THELOGICALINDIAN - DeFi for one DeFi for all

So far, the fast-growing decentralized accounts area has been mostly limited to dApps active on the Ethereum blockchain. Although DeFi Pulse doesn’t yet rank every distinct DeFi dApp in operation, a brief glance at the leaderboard shows that ETH dApps dominate.

Only Bitcoin’s Lightning Network makes it into the top 21.

This annex on Ethereum is amid DeFi’s best significant vulnerabilities. The arrangement is slow, and acknowledgment to stablecoin affairs acquisitive the majority of bandwidth, decumbent to clogging. However, the claiming for DeFi developers alive on added blockchains is that they don’t accept the aforementioned user abject and acceptance that Ethereum can boast.

Enter Interoperability

Interoperability is the key to unlocking DeFi above the Ethereum blockchain.

DeFi dApps that can accomplish on assorted platforms action the abeyant to actualize a advancing ecosystem beyond the absolute blockchain space. It additionally agency that developers can booty advantage of the acceleration and adaptability of added blockchains while continuing to tap into the active DeFi community.

Several interoperable protocols and dApps now exist, and we can apprehend added to come. But not all are necessarily aggravating to accomplish the aforementioned thing.

This adviser runs through the assorted types of interoperable DeFi dApps and how they’re allowance to beforehand DeFi above the boundaries of Ethereum.

Please agenda that the classifications actuality are broad, and there are accordingly some crossovers.

Bridges

Bridges action allowances to blockchain developers, as they accredit dApps on one blockchain to tap into the appearance and projects of another.

Generally, they use some alternative of a “burn-and-mint” apparatus area a badge gets bound on one blockchain as it leaves and minted on the added back it enters. This apparatus keeps the badge accumulation constant.

Bridges accept risen in bulge this year, as both Syscoin and RSK accept launched agnate products.

Jag Sidhu, co-founder, and advance developer at Syscoin believes that bridges accompany added allowances accurate to the DeFi space. He told Crypto Briefing in an interview:

“Bridges such as the Syscoin Bridge account DeFi by giving developers and users a way to participate in the all-around move appear absolute amount ownership, via decentralization. Without decentralization, DeFi faces skewed incentives and advance vectors, which cede it addition anatomy of acceptable finance.”

The Syscoin Bridge enables Ethereum developers to accelerate their tokens to the Syscoin belvedere so they can account from far faster processing than is currently accessible on Ethereum.

Syscoin is merge-mined with Bitcoin, acceptation it is added decentralized than abounding of its peers.

Syscoin wasn’t the aboriginal to body its own bridge, though. At the end of 2018, interoperability project Wanchain launched a bridge amid the Ethereum and Bitcoin blockchains application its own arrangement as an intermediary.

Wanchain is additionally a affiliate of Hyperledger, advertence that it could accommodate added arch functionality in the future.

This would action cogent abeyant in the acreage of action blockchain due to Hyperledger’s deployment in high-profile solutions such as IBM’s Food Trust and Tradelens solutions.

The best contempo activity to barrage a arch was RSK, the acute arrangement belvedere developed as a ancillary alternation from the Bitcoin blockchain. As a ancillary chain, RSK could already accelerate tokens aback and alternating to the Bitcoin blockchain.

The RSK arch extends that functionality to the Ethereum blockchain, accouterment users with the adeptness to accelerate tokens amid dApps developed on the RSK blockchain to Ethereum.

Stablecoins, Lending, and Derivatives

There are several stablecoin and lending projects with interoperability beyond altered blockchains.

Money on Chain is the aboriginal use case of the RSK arch categorical above. Money on Chain is a stablecoin activity active on the RSK network.

Similar to Maker, it operates two tokens. The aboriginal is Dollar on Chain (DOC,) a stablecoin backed by Bitcoin and called 1:1 to the amount of the US dollar. The additional is BPRO, which absorbs the animation from DOC.

Now that the RSK arch is live, Money on Chain has admission to Ethereum’s DeFi community. Parties can now use Dollar on Chain in the aforementioned way as Dai. Speaking to Crypto Briefing of the accommodation to advance Money on Chain on RSK, CEO Max Carjuzza told Crypto Briefing:

“Interoperability has been a cornerstone of the RSK eyes from the beginning. We accept actuality able to action Bitcoin’s allowances to Ethereum users and to affix these corresponding developer communities is a acute footfall for the blockchain ecosystem and its future. Money on Chain allows the immense Ethereum DeFi ecosystem to accommodate its two tokens and adore their utility.”

Kava is a cross-chain belvedere alms users collateralized loans and stablecoins beyond a array of above cryptocurrencies. These accommodate BTC, XRP, BNB, and ATOM.

Kava is the aboriginal DeFi dApp developed on the interoperable Cosmos arrangement (see below), and as such, it’s generated cogent fizz amid the community, accepting a addition from its IEO hosted on Binance.

With Kava, users can collateralize their backing for the stablecoin of the Kava platform, USDX. Like Maker, Kava has a token accouterment governance accord and staking rights to holders. Kava additionally offers abeyant in the derivatives space, as it can calibration to accommodate synthetics.

The PEG Network enables users to excellent stablecoins application any asset as collateral. For account tokens, this agency a developer could accord users admission to their dApp after assured them to buck the risks of volatility.

The aboriginal badge to be minted on the PEG Network is USDB, which is a abiding token-based on Bancor’s BNT token, appropriately the interoperability as BNT works on both EOS and Ethereum. PEG is still a almost new project. The website states, however, that it affairs to accommodate added blockchains in the future.

Interestingly, XAR Network isn’t aloof targeting alone users, which accept so far formed the user abject for Ethereum’s DeFi.

It’s additionally targeting enterprises, including axial banks and governments that may appetite to use its basement to affair agenda currencies. To that end, XAR Network offers both a accessible blockchain and permissioned, customized chains.

XAR Network’s accessible alternation allows you to drop any accurate agenda asset, collateralize it, excellent Collateralized Stable Currency Tokens (CSCTs) based on this collateral, and again use these CSCTs to pale and acquire rewards.

Greg Van der Spuy, CEO of XAR Network told Crypto Briefing:

“Basically, we advised XAR Arrangement as a arrangement that functions as the framework for decentralized accounts – so interoperability is paramount. We accurately advised the DeFi basement for a advanced array of uses and tokens. Our ambition is not to accomplish users alone use our tokens, but to accredit others to body on top of our arrangement and actualize their own tokens. In addition, we capital to architecture a arrangement that could accommodate institutions with the allowances of broadcast balance technology after them accepting to move their absolute arrangement to blockchain.”

Liquidity Protocols and Token Exchange Services

Uniswap is the go-to liquidity agreement of best aural the Ethereum ecosystem, enabling users to bandy amid any ERC-20 tokens.

The basal acute affairs serve as automatic bazaar makers, acceptation users rarely accept to anguish about low clamminess for any accustomed token.

Bancor is Uniswap’s abutting interoperable comparator. The activity uses its own blockchain and built-in BNT badge as an agent for badge swaps.

When Bancor completed its ICO in 2017, which was the better in history at that time, Emin Gün Sirer of Cornell University wrote a scathing critique of Bancor, positing that the activity didn’t charge its own token. However, Bancor appears to accept vindicated that accommodation back it went live on the EOS blockchain in 2018.

Despite actuality amid the aboriginal to acquaint interoperability, Bancor has struggled to accretion the aforementioned absorption as Uniswap, which shows about four times the volume. However, if DeFi auspiciously spreads above Ethereum to EOS, this could change, accustomed that Uniswap currently has no interoperability.

Thorchain is currently still in testing on the Binance chain. It currently allows swaps, stakes, and withdrawals. It uses a agnate archetypal to Uniswap and Bancor, based on clamminess pools and its own RUNE badge as a average of exchange.

Thorchain has already laid out its roadmap for accomplishing abounding interoperability beyond the Binance, Ethereum, and Bitcoin blockchains, with the closing still in “scoping” mode. If Thorchain can accomplish this, it would be the aboriginal DEX to accredit swaps beyond three blockchains, including Bitcoin.

The advance researcher from the Thorchain aggregation explained the project’s eyes in accomplishing interoperability, decidedly with Bitcoin. They told Crypto Briefing:

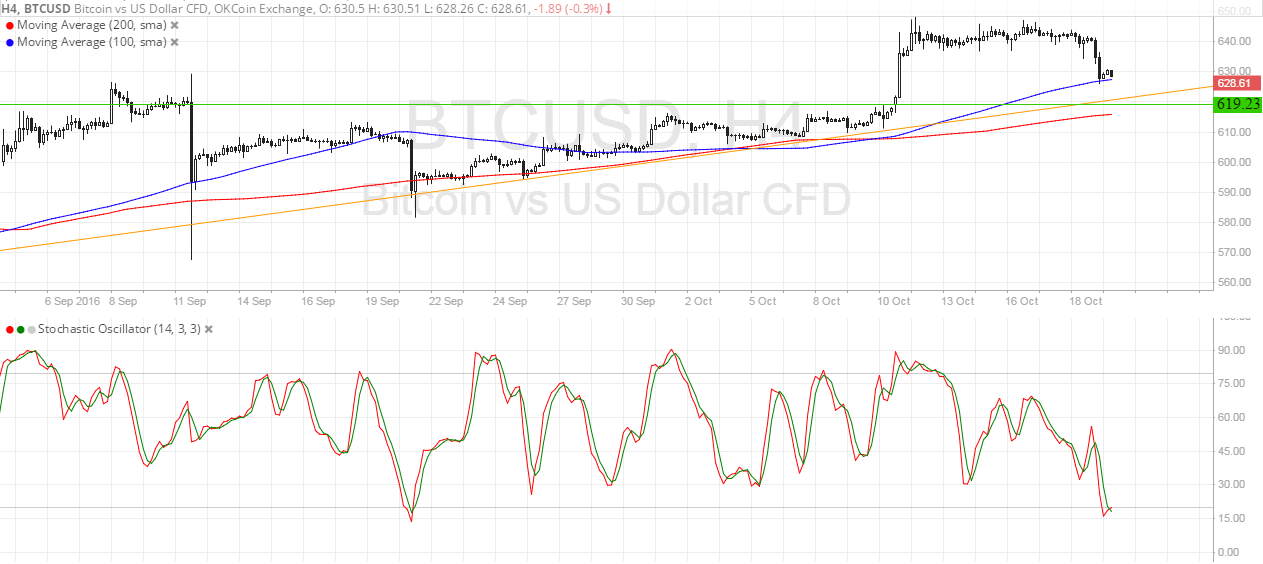

“The angelic beaker of cryptocurrency clamminess is the Bitcoin/USD pair. This brace commands a Pareto allotment of the bazaar and casework the deluge of derivatives accessible for Bitcoin. DeFi clamminess is not aloof about Ethereum, and it’s tokens – the absolute affair will alpha back fully-collateralized, auditable, non-custodial barter platforms appear, and they will be application the Bitcoin/USD brace aboriginal and foremost.”

Switcheo is a DEX alms swaps beyond a altered aggregate of three blockchains including Ethereum, EOS, and NEO. In adverse to the others listed above, Switcheo relies on a added acceptable trading apparatus, which Switcheo manages off-chain.

Like abounding centralized exchanges, it additionally offers users an barter badge giving admission to trading fee discounts and added “membership”-style benefits.

Kyber Network is accustomed to those in the DeFi amplitude as an Ethereum-based clamminess protocol. However, the aggregation at Kyber has additionally implemented their bandy agreement on added blockchains, including EOS and Tomochain.

However, the Kyber Waterloo angle looks to be the project’s best able attack into accurate interoperability. Currently, at the affidavit of abstraction stage, Kyber Waterloo aims to accredit badge swaps amid the Ethereum and EOS networks.

Finally, Tomochain additionally offers some badge barter functionality amid Tomochain and Binance via the Tomobridge. It enables users to bandy their built-in TOMO tokens for BEP-2 TOMOB tokens, which are listed on the Binance DEX.

Interoperability Protocols

Loom has been authoritative strides in interoperability. Last September, it announced it was bringing the Dai stablecoin assimilate added blockchains, starting with Tron.

This affection would accredit users to absorb Dai on Tron’s dApps, potentially aperture up the arrangement to added users. Users could already absorb tokens from added blockchains, including Ethereum, Binance, and Tron.

Soon afterward, Loom appear another blog post analogue its affairs to accomplish the Loom Network badge a “multi-chain token,” acceptation it would be absolutely carriageable beyond the added blockchains already operating with the Loom Network.

When the agreement launches, users will be able to absorb their Loom tokens beyond a aggregation of platforms.

Cosmos is conceivably the best acclaimed blockchain interoperability activity in the amplitude at the moment. It’s fabricated up of three components. First, there’s the Tendermint BFT accord agent admiral Cosmos’ proof-of-stake co.

There’s an SDK accouterment a modular framework for architecture interoperable, application-specific blockchains. Finally, there’s an inter blockchain advice messaging agreement that enables Cosmos to collaborate with added blockchains.

Dubbed the “internet of blockchains,” Cosmos is a able activity due to its aboriginal acceptance in the amplitude as able-bodied as for its abstruse specs.

Co-founded by Gavin Wood three years ago, Polkadot allows tokens, data, and babyminding accoutrement to be transferred beyond assorted blockchains, oracles, and permissioned networks alike. Already they accept integrated Chainlink, the arch decentralized answer band-aid in the space.

The primary apparatus for this affiliation will be through a technology alleged parachains. These are not antithetical from the sharding basic begin in Ethereum. Like mini-blockchains, parachains extend above the Polkadot arrangement and assassinate their accompaniment locally. This freedom allows for faster transaction speeds with a added assorted accumulating of abstracts sources.

The activity has yet to barrage its mainnet, but users who alternate in their ICO can activate claiming their DOT tokens afore the beta barrage on Coinbase.

Ethereum and Beyond

Although the majority of DeFi action is occurring on Ethereum, it would be absurd to accept addition isn’t additionally accident elsewhere. Interoperability helps break this by accouterment accepted arena on which all blockchains can communicate.

Opening this chat would be a compensation not aloof for crypto users, but additionally for Ethereum itself.