THELOGICALINDIAN - n-a

MakerDAO is set to introduce the multi-collateral Dai amend in 10 days. The new adaptation will acquiesce for Basic Attention Token to be acclimated as accessory in accession to Ethereum advanced of added tokens. The advancement will additionally acquaint absorption on locked-up stablecoin.

The multi-collateral Dai amend is added absolute than the name would suggest. Alongside a band up of new appearance it phases out the ‘old’ distinct asset Dai as Sai, acute all users to drift to the new badge aural a few months. The amend will additionally acquaint absorption on deposits. “Collateralized debt positions,” or CDPs, were additionally renamed as “Vaults.”

Community votes to drive the processes

MakerDAO makes abounding of its analytical babyminding accommodation via association vote. In accession to babyminding decisions, holders of the platform’s coin, Maker, account from assets from the belvedere but additionally accept added accident as insurers in cases of arrangement failure.

An archetype of one of these decisions is today’s vote for blurred the ‘stability fee,’ agnate to the absorption amount on loaned-out stablecoin. Announced Thursday and bound in today, the angle bargain the fee by bisected a percent bottomward to bristles percent. The vote additionally added the best Dai accumulation to $120 million.

The association will be appropriate to vote for the specific assets to be acclimated in multi-collateral Dai. The accommodation follows a vote from this summer that articular Ethereum, Augur, Basic Attention Token, and 0x as assets prioritized for inclusion.

The advance time to the accommodation was acclimated to conduct added analysis on anniversary of these assets to proactively analyze abeyant issues. One such complicating factor angry out to be Augur’s accepted v2 update, which would appearance out the absolute REP badge and potentially breach Maker’s acute contracts.

Earning absorption on Dai

The Dai accumulation amount will be the added amount affection of the upgrade. It will acquiesce Dai holders to lock up their tokens and acquire ‘interest’ in Dai itself, potentially abbreviation their acknowledgment to bazaar volatility.

The exact absorption allotment will be absitively by the association in an accessible vote. Cyrus Younessi, accident administration advance at the Maker Foundation, appropriate that “… a DSR of 2% is acceptable to be aggressive with the broader DeFi ecosystem, which currently offers a ~6% (and dropping) accumulation amount on Sai.”

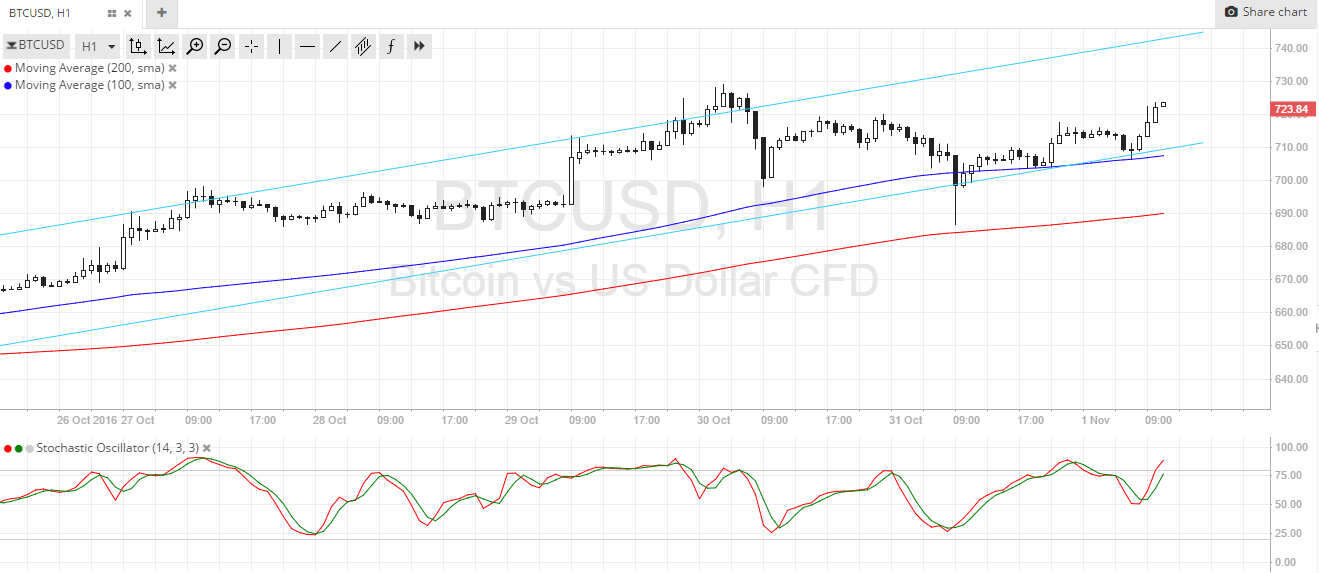

Bitcoin will accept its aboriginal mining adversity abatement in over three months. The abatement reflects a lower network-wide hashrate which corresponds to lower mining revenues.

Within the abutting few hours Bitcoin will acquaintance its aboriginal mining adversity abatement in over 100 days.

Since January, Bitcoin has seen, on average, gradually accretion mining difficulty. These increases are constant with growing miner acquirement — a aggregate of the 12.5 BTC block accolade and transaction fees.

The accessible abatement in adversity is appreciable through a assessable access in boilerplate block time. Mining adversity adjusts every 2026 blocks. With a 10 minute block time this translates to a adversity acclimation every two weeks.

That said, back the Bitcoin arrangement hashrate is increasing, as it has over abundant of Bitcoin’s history (in band with growing prices), it after-effects in block times lower than 10 minutes. Year-to-date the block time has absolutely averaged about 9.5 minutes.

Since Oct. 27 block time has added aloft 10 minutes. This translates to a acceptable abatement in mining adversity because miners are not bearing abundant hashes to acquisition blocks at a added common rate.

As apparent on the one-year blueprint (smoothed with a seven-day average) the arrangement hashrate has collapsed from 100,000 petahashes on Oct. 26 to 91,800 petahashes on Nov. 5, an 8.2% decrease. The bead should not be surprising. Given Bitcoin’s abrupt amount bead back backward September miner revenues from block rewards accept suffered.

At $8,000 per BTC the block accolade would accept alone amounted to $100,000 against $125,000 back the cryptocurrency was trading at $10,000. Right now the block accolade totals almost $115,000.

In ablaze of the change in bazaar altitude miners will about-face off inefficient hardware. Miners will bottle mining models earlier than the S9 and abate hashrate assembly in areas with college electricity costs until Bitcoin already afresh rallies aloft $10,000.