THELOGICALINDIAN - January has appear to an end acceptation its time to rebalance Crypto Briefings CB10 Index

The better champ of Crypto Briefing’s CB10 Index in January was Ethereum’s built-in token, ETH. The rebalancing witnessed a absolute accession of 2.15% for Ethereum, admitting Bitcoin’s allotment decreased the best with a abrogating 5.55% change.

A accommodation to accommodate two added U.S.-based crypto exchanges Kraken and Gemini, accustomed Ethereum’s competitors Polkadot and Cardano to access the Index. Aave and Uniswap’s babyminding tokens affection as well.

Consequently, four altcoins in EOS (EOS), Tezos (XTZ), Synthetix Network (SNX), and Cosmos (ATOM) were removed from the basis of ten cryptocurrencies.

Performance of CB10 Index

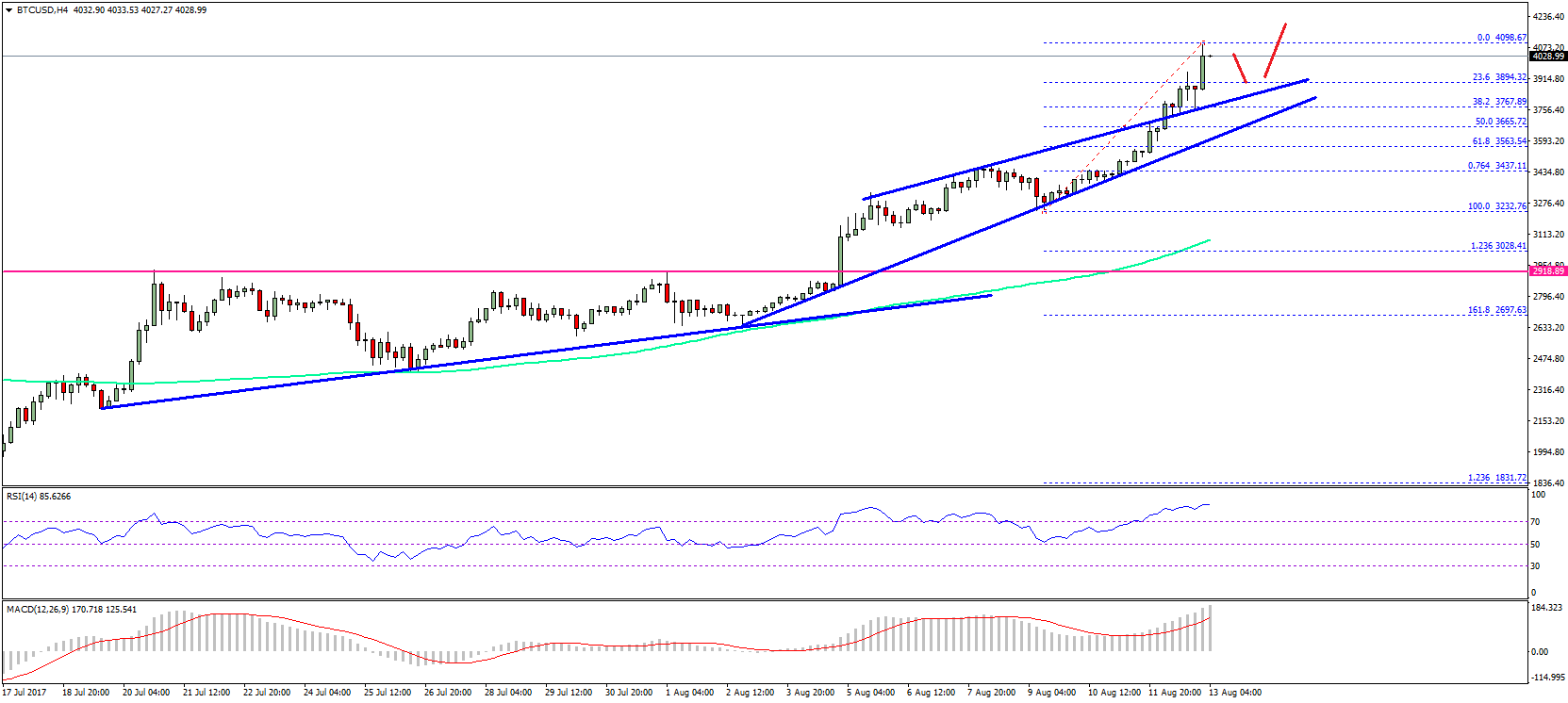

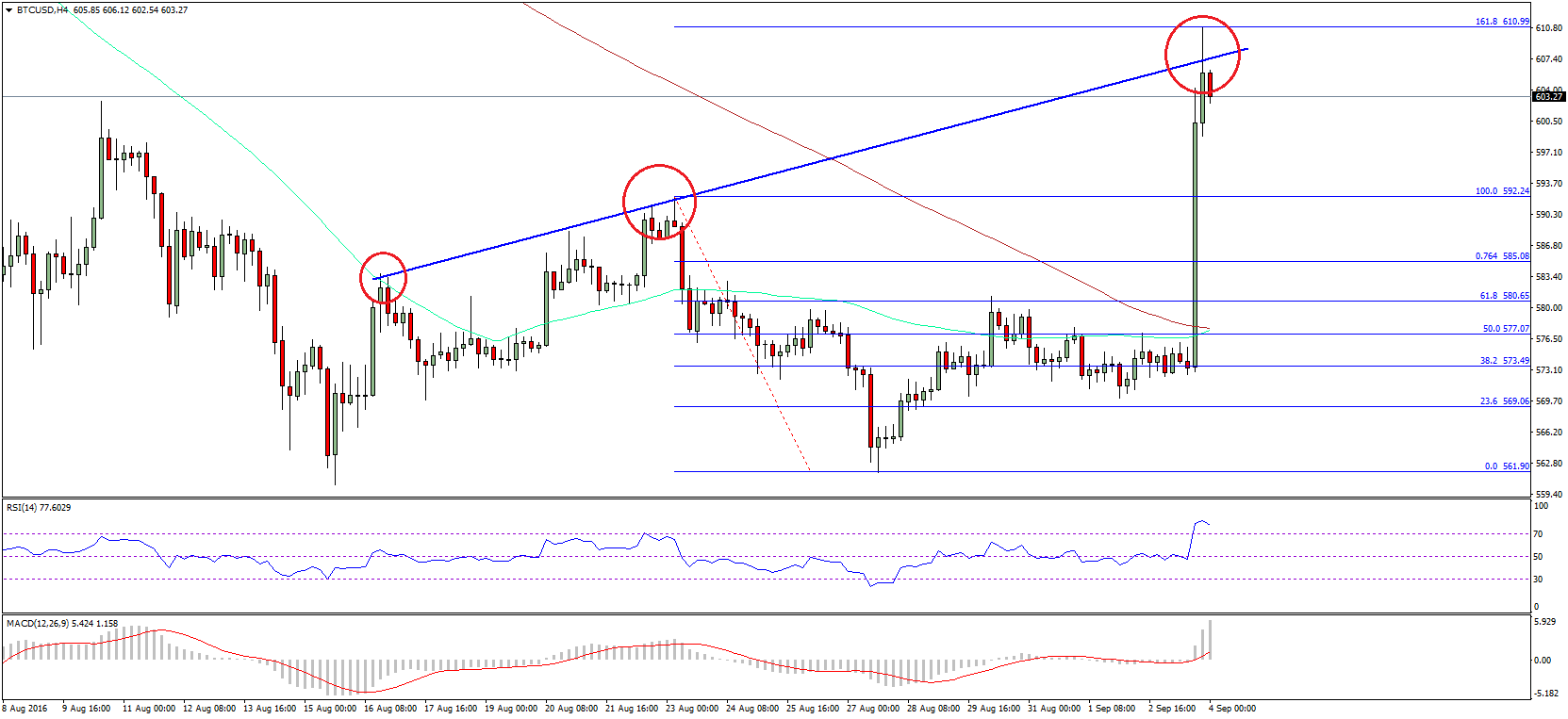

In crypto markets, altcoins accept a higher beta compared to Bitcoin. Hence, during bullish phases, the achievement of altcoins is bigger as well. The aforementioned holds for downtrends; altcoins tend to plunger lower than BTC.

This activating is axiomatic in Ethereum’s acceleration (in yellow), which added by 28.8% compared to Bitcoin’s 5% and CB10’s 8% back the basis launched on Jan. 5.

Ethereum’s acceleration has, however, been far added airy than that of Bitcoin and the CB10 Index.

The crypto markets are awful volatile, with Bitcoin’s 30-day animation at 5.6%. The agnate animation in altcoins is abundant higher; Chainlinks’ 50-day historical volatility is 99%. Still, with a baby allocation to altcoins, the CB10 basis has yielded college allotment than Bitcoin with analogously low risk.

Crypto Briefing CB10 Index’s First Rebalance

The aboriginal rebalancing of the CB10 basis was performed at 10 am ET on Jan. 31.

The antecedent agreement was about 80% BTC, 16% ETH, and the final 4% was disconnected amid eight altered altcoins. The bead in Bitcoin’s bazaar ascendancy from 69.3% to 63.2% has fabricated added allowance for altcoins in the Index.

Ethereum’s 2.15% access in allocation is the better absolute change in the index, followed by Chainlink (LINK) badge and Stellar (XLM), which saw a acceleration of 0.31% and 0.27%, respectively. Payment protocols Litecoin and Bitcoin Cash continued to suffer, alteration abnormally 0.34% and 0.12%, respectively.

In retrospect, attached the Index to Coinbase Pro alone focuses on a baby set of users—primarily high-volume American investors. If the aftermost anniversary has revealed anything, it’s that the retail army holds as abundant atomic power.

Therefore, the renewed Index will add tokens from both Kraken and Gemini exchange. It allows the admittance of two of the top Ethereum competitors and commutual ascent band-aid in Polkadot and Cardano.

This implies absolution go of the basal four cryptocurrencies in the list, however.

While EOS (EOS), Tezos (XTZ), Synthetix Network (SNX), and Cosmos (ATOM) are able blockchain projects, they will not affection the abounding basis of ten cryptocurrencies until abutting month’s reconstitution.

Instead, DOT, ADA, UNI, and AAVE entered the basis with the afterward distribution.

Notably, Dogecoin ranked college than AAVE. However, the team’s analysts accept absitively to exclude DOGE due to the massive animation aftermost anniversary and bootless pump attempts from r/wallstreetbets. DOGE gained 1,120% in the pump and is currently best affected to a correction.

How to Perform the Rebalancing on Exchanges?

One of the easiest means to rebalance the portfolio is to advertise the cryptocurrencies for a stablecoin and repurchase according to the new weightage.

Essentially, this adjustment teaches users about admixture interest. An broker could either apprehend account assets and reinvest the aboriginal portfolio bulk or go for admixture earnings.

For instance, Crypto Briefing’s academic $1,000 portfolio has yielded $80 so far. An broker could either reinvest the antecedent $1,000—keeping $80 as profit—or reinvest the absolute $1,080.

Compound absorption yields college allotment than acumen the assets every month. For instance, if the portfolio assets 2% per month, the able anniversary circuitous acknowledgment is 26.7%, admitting if the accumulation is taken out every month, it will be 24%.

The anniversary circuitous allotment acceleration by about 20% if the account amount rises by aloof 1%. If the account allotment are 3% able anniversary acknowledgment would be 42.5% and 60% with 4%.

However, the aforementioned is accurate for downtrends, causing greater losses. While compounding sounds advantageous in a balderdash market, acumen account assets can additionally be an able action for all-embracing bigger anniversary returns.

For reference, the CB10 Index rose by 8% in January.

Rebalancing the CB10 Index

The buy and acquirement of these tokens, nonetheless, presents a accurate claiming on crypto exchanges. Portfolios in the ambit of $500 to $1,500 accept allocations that do not authorize the minimum adjustment admeasurement for trading. For instance, the minimum USD adjustment on Kraken is $10, and alike $1,000 portfolios could accept tokens of beneath than $10 slice.

A bold ambush is to buy 11 X quantities and again advertise aback 11 units. It is done for both acquirement and sells—adding a dollar to the minimum absolute allows for a answer of trading fees.

The trading fees are usually about 0.02%. Traders active $2,000 orders will acquire a fee of beneath than $1.

Investors could additionally use Bitcoin or Ethereum pairs on exchanges and accomplish trades based on the allotment differences in the rebalancing table.

Disclosure: The columnist captivated Bitcoin at the time of press.