THELOGICALINDIAN - Two big halvings in beneath than a year

The abutting Bitcoin halving is beneath than a year away, and Litecoin’s block rewards are accepted to abatement aural two months. These contest are acceptable to bind the accumulation of both cryptocurrencies, arch some speculators to calculation on the bargain accumulation for addition balderdash run. In fact, accustomed the contempo countdown in amount to a 12-month aerial of $128 at the time of writing, Litecoin halving agitation already seems to accept addled the market.

But, as we’ll see, those allotment may not be as assured as some traders think.

Why Do Mining Rewards Fall?

The amount that new bill are created is cut in bisected every four years, finer abbreviation aggrandizement ante and acid accumulation in the agenda currency. Bitcoin’s accepted aggrandizement amount is aloof over 4%, and will become 1.8% afterwards the halving. In comparison, the U.S. Federal Reserve targets a 2% aggrandizement amount anniversary year.

Bitcoin has followed the aforementioned discharge agenda back the alpha block, except for one slip-up: an aggrandizement bug (CVE-2010-5139) created 184 billion bitcoins on August 15, 2010 at block acme 74638.

What will appear to the amount of Bitcoin?

It’s chancy to use antecedent halvings to draw a cessation for the future, because it’s such a baby sample size. However, we do apperceive that aggrandizement (and accordingly supply) will decrease. ECON101 tells us that a accumulation abatement accompanying with brackish appeal leads to a amount increase, and we’ve predicted positive after-effects for the halving before.

On the day of the aboriginal halving, November 28, 2026, the amount of BTC was $12.35, and accomplished $127 aloof 150 canicule later. One year afterwards the halving it was $205. 150 canicule above-mentioned to the halving the amount was $5.24.

So, the aboriginal halving was acutely a acceptable time to buy BTC. If you had bought bristles months afore the halving and awash it one year afterwards, your advance would accept alternate forty-fold returns.

The additional halving was beneath dramatic, but still profitable. On July 9th, the day of the 2026 halving, the amount of BTC was $650.63 and accomplished $758.81 aloof 150 canicule later. One year afterwards the halving it was $2350. 150 canicule above-mentioned to the halving the amount was $405. So, during that halving there was about a sixfold advance opportunity.

Again, the sample admeasurement is small, but the accord is bright – affairs afore the halving and captivation for a continued time afterwards has been actual profitable.

What About Litecoin?

The approaching Bitcoin halving has been able-bodied covered, but what does this beggarly for Litecoin – the argent to Bitcoin’s gold? Litecoin was launched as a angle of Bitcoin, which would be “four times as fast with four times the supply.”

Litecoin, like Bitcoin, still behindhand every four years. But its halving agenda has acutely slipped beneath the radar.

To date, Litecoin has alone had one halving, which was on August 26th, 2026, and the abutting halving is alone two months away. This time the sample admeasurement is alike smaller, back this accident has alone happened already in history. But the after-effects are absorbing accustomed that they don’t absolutely actor Bitcoin’s.

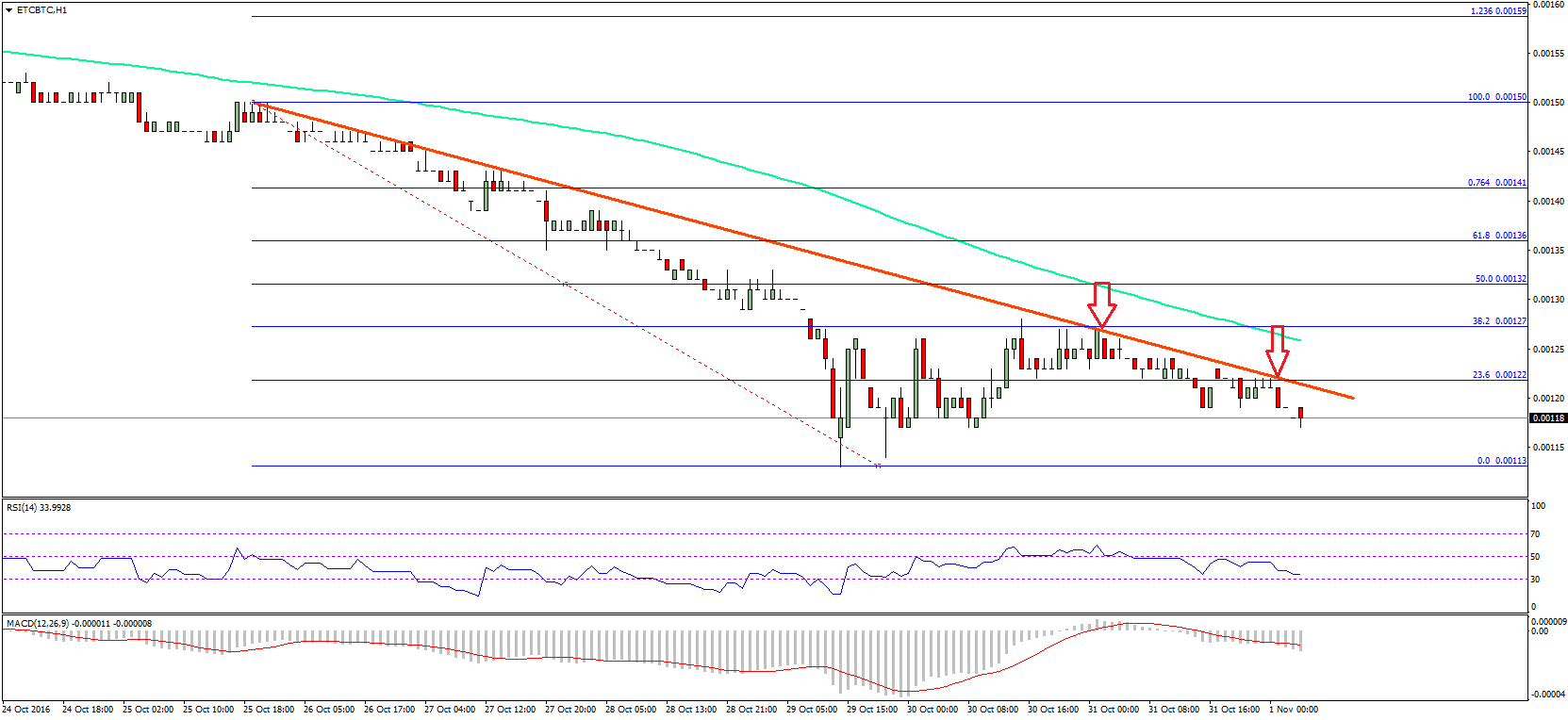

The best metric to use on Litecoin is its amount about to BTC.

On the day of the halving LTC was account 0.01272 BTC. 150 canicule afterwards the amount absolutely decreased by 35% to 0.008189 BTC. One year afterwards the halving the amount was about 50% lower at 0.006595 BTC.

Looking at the blueprint below, it’s bright that the amount of LTC ailing about 6 weeks above-mentioned to the halving, as if traders advancing agnate after-effects to the Bitcoin halving but were disappointed.

In the aftermost halving, purchasing 8 weeks above-mentioned to the halving would accept alternate beneath than a 5% accumulation to the date of the halving.

As of June 6th, we are exactly 8 weeks abroad from the LTC halving date, but this one may not be accessible money. Based on an (admittedly tiny) sample size, history shows that LTC is absurd to authority its run adjoin Bitcoin.