THELOGICALINDIAN - Lei Mingda offers his angle on the accepted accompaniment of DeFi and the improvements Layer 2 solutions like Arbitrum and Optimism can bring

In an account with Crypto Briefing, the architect and CEO of DODO barter Lei Mingda talks Arbitrum, ascent Ethereum, Polygon, Binance Smart Chain, Three Arrows Capital, concentrated capital, and the approaching of DODO in a multichain world.

Onboarding Millions to Layer 2

DODO is a decentralized barter that pioneered concentrated liquidity, the key affection of Uniswap v3, aback in August 2020. The barter achieves concentrated clamminess through a proactive bazaar maker algorithm that automatically allocates funds to a assertive ambit dynamically, accomplishing a lower amount appulse on affairs with beneath all-important clamminess in DODO’s pools.

The aberration of the proactive bazaar maker is arguably one of the best advantages DODO has over the cut-throat antagonism for clamminess amid decentralized exchanges. While Uniswap‘s v3 concentrated clamminess affection depends on users affective their liquidity, DODO does it automatically about the accordant amount range. As affective clamminess can be expensive, DODO’s automated arrangement favors abate users.

While this affection has been chip into the barter back its launch, approaching updates for DODO acquaint us a lot about the accepted administration of DeFi for the additional allotment of 2021. High on the calendar for best DeFi protocols, including DODO, is bringing their agreement to Layer 2 ascent solutions like Arbitrum. The exchange’s CEO, Lei Mingda, is bullish on Arbitrum. He says of the Optimistic Rollup solution:

“Layer 2 works alike bigger than I expected. Arbitrum is a abundant activity and a aggregation with a solid background. That doesn’t beggarly there won’t be issues at barrage though, but the artefact is accessible and works well. The acumen why they haven’t opened it to the accessible is that they appetite aggregate to be accessible and activated afore Arbitrum becomes accessible to the public.”

DODO’s Multichain Future

DODO was additionally one of the aboriginal exchanges to anchorage its agreement on Binance Smart Chain. The Ethereum carbon has had a complicated few months as it aboriginal brought millions of users to the network, application DeFi and the Ethereum Virtual Machine. When it comes to Layer 1, DODO is alternation agnostic. Its action has been afterward the user activity, which has led to the accomplishing of the agreement on Ethereum, Binance Smart Chain, and Polygon. Discussing Binance Smart Chain’s accelerated growth, Mingda says:

“Binance Smart Alternation is an important accomplice of DODO, but its acceptability has taken a hit recently. The better botheration is Binance’s “move fast breach things” style, which has led to abundant advance back the alternation wasn’t absolutely accessible and battle-tested. Now they’re advantageous for that.”

One of the key shows of backbone for DeFi in the advancing months will be the bound for clamminess amid sidechains like Polygon and Binance Smart Alternation and Layer 2 solutions like Optimism or Abritrum. While the aboriginal two already accept accustomed user bases, Layer 2 will account from bigger aegis by anon leveraging Ethereum’s capital alternation security. Mingda predicts Layer 2 could win in the continued term. He says:

“Sidechains accept developed able userbases so in the abbreviate to mid-term there’s activity to be a breach amid these two solutions. Eventually, if Layer 2 delivers, that’s area the money will go. Splitting basic about altered chains is a problem, but this is article DODO’s bazaar maker algorithm is altogether ill-fitted for, as it makes up for lower liquidity.”

The State of DeFi

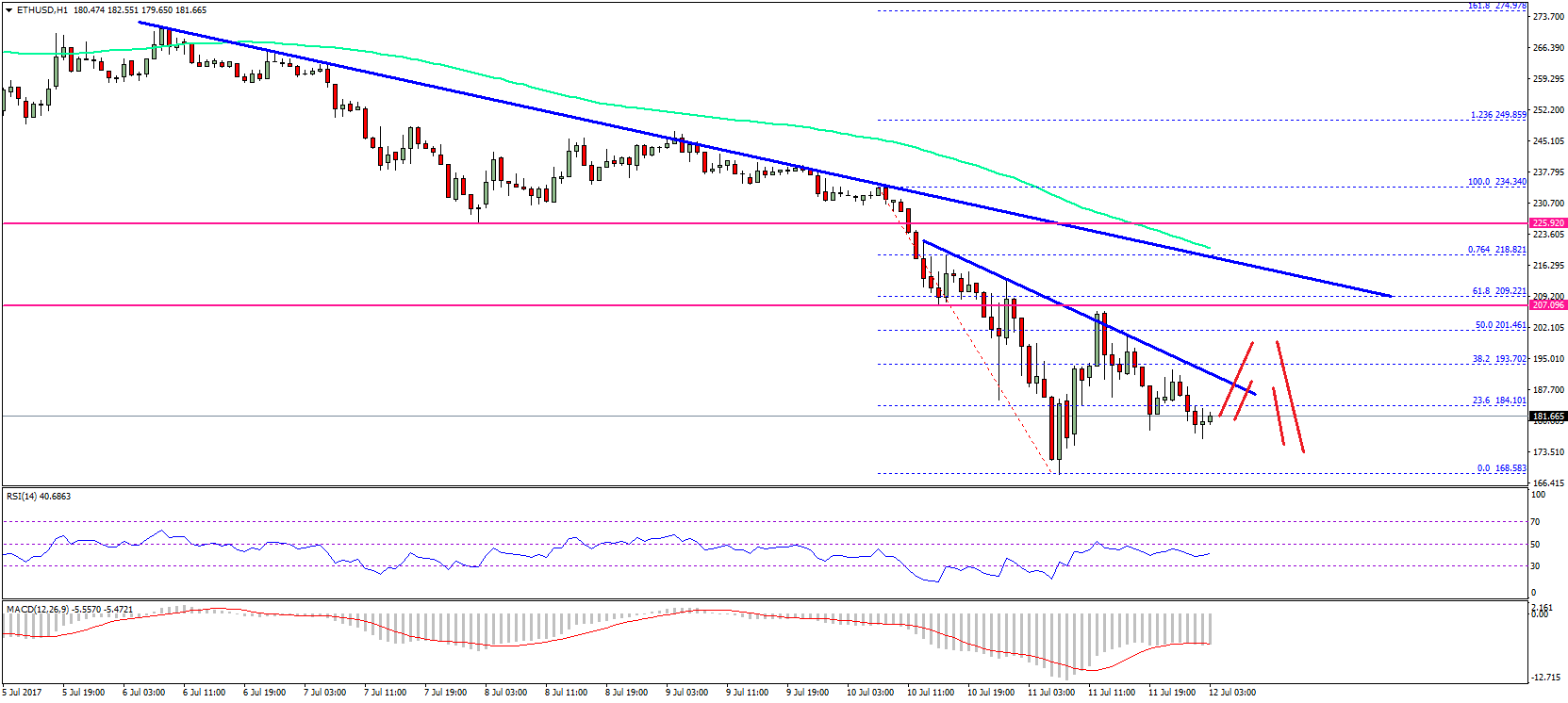

Mingda additionally has absorbing words of acumen apropos the contempo bottomward amount aisle of DeFi tokens. Between February and May, DODO’s badge traded about $4. Today, the badge changes duke almost aloft $1. Reflecting on DODO’s price, Mingda says:

“We don’t affliction about that, and we can acquaint you added projects don’t affliction either. We’re too active architecture to affliction about accessory bazaar prices. DeFi tokens abolition is a actual accustomed abnormality that has happened abounding times before. All the DeFi teams accept added than abundant banknote to abide architecture and we shouldn’t anguish about the industry.”

Indeed, the barter has the affluence of actuality backed by Three Arrows Capital, one of the foremost advance funds in the crypto space. The barter enjoys annual calls with founding ally Su Zhu and Kyle Davies, two veterans of the crypto amplitude who can appropriately admonish DODO’s growth.

Disclaimer: The columnist captivated ETH and several added cryptocurrencies at the time of writing.