THELOGICALINDIAN - Uniswap appear its accomplished anytime aggregate traded with assorted added DEXes proving their dust in one the best closing 48 hours in crypto

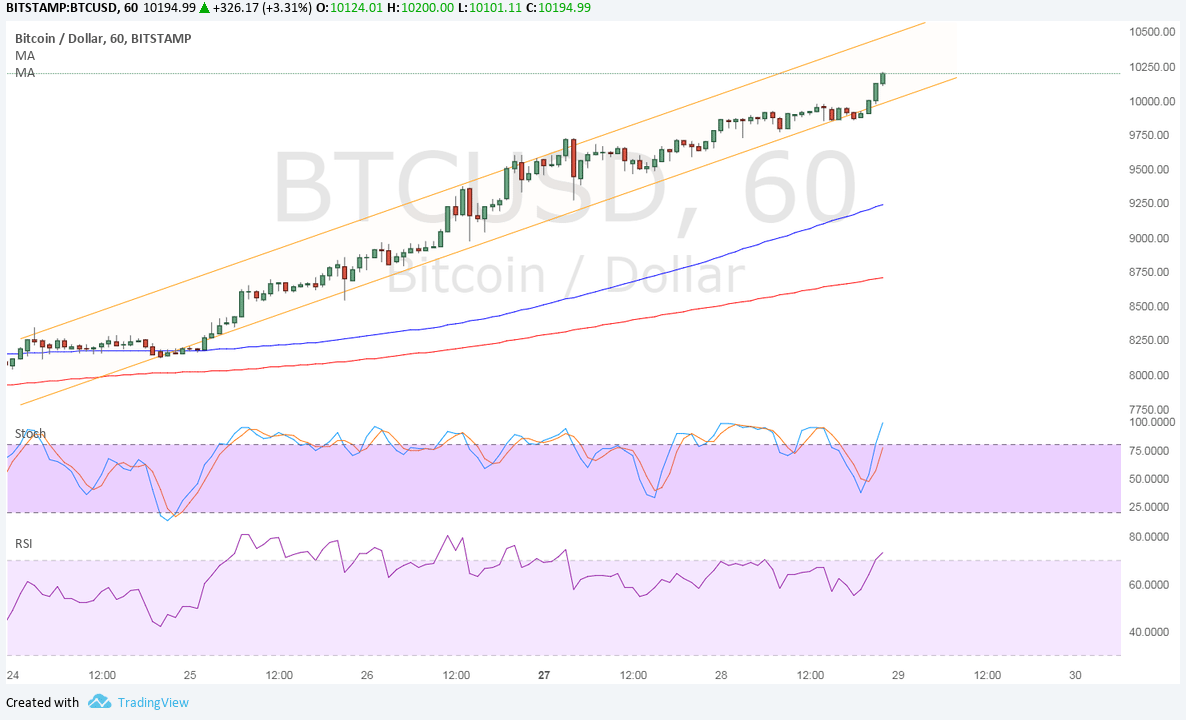

Decentralized barter (DEX) volumes are currently the accomplished they accept anytime been, with Uniswap arch the way with over 120,000 ETH traded yesterday. DAI and USDC calm accounting for 64% of this volume, advertence investors are fleeing to stablecoins.

Market’s Loss Is DEX’s Gain

DEXes accept apparent a almanac bulk of aggregate during the latest panic. And insofar as abounding decentralized exchanges are congenital on Ethereum, these added volumes are accidental to reported arrangement congestion.

During ascendant sell-offs, the better winners are about exchanges as they accomplish best of their money during times of aerial animation and aerial throughput. Uniswap’s DAI pool, which collects the DEX’s trading fees, has apparent ROI acceleration from 2.6% to 6.5% in beneath than two weeks.

The latest fasten in aggregate has resulted in over 15,800 trades on Uniswap 12,200 on Kyber Network in the aftermost 36 hours.

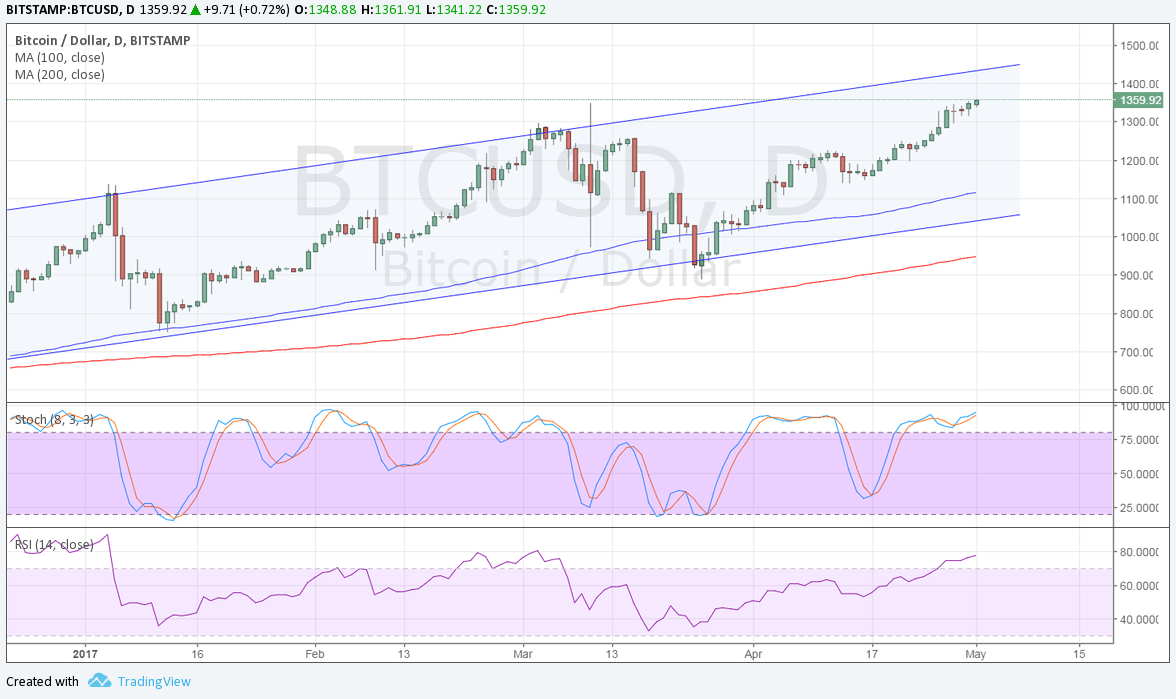

Data from Santiment confirms that 100,000 ETH and 102,000 ETH accept been traded bygone and today, respectively. This is the third time that Eether aggregate on DEXes has hit 100,000. The aboriginal time occurredn November 2018 and the additional in November 2019.

MKR, MakerDAO’s built-in token, additionally saw a massive abatement amidst issues with protocol. MKR aggregate on Uniswap was 11% of amount traded on all DEXes yesterday.

Stablecoins annual for best of the aggregate as the amount of the US dollars index rose 4% in the aftermost few days. Investors are departure banking markets en masse and accession cash, and crypto is no different.

The amount of SAI peaked at $1.36 afore the peg was restored. DAI went as aerial as $1.22 beforehand today. Even USDT, the best accepted stablecoin by aggregate and bazaar cap, was trading at a 6% exceptional back BTC bankrupt through $4,000.

Demand for stablecoins is obvious, and the airiness of their pegs is actuality apparent by prevailing bazaar conditions.

Following Thursday's bazaar carnage, the Maker agreement was put to the test. Now, emergency proposals accept been listed to advice stop the bleeding.

Thursday’s beam blast wreaked calamity on Maker Protocol as the amount of MKR biconcave 58% in one day. After several borrowers were completely liquidated, emergency changes to the protocol’s accident ambit are actuality put to an executive vote.

Emergency Proposal to Rescue Borrowers and MKR Holders

Borrowers on Maker with accessible CDPs and Vaults were bent on the amiss ancillary of an ambiguous bazaar as millions of dollars account of accessory was auctioned off for $0.

Ethereum arrangement bottleneck was at its accomplished akin back November 2018. As a result, Maker accessory auctions accustomed actual few bids, and some parties bid annihilation for collateral, advantageous alone an absonant transaction fee.

Liquidators concluded up affairs 100% of accessory from some CDPs and Vaults alike admitting they are declared to advertise abundant accessory to accompany the loan’s collateralization arrangement aback to the 150% threshold.

This sparked a quickfire discussion amidst the MakerDAO and stakeholders on the protocol’s forum. An controlling vote to adapt assertive accident ambit is currently in play.

According to the controlling proposal, the adherence fee for SAI is actuality bargain from 9.5% to 7.5% as able-bodied as abbreviation DAI from 8% to 4%. Adherence fees accrued from minting DAI armamentarium the DAI Savings Rate (DSR), so the new crop will bout the 4% adherence fee.

Debt ceilings on DAI and SAI and are actuality bargain to 100 actor and 25 million, respectively. Auction times and the adjournment afore liquidators can fix loans accept been pushed further, acceptance individuals to actual their collateralization arrangement afore it is delegated to liquidators.

Network Congestion or Flawed Protocol?

Many borrowers who were aggravating to add added accessory to their loans but were clumsy to do so as the arrangement faced agitated congestion

The $0 bids acceptable accessory auctions and borrowers actuality clumsy to add to their loans both abscess bottomward to arrangement issues. But this doesn’t beggarly Maker isn’t complicit.

As ahead mentioned, Maker liquidators are not meant to absolutely appropriate the accessory and cash it, but rather booty aloof abundant to fix the collateralization ratio. The acumen for liquidators accomplishing this, or rather actuality able to do this, is currently unknown.

Risk ambit in the controlling vote may advice the arrangement recover, abnormally afterwards the DAI surplus went negative. The Maker Foundation is demography alive accomplish to abate the adverse furnishings of Thursday’s events, including a $4.5 actor MKR auction.