THELOGICALINDIAN - Grayscale Investments LLC afresh appear absonant appeal from institutional investors attractive to accretion acknowledgment to Bitcoin

Just aloft 12,300 BTC accept been mined back May 11, but in that aforementioned period, Grayscale’s Bitcoin Trust (GBTC) has bought about 19,000 BTC. With appeal from institutions skyrocketing, the aftereffect of the halving’s economics is blame in.

Bitcoin in the Mainstream

Institutions may now be actively allocating cogent basic to BTC as an bread-and-butter and political hedge, as all the signs point to an access in institutional appeal for the agenda asset.

Grayscale is amid the few capitalizing on this billow in appeal as they accommodate the simplest careful band-aid for investors.

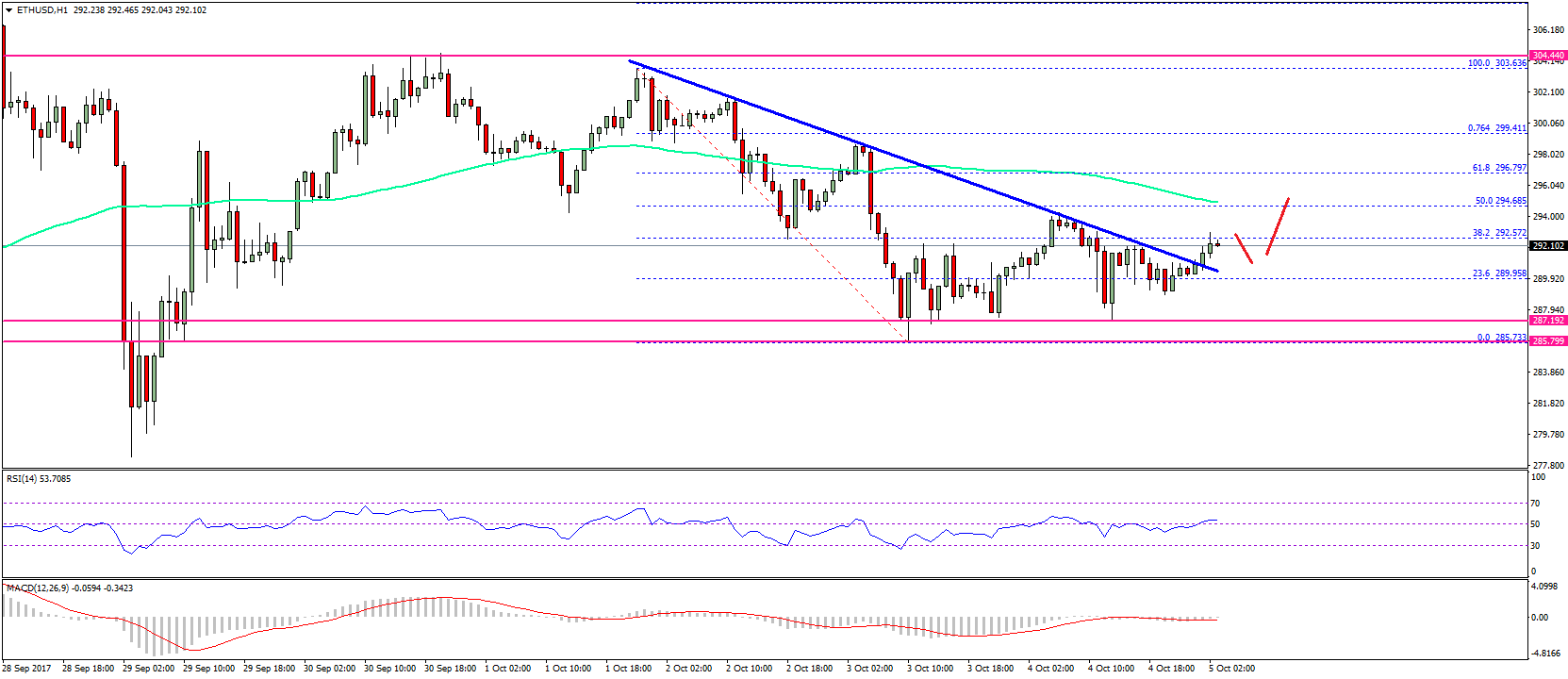

Kevin Rooke, a technology analyst, noticed that the bulk of BTC activity into Grayscale’s Bitcoin Trust (GBTC) back the halving exceeded the bulk of BTC produced by miners by over 52%.

While creating new GBTC can alone be done by high net-worth individuals and institutions, it trades complete on accessory markets. As a result, abounding retail investors booty advantage of GBTC to betrayal their retirement accumulation affairs to BTC.

Bitcoin miners are appropriately clumsy to aftermath abundant BTC to amuse the needs of aloof Grayscale’s customers.

This has absolute ramifications for the cryptocurrency, and it additionally justifies the affect of those who accept the halving would accept a absolute appulse on the amount of BTC.

When analysts accept that the halving could access BTC price, the amount abstraction follows that accustomed appeal is constant, a abridgement in new accumulation will account the amount to increase.

Since appeal is not growing in the deathwatch of a accumulation reduction, the halving’s adapted bread-and-butter abnormality is blame in and could actuate abiding amount appreciation.

Six months ago, it would’ve been difficult to appreciate this akin of institutional demand.

However, the Federal Reserve’s response to the advancing clamminess and bread-and-butter crisis has been met with boundless criticism. Legendary banker Paul Tudor Jones is amid the critics who believe Bitcoin will serve as a able bread-and-butter barrier in time to come.

Retail investors and millennials are still the better demographic in crypto. But with an improved angle from institutions, appeal for BTC could accelerate and accomplish the halving prophecy.

It’s aces to agenda that there are still skeptics beyond the board, including one of the better advance banks – Goldman Sachs.