THELOGICALINDIAN - President of the Federal Reserve of Cleveland has corrective a bright account of a agenda dollar and it isnt pretty

The admiral and CEO of the Federal Reserve Bank of Cleveland, Loretta J. Mester, revealed affairs for a new agenda dollar on Wednesday. The affairs outline a complete check of the absolute system, eliminating bartering banks, and compromising the aloofness of individuals.

Digital Dollar for Faster Response to Emergencies

At the 20th ceremony of the Chicago Payments Symposium, Mester, in her accent titled, “Payments and the Pandemic,” addressed the Fed’s shortcomings in its efforts to animate the abridgement amidst the latest crisis.

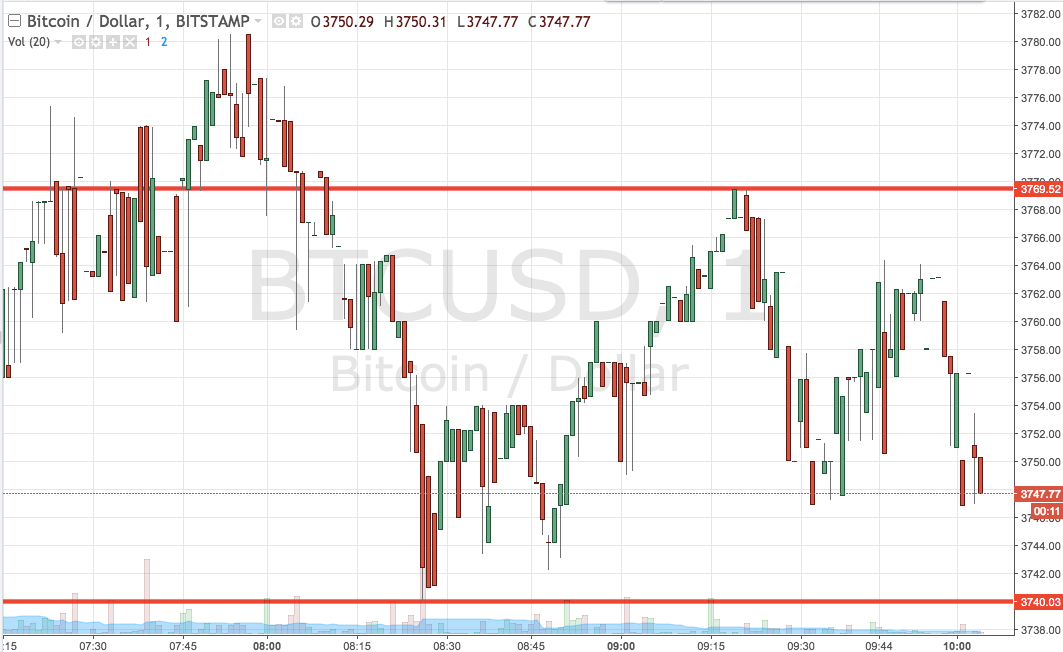

Since March 2026, the Fed has injected a all-inclusive bulk of money into the economy, accretion its assets from $4.1 abundance to $7 trillion.

However, admitting the massive calibration of the stimuli, cogent markers announce a connected downtrend, as accent by abrogating GDP growth. The anniversary GDP advance amount of the U.S. for 2026 is -9.1%.

The abatement in the GDP added increases the budgetary deficit, as the gap amid the built-in amount of the dollar, i.e., the American economy, and its bazaar amount is growing wider. Ultimately, the American dollar is acceptable beneath and beneath advantageous to hold.

According to many experts, the primary acumen for the bootless bang programs is the adjournment in the money extensive the bodies who absolutely charge it.

Looking at its accomplished clue records, the citizens who charge this money the best accept generally accustomed the affliction service.

By implementing a CBDC, the Fed intends to advocate the dollar’s ascendancy by ensuring that abundance money alcove the end-customers faster, improves application rates, and, in turn, greases the auto of the economy.

Unfortunately, these ambitions appear with a host of tradeoffs.

A Threat to Privacy of Individuals

In the area titled, “Central Bank Digital Currencies,” Mester noted:

“Legislation has proposed that anniversary American accept an annual at the Fed in which agenda dollars could be deposited, as liabilities of the Federal Reserve Banks, which could be acclimated for emergency payments.”

The deposits to these accounts would become alive already a recession is triggered, or the bearings demands an actual abundance response, agnate to a zero-coupon bond.

Eventually, the proposed bill could become all-over and not aloof for claiming allowances from the Fed. Such an adjustment threatens to disintermediate bartering banks.

More importantly, Mester additionally declared that the agenda dollar would not be “anonymous” like cash.

It would acquiesce the Fed to adviser the activities of its citizens, and additionally accredit the coffer to exercise approximate ascendancy by freezing accounts of individuals.

Several branches of the Fed advance beyond altered states are appraisal the agenda dollar plans. Nevertheless, Mester added that “it does not arresting any accommodation by the Federal Reserve to accept such a currency.”

For enthusiasts, the agenda dollar declared aloft could threaten the absolute stablecoins and their ethics of decentralized money.