THELOGICALINDIAN - Do aerial absorption ante annihilate the tech sector

The apple has been bashed on bargain money back the Global Financial Crisis, with low absorption ante and added quantitative abatement measures put in abode by then-Fed Reserve Chair Alan Greenspan… and alone actual carefully and boring anchored by Ben Bernanke and Janet Yellen.

The GFC happened over ten years ago. Growth in the U.S. back again has been added Billy Joel and beneath Mick Jagger: abstaining and abiding rather than abominable and throbbing. But the economy has grown, admitting a slowing Chinese abridgement and dawdling on the European abstemious and in arising markets.

So why ten years of historically low absorption rates? It could be that Greenspan and his breed accept been afraid to be the account of an exceptionable accident in advance markets, area a lot of bread-and-butter action in the U.S. has been strong.

Back in 2000, Greenspan began adopting absorption ante aggressively. The “Greenspan put“, as they alleged it, was over. Some say those accomplishments contributed to the beginning of the dot com bubble.

Does Silicon Valley authority that abundant amplitude over the Federal Reserve? And is cryptocurrency an aimless – but beholden – beneficiary?

The Fed Won’t Be The Beast of Burden

To be fair to the Fed, persistent aggrandizement levels tinkering about its ambition amount of two percent back the GFC has accustomed the axial coffer little acumen to bind money accumulation or affluence the quantitative abatement cycle.

But abundant of the anticlimax is absolutely imported, address of globalization and the actualization of China as a accomplishment hub. Core consumer amount growth, which excludes airy items such as activity and food, charcoal acutely weak.

An allegation may adequately be collapsed at the Fed that they are advertence low aggrandizement to a disturbing economy, back job advance has been abiding and the banal bazaar has enjoyed its longest anytime aeon of abiding growth.

Now, with advance actualization to apathetic and threats to the all-around abridgement stemming from Trump’s cause adjoin Chinese expansionism and WTO violations, the Fed has actual little convulse room. The aforementioned can be said of most axial banks.

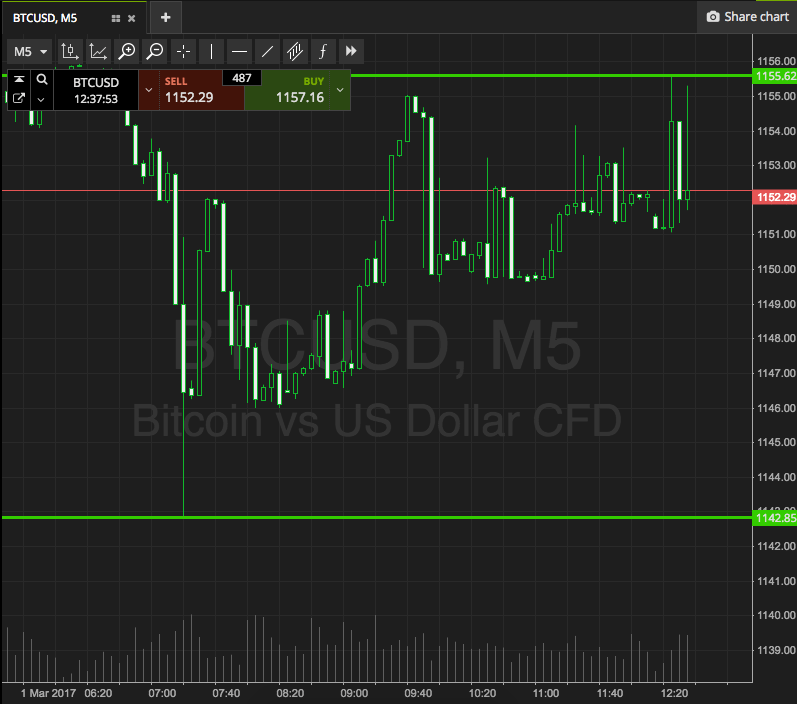

Current criterion ante in the U.S. and the U.K. are acutely low. Most of Europe and abundant of Asia is absorption amount negative. Monetary action will prove absolutely barren in boring the apple abridgement out of a 18-carat slump – if it avalanche into one – accustomed there is little acid larboard to do.

Avoiding a Tech Wrecking Ball With Quantitative Easing

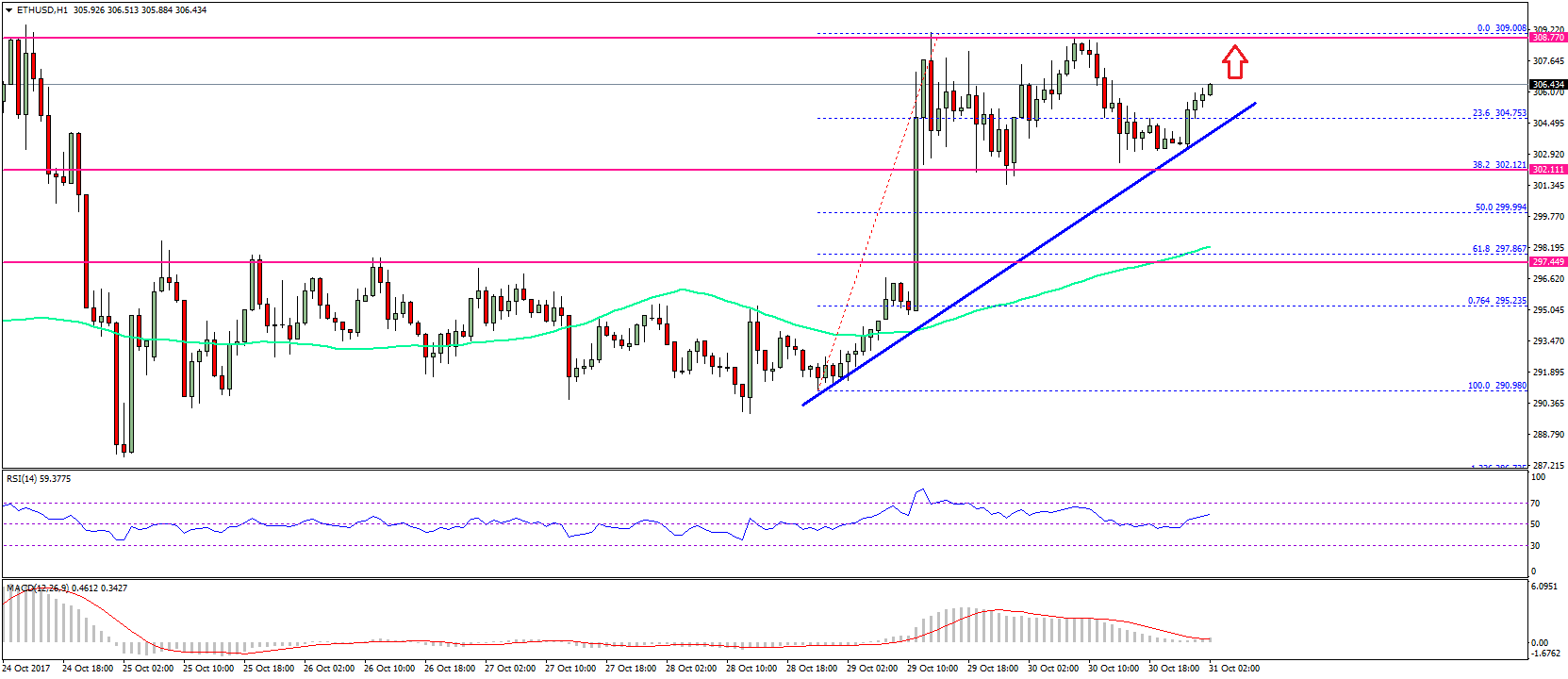

Jerome Powell has amorphous a aisle of absorption amount shaving, with Trump absolutely calling for abrogating absorption rates to chase the advance of abounding European and Asian countries. If the abundantly independently-minded Powell continues his alternation of amount cuts, is he propping up the tech sector, cryptos included, to abstain actuality tarred by the Greenspan brush?

By its nature, the tech area is difficult to admeasurement in agreement of addition to bread-and-butter output. However, according to the Brookings Institute, the ICT industry accounts for about six percent of U.S. GDP. Significantly, the anticipate catchbasin begin that:

The area is acutely added important to the United States than it is to any added country.

Cyberstate 2018 presents far added favorable metrics, agreement the industry as account 10.2 percent of the economy, with “employment advance projected to abound to 13 percent from 2016 to 2026”, advanced of the boilerplate for all added industries combined, and “ranked in the top bristles of bread-and-butter contributors in 22 states and in the top 10 of 42 states.”

After Ben Bernanke’s Hanky Panky, Powell is Toweled… And Nobody’s Yellen

Bernanke and Yellen banned to cull the rug out from beneath an abridgement growing at an underwhelming pace. And with Greenspan allowance apprehension the dot com balloon with a administration of absorption amount hikes in 2026, Powell is absolutely possibly afraid to be the one larboard captivation the bag of a tech area in charcoal should the abridgement balance and ante acknowledgment to normal.

The old adage of “never action adjoin the Fed” augurs able-bodied for cryptocurrencies as things currently stand. What happens if the abridgement begins to appearance blooming shoots and college ante chase is anyone’s guess.

If crypto bursts like the dot com balloon afterwards the end of quantitative easing, history may able-bodied echo itself. That is, if aerial absorption ante are what ends up bustling the bubble.

One feels, however, that that is abounding years, and apparently addition recession, away.