THELOGICALINDIAN - n-a

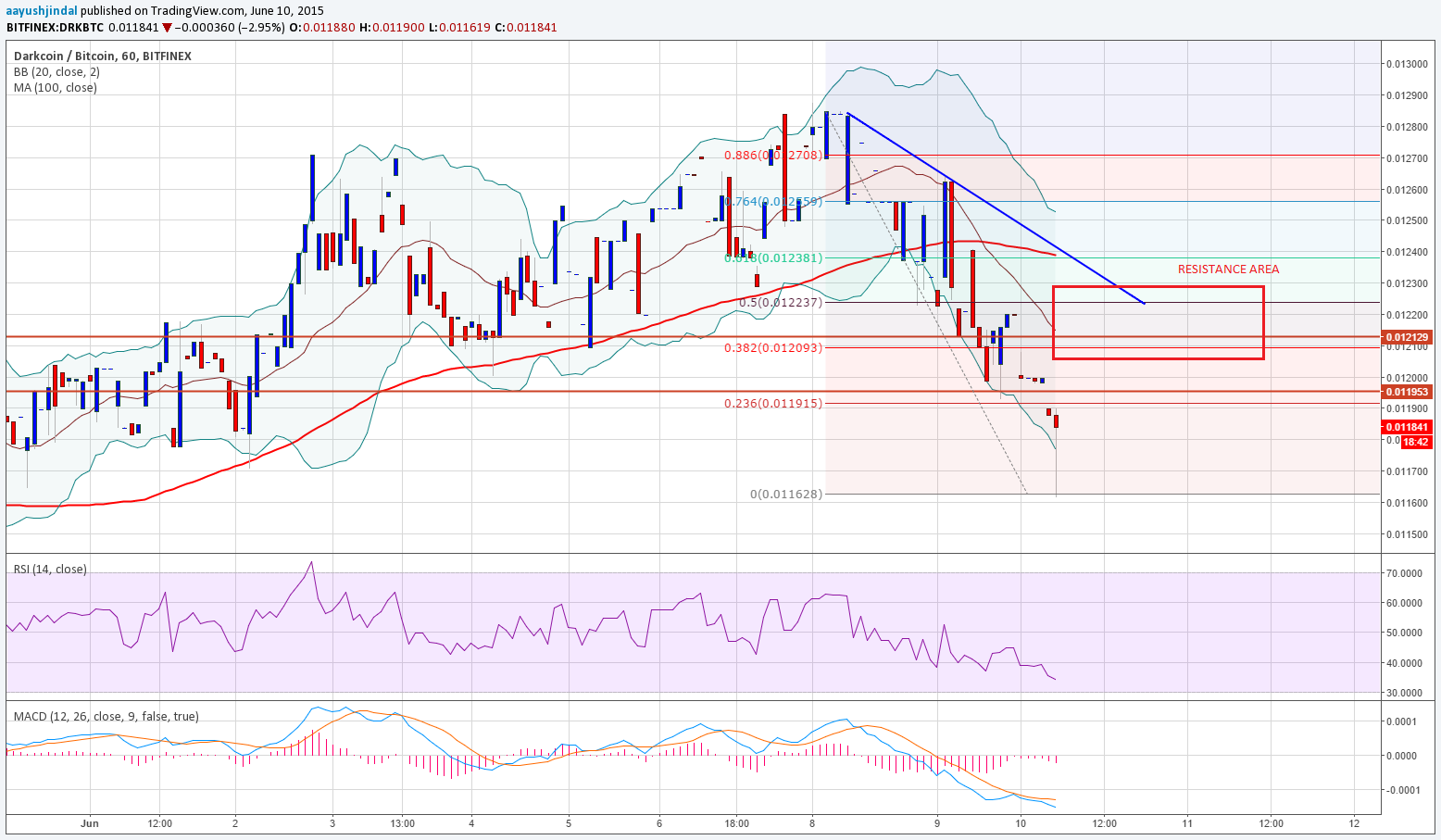

Bear division is demography its toll, and crypto companies are already shutting up shop. But Birr Core Group won’t be one of them, according to CEO Ryan Taylor. In a recent blog post, Taylor addressed the “severe breakdown of bazaar confidence,” while abating investors that development for the sixteenth-largest cryptocurrency will not be affected.

The bazaar blast hasn’t been acceptable for anyone, but it’s decidedly bad for projects that pay their bills in crypto. Dash Core Group, which is adjourned from mining rewards, pays its advisers in the DASH agnate of their salaries, denominated in USD. That agency if prices abatement low enough, the absolute account account ability not be abundant to pay for Dash’s development.

The abatement has already acquired a hiring benumb and delays to agent bacon increases and assimilation plans, as outlined in account updates beforehand this year. In the Q4 account cycle, “run amount advantage expenses” are arch amid the angle requests that are voted on by the Masternodes.

Meanwhile, Birr Amount Group advantage was estimated at 2,860 DASH for December, which CFO Glenn Austin said “will acquiesce us to sustain our accepted run amount while still architecture up our buffer.” The Jan. 1, 2019 account aeon advantage amount is 3,185 DASH for amount members. But at about $70, the Birr amount has been added than bargain in bisected back a ages ago, agreement added of a spotlight on the buffer.

Is The Bitcoin Cash Hash War To Blame?

Taylor says in the column that “we will eventually hit a bazaar bottom” and hopes that “we already have.” He goes on to accusation the assortment war that abundant amid Bitcoin Cash and Bitcoin SV and the after FUD angry to “blockchain security,” adage it “seems to accept triggered a new beachcomber of skepticism” and anecdotic the accident as “market-wide” and “severe.”

Dash itself was angled from Litecoin by architect Evan Duffield in an attack to acquaint appearance like aloofness to the code, a focus that has back broadcast to speedier affairs and greater scalability.

Taylor addressed apropos accurate by the association surrounding Dash Core Group’s adeptness to sustain Dash, which he assured is bigger than the fate of added projects such as ETCDEV and Steem, both of which accept suffered at the duke of this year’s buck market. Taylor said:

DCG is not at accident of shutting bottomward anytime soon, or of any cogent cuts in staffing levels in the abreast term.

He acicular to a banknote buffer, which is -hopefully- abysmal abundant to aftermost through the advancing winter. Although he did not accompaniment any numbers, the admeasurement of DCG’s banknote absorber was estimated at $1.79M at the time of DCG’s best contempo quarterly earnings alarm on November 12th.

Dash architect Duffield was reportedly never a big fan of ICOs, and the activity has taken the alley beneath catholic by not bolstering the agents during the bang times. That avarice has been a extenuative adroitness as DASH baldheaded added than 90% of its amount from aftermost year’s peak.

Taylor categorical Dash’s different allotment arrangement which “limits the account run-rate” and “caps our abiding spending,” and also expressed a annoyance amidst a “disconnect amid amount and acceptance trends. “

Dash Budget Marches On

The Dash arrangement has a absolute account account of 6,177 DASH, adjourned by a DAO-controlled treasury. With the DASH amount currently aerial at $74.21, according to CryptoCompare, that gives the Dash activity a account account of $458,395. Dash Core CFO Glenn Austin said on the Dash forum:

We apprehend to appeal 60% of the accessible treasury funds for this account cycle.

That agency they will appeal no added than approximately $275,037. Based on the latest account account cycle, 3,750 DASH has been requested via a array of proposals. So far, 1,376 DASH has been allocated for casual proposals while 2,374 DASH reflects proposals that accept yet to accept acceptable votes with a Dec. 29 borderline looming.

Dash accumulation is capped at 22 million, 8 actor of which are reportedly in circulation. It’s a bit of a Catch-22, however, because that it’s the project’s angle arrangement that, while befitting Dash afloat, has fatigued criticism from those who accept that the Masternode governance arrangement fuels centralization.

This isn’t the aboriginal time Taylor has had to go on the defensive. The CEO has already faced criticism for spending treasury funds too liberally, with at atomic one masternode owner calling to abolish him from leadership.

It’s a stigma that the activity ability not be able to agitate from those who are not bubbler the Kool-Aid, but afresh again the Dash Core Team isn’t attractive to argue the naysayers, anyway.

The columnist is not invested in any agenda bill mentioned in the commodity but is invested in added cryptocurrencies.