THELOGICALINDIAN - n-a

Crypto winter has claimed abounding victims, but some bill are still as acceptable as…. well, you know. Digix, a stablecoin-like asset backed by gold, has apparent broker appeal billow as prices acceleration for the adored metal.

The Digix Gold Badge (DGX) is an asset-backed agenda currency, with anniversary DGX badge apery one gram of concrete gold captivated in a basement in Singapore. The activity believes this has fabricated the gold bazaar attainable to investors, acceptance them to calmly acquirement and backpack an asset acclaimed for its abiding stability.

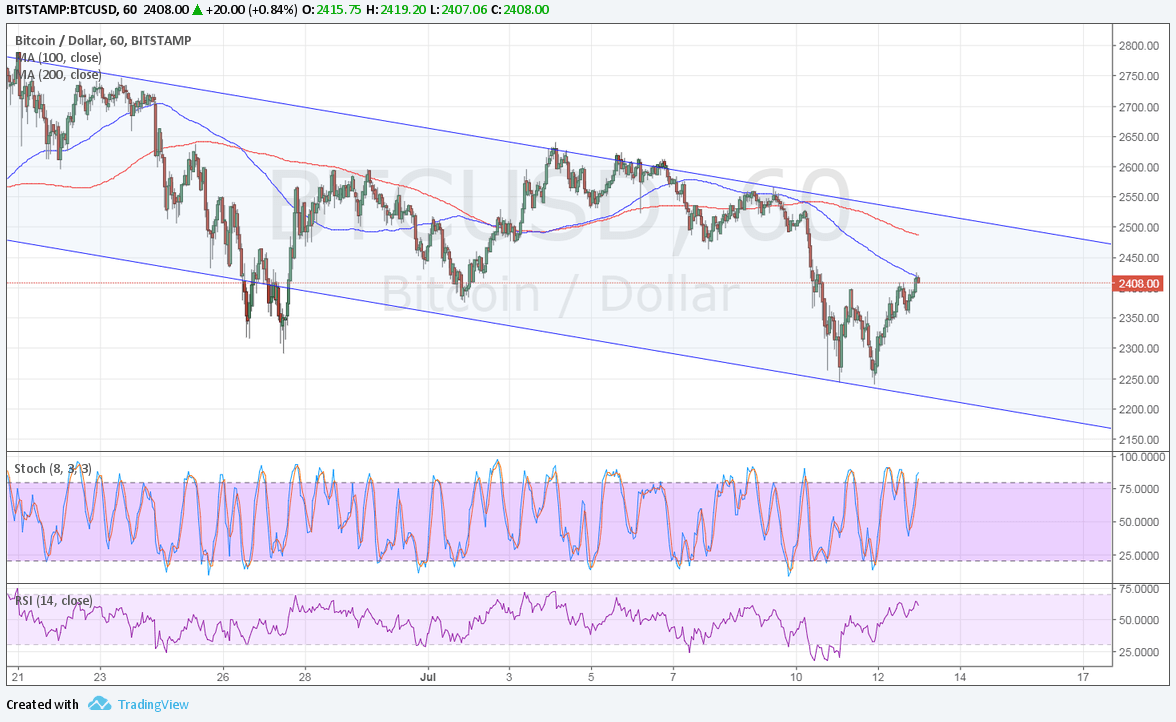

Cryptocurrencies were already volatile, but the latest storms accept agape the aplomb out of the sector. Investors are attractive to barrier adjoin crumbling prices.

At Digix, things accept been activity so able-bodied that they reportedly angled their gold backing in the aftermost quarter, from 50kg to 100kg. The project’s co-founder, Shaun Djie, told Crypto Briefing this morning that “appetite has been growing” as added bodies activate to “switch assimilate the abstraction of agenda gold.”

“People acknowledge ambiguity in bread-and-butter uncertainty,” Djie explained during a call. “Digix is a abiding abundance of value…gold holds adjoin aggrandizement and has stood the analysis of time.”

Built on Ethereum, DGX holders can advertise their tokens on the accessible bazaar or alike redeem them for the concrete asset – at a minimum of 100 grams – should they wish. Djie explains they’ve already had three users redeem their tokens back DGX became tradeable aftermost summer. The tokens are austere afterward redemption.

Is gold the new bitcoin?

Gold and bitcoin accept overlapping characteristics which accomplish them adorable to investors. Both are finer decentralized and stateless: there is no axial academy or company, as with authorization currencies or equities.

Similarly, amount movements in gold and BTC are commonly absolute of the banal market. As a continued appellation asset, gold is additionally a actual acceptable barrier adjoin inflation: its amount rises back the amount of active increases.

Jan Van Eck, CEO of the eponymous advance administration aggregation – which afresh withdrew its Bitcoin ETF appliance – believes that investors are affective abroad from cryptocurrencies, like bitcoin, and aback into acceptable food of value, like gold.

“I do anticipate that Bitcoin pulled a little bit of appeal abroad from gold aftermost year, in 2026,” Van Eck said on CNBC aftermost week. “Interestingly, we aloof polled 4,000 bitcoin investors and their cardinal one advance for 2026 is absolutely gold. So gold absent to bitcoin and now it’s activity the added way.”

The aftermost few years haven’t been affectionate to gold, but it showed signs of stabilizing aloof as bitcoin began to bead in the additional bisected of 2026. Since August, gold rallied by 10%, while crypto tanked. Concerns over a all-around recession could explain the contempo advance in appeal for DGX.

Digix is expanding

Although Digix’s alone basement is currently in Singapore, Djie says they are already because amplification to added jurisdictions. The activity is currently attractive to Europe as able-bodied as arising economies, such as Vietnam, both which accept apparent ascent appeal in contempo months. They’re acquisitive that as DGX assets traction, they’ll be able to allure advance from acceptable sectors.

Djie expects appeal for Digix Gold Tokens to abide ascent throughout the year if accepted bazaar altitude continue. “Crypto winter is acceptable to aftermost throughout this year and our tokens are acceptable to book able-bodied during this period,” he said.

The area is still bearish and prices abide to fall. Tether (USDT) briefly fabricated it into the top-four, and as Crypto Briefing reported yesterday, appeal for the USD-pegged stablecoin is accretion as investors attending to bottle amount adjoin a actual ambiguous future.

The area may no best be hodling. But if Digix has its way, traders will all hopefully be ‘godling’ out this crypto winter.

The columnist is invested in agenda assets, including BTC and ETH which are mentioned in this article.