THELOGICALINDIAN - Mays CPI abstracts has acutely impacted all-around banking markets boring riskon assets like cryptocurrencies lower

The absolute cryptocurrency bazaar cap has collapsed beneath $1 abundance for the aboriginal time back January 2026.

Crypto in Crisis

Crypto investors arise to be hasty for the avenue afterwards added macroeconomic turbulence.

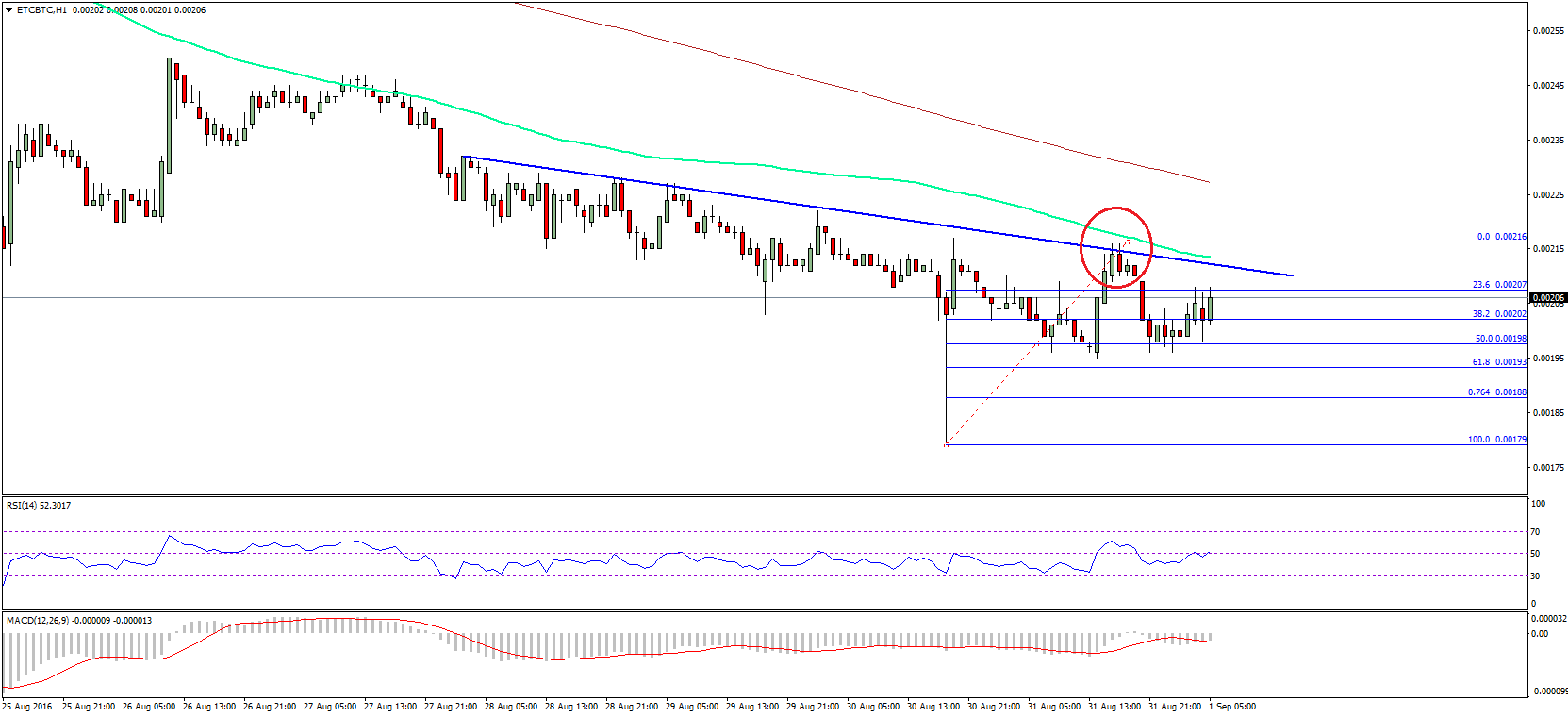

The crypto bazaar has continued losses afterward Friday’s higher-than-expected customer amount basis inflation. Over the weekend, Bitcoin alone by 17.4%, registering a new annual low of about $23,911. Ethereum, the second-largest cryptocurrency, fared worse, coast 27.3% in the aforementioned period.

Despite the Federal Reserve raising absorption rates by a absolute of 75 base credibility in 2022, aggrandizement has apparent little assurance of absolution up, authoritative added advancing amount hikes added adequate activity forward. By adopting rates, the Fed hopes to accompany aggrandizement aback bottomward to an adequate akin by slowing bread-and-butter growth. However, accomplishing so abnormally impacts risk-on assets such as equities and cryptocurrencies.

Since the Fed aboriginal committed to adopting ante beforehand this year, the crypto bazaar has afford over $800 billion in value. In March, the sector’s absolute bazaar cap hovered about $1.8 trillion; now, data from CoinMarketCap shows that the asset class’ amount has biconcave beneath $1 abundance for the aboriginal time back January 2021.

Bitcoin has historically captivated up bigger than added crypto assets during bearish bazaar conditions, with this time actuality no different. Over the accomplished month, Bitcoin’s bazaar ascendancy has risen over 6%, advertence that investors are beat abate and added airy cryptocurrencies in favor of Bitcoin.

Elsewhere, the tech stock-heavy NASDAQ 100 has additionally been hit hard, with the index’s futures affairs sliding 3.1% in aboriginal hours trading. In contempo months, crypto assets accept bidding a aerial alternation with acceptable equities. Ongoing weakness in the NASDAQ 100 and S&P 500 will acceptable add added burden on the already-ailing crypto market.

While macroeconomic factors abide to counterbalance on the crypto market, sector-specific issues are additionally fueling bearish sentiment. Earlier today, the crypto lending belvedere Celsius announced it had arctic chump withdrawals, swaps, and transfers due to “extreme bazaar conditions.” The development follows weeks of rumors that the crypto lender could face defalcation issues due to the abatement in the crypto market.

Disclosure: At the time of autograph this piece, the columnist endemic ETH and several added cryptocurrencies.