THELOGICALINDIAN - DeFis best accepted DEX may be assault centralized antagonism but its built-in badge is acceptable fodder for the bears

After a 60% bead from its peak, the UNI token amount is adverse connected affliction admitting the success of Uniswap. A contempo angle from the yEarn association may, however, save the falling token.

Decreasing Volume and Fees on Uniswap

In September, Uniswap’s trading aggregate was greater than alike Coinbase, demography the DEX to the fourth position in the all-around barter rankings.

Nevertheless, abundant of this acceleration is attributed to the UNI badge launch and the consecutive blitz to yield farm the token.

While the protocol’s clamminess is still rising, the circadian aggregate is basic lower highs back its aiguille on Sept. 17. And as circadian aggregate drops, so too do clamminess providers’ (LPs) allotment on trading fees. LPs earning UNI tokens aren’t safe from the bead either.

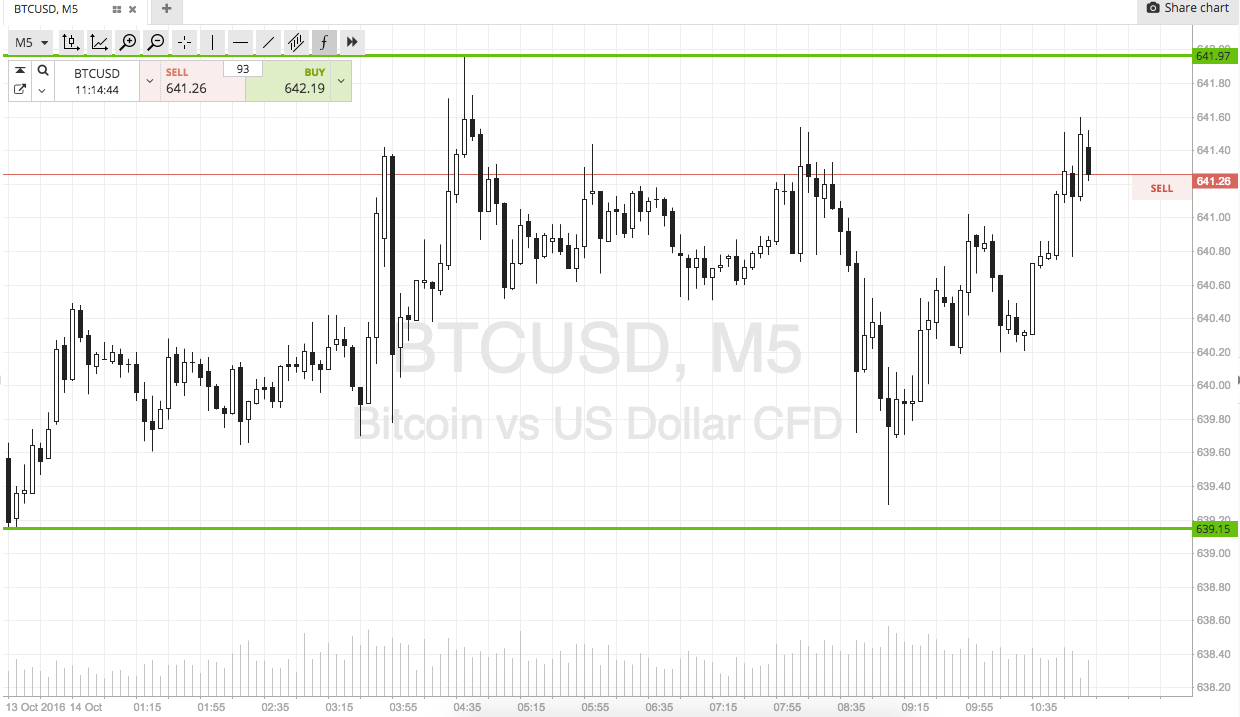

UNI has burst beneath the abutment of its bottomward triangle at $3.65, advertence added losses for badge holders affective ahead.

Lower highs and accumbent abutment characterize a bottomward triangle pattern. The ambit from the abject to the top of the triangle is $3.54.

Currently, the 38.2% Fibonacci retracement akin for UNI badge from the basal to the aiguille is $3.42. If this abutment breaks, the amount will attending for abutment at $2.1.

On the upside, the attrition from the 50% and 61.2% Fibonacci retracement levels are $4.42 and $5.42, respectively.

yEarn Vault Adds More Pain

Franklin, an absolute programmer, has proposed to add a Uniswap-based basement to the yEarn Finance platform.

The architecture will add clamminess to incentivized Uniswap pools, which accredit crop agriculture of UNI tokens. Users can currently acquire UNI tokens by mining four pools: ETH-USDC, ETH-USDT, ETH-DAI, and ETH-WBTC.

For example, the vaults will catechumen UNI to both ETH-USDC, add it to the corresponding Uniswap pool, abundance UNI from it, advertise the UNI autumn for added ETH-USDC, and repeat.

Out of 150 voters, 127 of them accept voted for the proposal, at columnist time. Once passed, the action could still any actual appeal for the UNI badge as users cascade basic into the new strategy. By consistently affairs UNI for added ETH-USDC, advertise burden for Uniswap’s badge will abide to abolish prices.

All that actuality said, Uniswaps’ circadian trading aggregate is still outpacing Coinbase by almost $116 million, according to CoinGecko. Unfortunately, abundant of this may alone be due to the incentivized crop agriculture scheme.

The absolute analysis for Uniswap will appear on Nov.17 when these incentives abatement away.

Editor’s note: This commodity has been adapted to appearance that the UNI action on yEarn is bearish for the token, not bullish.