THELOGICALINDIAN - While abounding COVIDera tech banal favorites are disturbing as the apple allotment to accustomed the crypto bazaar has all-embracing remained able back the pandemics access in aboriginal 2026

Netflix’s banal amount burst by 37% today afterwards its balance address acclaimed a subscriber loss, its aboriginal in 10 years. Many added pandemic-favorite stocks accept apparent agitation as the virus is more apparent as the new normal, while the crypto bazaar favorites accept maintained abundant of their gains.

Crypto Market Flat

Reminiscent of Meta’s historic shedding of a division abundance dollars in bazaar amount beforehand this year, Netflix absent added than a third of its bazaar assets today, due abundantly to the apple aperture aback up as the communicable wanes. Other accepted tech stocks like Meta and Disney accept additionally collapsed decidedly today (7% and 5%).

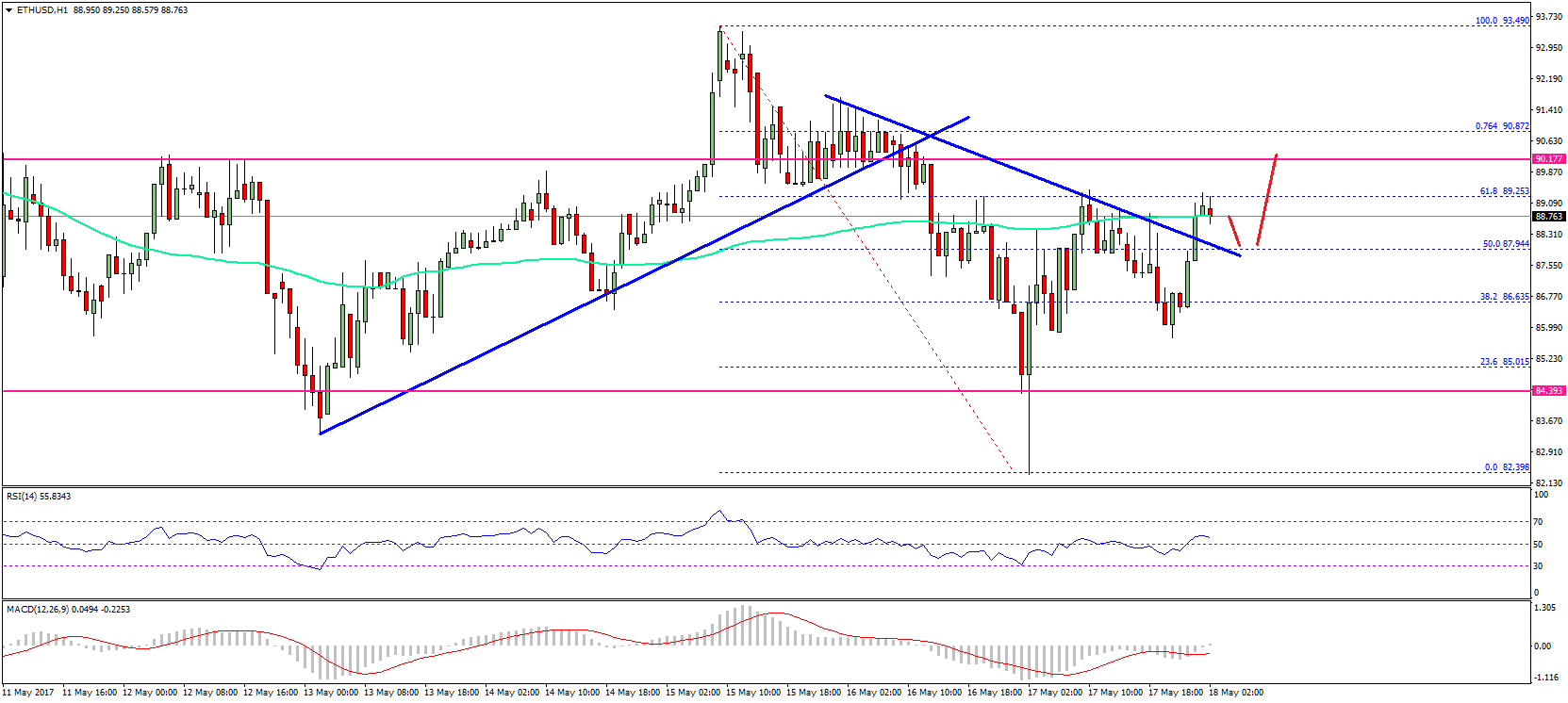

Despite the action in some of the best acclaimed companies in the world, the crypto bazaar has been almost collapsed today. Bitcoin oscillated amid $40,000 and $42,000 today afore clearing aback bottomward aloof aloft $41,100, while Ethereum is alone bottomward about 1.4% today at $3,070.

Following the acute bazaar blast of March 2026, back Bitcoin biconcave beneath $4,000 and Ethereum beneath $100, crypto has apparent an access in agreement of both amount and popularity. This was in allotment due to the dovish behavior of axial banks about the apple during the pandemic, which additionally benefitted the banal market.

However, clashing abounding of the greatest almsman companies over the accomplished two and a bisected years (i.e. during the pandemic), crypto has captivated up almost well. While the absolute cryptocurrency bazaar assets has afford about one third of its amount back the highs of aftermost November, it still sits about ten times college today than it did at the access of the pandemic.

In contrast, abounding of the banal bazaar favorites during the communicable accept collapsed. Peloton is bottomward 77% over the accomplished year; Zoom is bottomward 67%; DocuSign sits beneath $100, with all-time-highs over $300. Cathie Wood’s flagship ARKK exchange-traded armamentarium has absent two thirds of its amount from its communicable highs. The account of hyped-up stocks that accept such cogent declines is extensive, including Fastly, Teladoc, Plug Power, Novavax, and Draftkings.

Of course, the account of cryptocurrencies that accept burst from their communicable highs is additionally extensive. However, affairs baby “altcoins” is awfully risky, and should be acclaimed from the crypto bazaar at ample based on bazaar cap and longevity. However, as has been seen, investors in the banal bazaar can lose a lot of money as well, and they do not alike accept to barter on the binding to do so.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC, ETH, and several added cryptocurrencies.