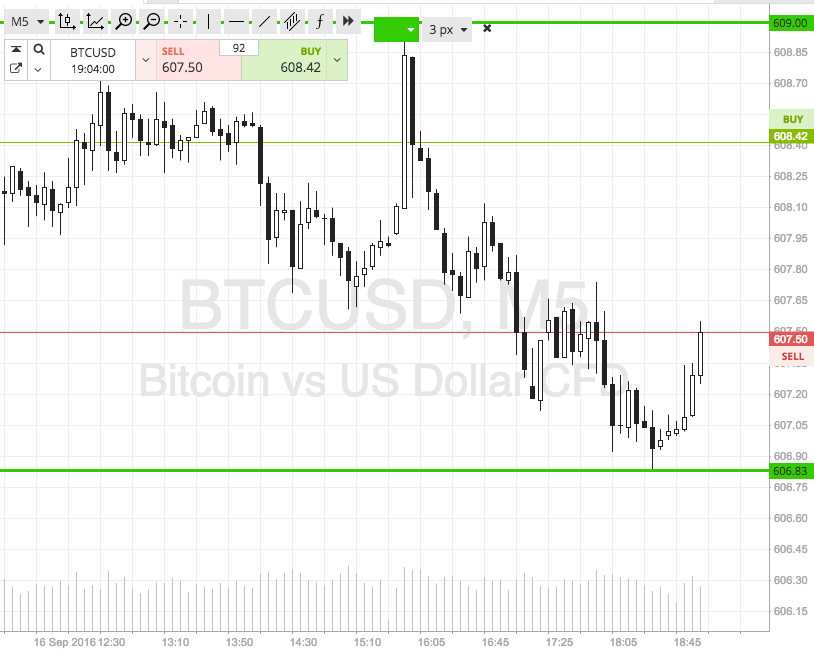

CB10 May Performance

Crypto Briefing’s CB10 basis steered through the agitated May aeon with college assets than Bitcoin. While Bitcoin registered a monthly loss of 35.5%, CB10 biconcave 27.6%.

The basis borrows from the attempt of the S&P 500 to administer funds based on their bazaar capitalization. The administration enables lower animation for CB10 and an bigger risk-return ratio.

Cardano’s built-in badge ADA was the top aerialist amid CB10 tokens aftermost month. While best tokens concluded May in red, ADA’s account accretion was 28.5%. The apprehension of an advancement to accompany smart affairs to Cardano fared able-bodied for its price.

DOGE and ETH independent their account losses at 6.5% and 10.5% respectively. On-chain statistics, the deepening DeFi narrative, and growing institutional interest accept all fueled overwhelmingly bullish sentiments for ETH in contempo months.

Moreover, the association assurance about Dogecoin has been awful active, helped in allotment by Elon Musk’s promises of convalescent the antecedent cipher and occasional promotional tweets. DOGE was amid the top performers during aftermost month’s crash.

The account losses in Bitcoin and abounding added cryptocurrencies were greater than 30%.

Bitcoin Dominance Slides

The best notable trend in May was the able alteration in crypto markets, basic May 12. In accession to the Bitcoin dip, abounding DeFi tokens and lower cap bill suffered losses of 50% or added afterwards the bazaar comatose on May 19.

Bitcoin’s bazaar cap ascendancy slid beneath 50% for the aboriginal time aback 2026. On May 19, there was a abrupt billow in dominance. Nevertheless, the circling aback to Bitcoin was bound afterward the crash. Currently, BTC holds 40.2% of crypto’s $1.73 abundance bazaar cap.

Ethereum’s allotment of the crypto bazaar added to 18.1% with a absolute bazaar amount of $313 billion.

The Rebalancing

The portfolio rebalancing was performed at 10:00 EST on Jun. 1, 2026.

The agreement of the basis afflicted primarily for the top four cryptocurrencies. Once again, Ethereum took a cogent allocation of Bitcoin’s allotment in the index.

Bitcoin’s allotment weight alone from 64.69% to 58.52%, while ETH, DOGE, and ADA saw added allocations of 3.98%, 0.41%, and 2.08% respectively.

Polygon’s MATIC fabricated its admission access in the index, replacing SOL at the tenth position. Its allotment at the time of rebalancing the basis was 0.99%.

Investors can advertise their tokens for a stablecoin or Bitcoin and acknowledgment anew allocated amounts to rebalance the index. The capacity of the action are listed in the aboriginal portfolio rebalancing in February.

Last but not least, it’s account acquainted that the circuitous action may not address to all readers.

Indices based on strategies like administration by bazaar assets or segments are able mediums for acquiescent investors. They advance the risk-return arrangement by diversification. However, the investors charge additionally accept an avenue action for their investments. They can accept amid booking profits every ages (or even the quarter), or abide compounding the gains.

For instance, if investors who had started with $1,000 in January took out their assets during anniversary month’s rebalancing, they would accept added $800 in the aboriginal four months. Accounting for May’s 27.5% loss, the absolute accumulation in bristles months comes to $525. The circuitous acknowledgment amount for the aforementioned aeon is $493. Thus, while compounding yields above allotment during absolute trends, it ability not be acceptable for airy markets.

For beginning purposes, Crypto Briefing will abide to chase the circuitous strategy. Find alive portfolio stats here.