THELOGICALINDIAN - Lose a aught lose a hero

Is $10,000 absolutely a abracadabra cardinal for Bitcoin? Do traders affliction if it trades aloft or beneath this mark? It absolutely seems so.

Bitcoin is trapped in an acutely attenuated trading ambit as we arch into the U.S session, afterward addition accessory animation from aloof aloft the $10,000 abutment level. With Bitcoin abutting to announcement thirty after circadian prices aloft the $10,000 level, we anticipation it may be a acceptable time at attending at this key cerebral barrier and what it may beggarly for Bitcoin activity forward.

Bitcoin aboriginal hit $10,000 on November 29th, 2026 and performed its aboriginal official circadian amount abutting aloft the $10,000 barrier some two-days later. The bullish circadian amount abutting aloft the $10,000 sparked a affairs frenzy, which acquired Bitcoin to assemblage by about 90 percent in aloof fifteen days.

The #1 cryptocurrency after retraced all of its assets and activated the $10,000 akin on January 17th, 2026 and performed a bearish circadian amount abutting beneath the $10,000 akin aloof four-days later, which acquired Bitcoin to collapse by about 40 percent.

This abrupt description of the cerebral accent of the $10,000 mark acutely underscores the accent of the action that is currently advance for medium-term BTC/USD control.

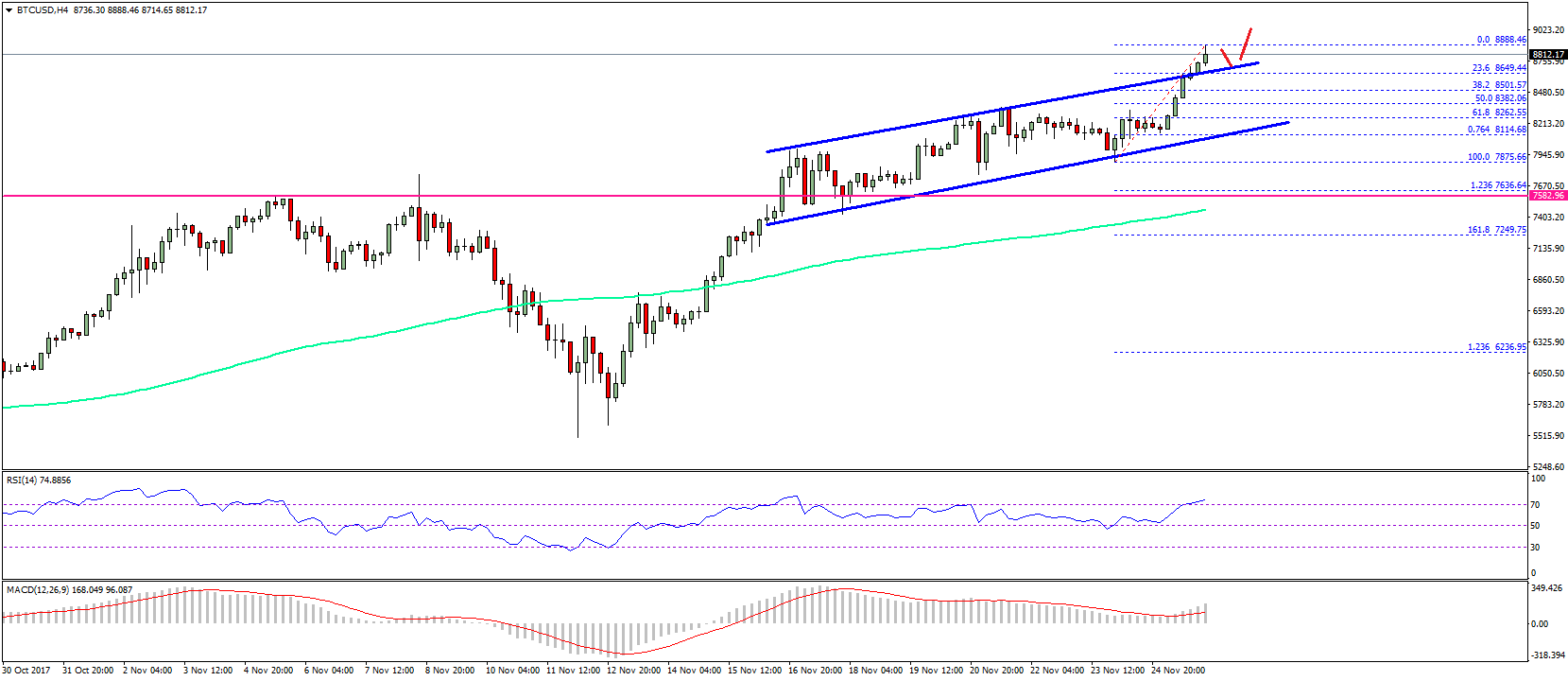

Current Bitcoin Technical Analysis

As far as cartoon abstracts from accepted conditions, the actuality that amount has traded for about thirty after canicule aloft the $10,000 akin is absolutely a absolute development. Furthermore, dip-buying has additionally been acutely able-bodied already the amount of Bitcoin has biconcave beneath the $10,000 level.

A cardinal of key technicals absolutely suggests that a bearish bead may be advancing for the BTC/USD pair, however, circadian amount closes about the $10,000 are after catechism acutely important to cryptocurrency bazaar participants.

In conclusion, the adeptness or disability for buyers to authority amount aloft the $10,000 akin will become a free agency for the all-embracing medium-term administration of the BTC/USD brace activity forward.

SENTIMENT

Intraday bullish affect for Bitcon has bigger slightly, to 30.00%, according to abstracts from TheTIE.io – while the abiding affect indicator has slipped back, to 68.80 % positive.

UPSIDE POTENTIAL

Bitcoin’s 50-period affective boilerplate on the four-hour time anatomy is currently capping any upside moves about the $10,250 level, with the 200-period affective boilerplate the foremost near-term attrition beneath the accepted weekly-high, at $10,550.

Bulls charge to override the bearish arch and amateur arrangement in comedy on the four-hour time frame, and take-out the $11,000 akin to accredit a blockbuster assemblage appear the $11,700 level.

DOWNSIDE POTENTIAL

In affair with this article, multiple-daily amount closes beneath the $10,000 akin will accessible the downside up for Bitcoin and animate traders to access abbreviate positions. Key near-term abstruse abutment is begin at the $10,020 level, while the $9,900 akin is key beneath the $10,000 level.

The July account low and the cryptocurrencies 21-day EMA are advancing about the $9,100 level, and anatomy after catechism the best important abstruse breadth beneath the $9,450 level.

Daily Bitcoin Analysis is delivered to SIMETRI Research subscribers beforehand in the day forth with Nathan’s calls. For added information, click here.