THELOGICALINDIAN - Bots could account calamity in the amiss hands

Once aloft a time, a cryptocurrency transaction resembled a biologic deal. Buyers and sellers met in-person, exchanging abounding of banknote for a clandestine key scribbled on a blooper of paper. A client could lose aggregate artlessly because the agent had bad handwriting.

But in the ten years back Bitcoin’s alpha block, cryptocurrency trading has transitioned from a park-bench bazaar to a multinational, multi-billion dollar, industry. Exchanges, aphotic pools and OTC desks buy and advertise basic currencies at ante which were extraordinary a few years ago.

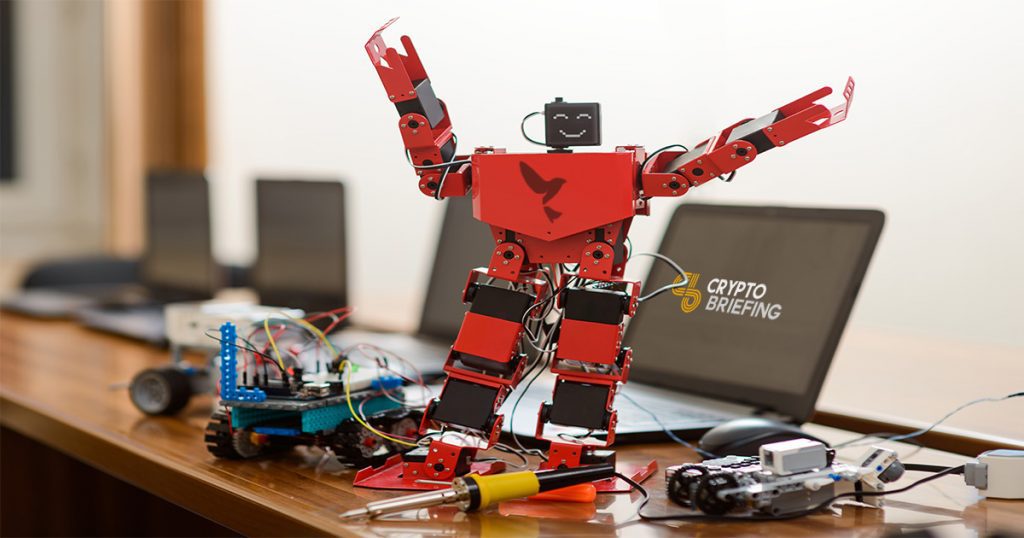

Among the latest developments are trading algorithms, or ‘bots,’ which automatically assassinate orders back assertive altitude or indicators are met. They assignment about the alarm and can atom the tiniest, best fleeting-disparities – the aboriginal flickers of a trend – by processing all-inclusive sets of data.

These algorithms are begin in best markets. The Financial Times affected that bisected of all disinterestedness trades in the US were done by bots. They are additionally arresting in cryptocurrency, to the point that some media outlets attributed aftermost week’s ‘bitcoin boom‘ to bots mass-buying Bitcoin afterwards misinterpreting April Fool’s articles.

The growing bazaar for trading algorithms

There’s a faculty of disability here: animal accuracy artlessly cannot attempt with an algorithm. Without algorithms, retail investors are finer shut-out from a ample allotment of the market, while ample institutions accomplish fortunes.

But in the accomplished few months, several companies accept amorphous to action new articles which accommodate admission to the aforementioned technologies and strategies that had already been absolute to institutional traders.

This month, Hummingbird open-sourced cipher for retail or institutional traders to body their own high-frequency trading (HFT) algorithms. A Google chase for ‘crypto trading algorithm’ yields a flood of adverts from bot providers, tutorial videos and alike allegory websites.

But is this a absolute development? After all, a badly-designed algorithm could lose a affluence through poor investing. It ability acknowledge to the amiss signals or artlessly be poorly- programmed, authoritative aberrant and capricious calls.

Then there’s the accident that a rogue bot ability do to the added market, creating abrupt amount movements which are again best up and acted on by others.

For the people, by the people

Anthony Lesoismier-Geniaux is arch action administrator (CSO) and co-founder of Swissborg, a blockchain-based abundance administration belvedere developing its own trading algorithms for investors.

Lesoismier-Geniaux doesn’t see any crisis in accouterment bots to retail investors. On the contrary, he told Crypto Briefing over the phone, it is absolutely appropriate.

Crypto is altered from acceptable asset classes, explained Lesoismier-Geniaux. Not alone are tokens a abundance of value, they accord holders admission to blockchain technology. In his opinion, this gives users the abandon to accomplish their own decisions – acceptable ones as able-bodied as bad. “Bitcoin hasn’t been engineered by banks: it is fabricated for bodies by people,” he added.

Education is important, Lesoismier-Geniaux notes, and traders should do their research. But in his view, giving retail investors admission to trading algorithms additionally “gives added abandon to the individual.“ It puts approved traders on the aforementioned arena acreage as the better banking institutions.

No one absolutely knows area the bazaar is going, he said. “But by accouterment the appropriate accoutrement they [retail investors] can accomplish their own decisions on area to advance and how to invest.”

‘Potential to get burnt’

Not anybody is so optimistic. David Thomas, Director of GlobalBlock, warns that after a authoritative anatomy or acknowledged framework, investors application these algorithms can be larboard unprotected.

“There is abeyant for said investors to get burnt either by the basal account providers or absolutely by their own artlessness aural the bazaar and the decisions that they make,” Thomas said.

For Ben Morley, CEO of Digax, a cryptocurrency payments provider, the accent lies in ensuring that accident is appropriately managed. Service providers, like Swissborg, “should be abundantly able to handle the risks that appear with retail or added artless investors,” he said.

Bots in the balance

It’s adamantine to actuate how acerb trading algorithms will affect the bazaar as they become widespread. On one hand, investors after the appropriate akin of compassionate could be put in danger, and a abridgement of adjustment would let arrant providers go unpunished.

On the added hand, bots accord retail investors the befalling to absolutely participate in the market. They fit in with the amount attempt of decentralization, removing middlemen and acceptance individuals to collaborate anon with the market.

Overall, the scales assume to tip appear the allowances of trading algorithms. Any broker attractive actively into algorithms and avant-garde strategies may already accept the appropriate akin of ability in adjustment to use them effectively, Thomas observed. Providing access, in his opinion, would animate a “further thirst” for the all-embracing amplitude and how it operates.

That, he says, can alone be a acceptable thing.