THELOGICALINDIAN - BitMEX has denied any bent atrocity

US regulators are attractive into BitMEX over accusations the accepted cryptocurrency derivatives belvedere bankrupt austere trading laws. The probe might aggrandize into a absolute analysis if American citizens are begin to accept been victims of artifice or abetment by the derivatives platform.

According to a Bloomberg report this morning, the Commodities Futures Trading Commission (CFTC) is ascertaining whether BitMEX accustomed Americans to barter on the platform.

The CFTC classifies Bitcoin as a article and has administration over any acquired artefact based on it. BitMEX, which is based in the Seychelles, would accept aboriginal bare to annals with the regulator in adjustment for US citizens to barter on the platform.

Currently the CFTC is alone absorbed in investigating whether an un-registered derivatives belvedere has been alms trading casework to US citizens. But Crypto Briefing understands that it is accepted action for the regulator to investigate any added absolute allegations surrounding a company.

In the case of the BitMEX probe, it ability extend to any accusations area US citizens accept been anticipation to be victims of artifice or manipulation.

REKT Player One

While best regulators accede their administration to extend alone as far as operations aural their borders, American regulators affirmation ascendancy over the absoluteness of a business if it serves or affects aloof one US citizen.

This important acumen agency abounding cryptocurrency companies either use subsidiaries for American-specific business – like HBUS for Huobi – or accept not to accomplish there at all. Binance has appear that it will cease crypto trading in the country beforehand this year, while both Poloniex and Bittrex accept amorphous geoblocking tokens – blocking specific badge affairs to and from an American IP address.

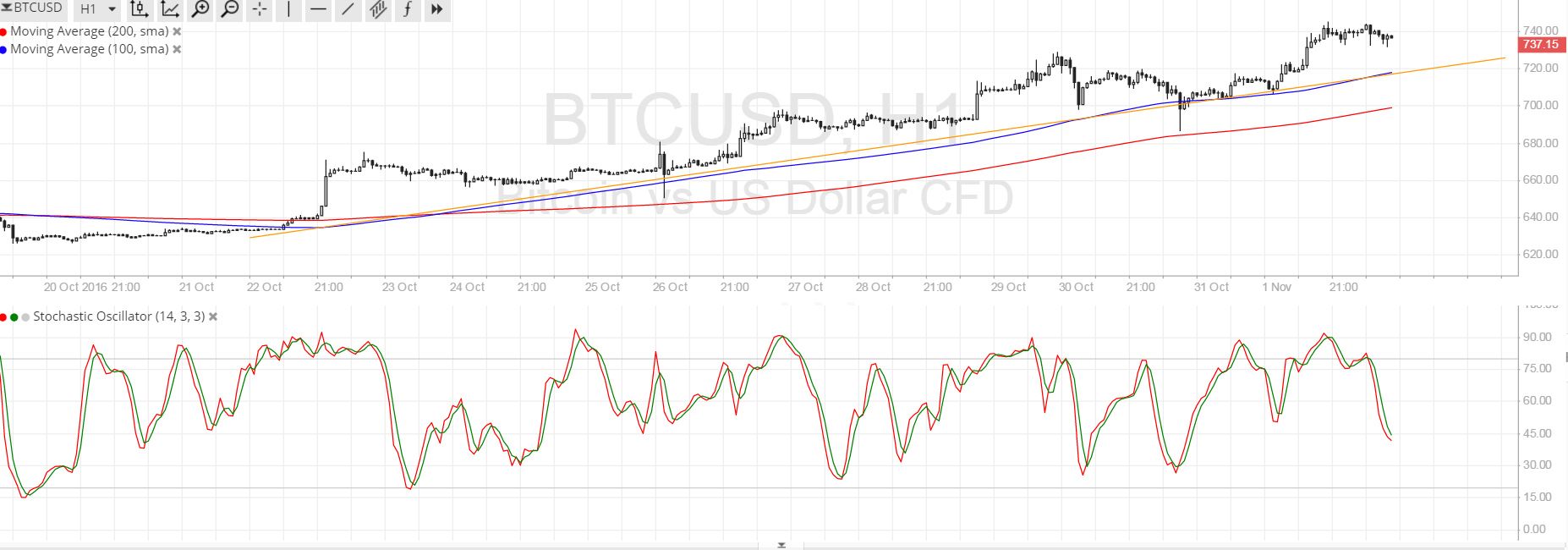

BitMEX allows audience to barter a accomplished host of futures and leveraged cryptocurrency products. It offers a best of 100:1 on its CFDs, some of the highest leverage in the industry. CEO Arthur Hayes tweeted aftermost ages that the platform’s annual aggregate had surpassed one abundance dollars.

In October, the bearding cryptocurrency researcher Hasu accused the belvedere of base its advantaged position in the market. “If [BitMEX] misbehave, there is alone the chargeless bazaar to abuse them for it,” wrote Hasu. “But what if the aggregation has a quasi-monopoly like BitMEX?”

Nouriel Roubini – who debated Hayes in Taipei beforehand this ages – has again accused the aggregation of acting illegally, including front-running its own audience and acting as a money launderer for all-embracing criminals.

In FT Alphaville yesterday, Hayes refuted these allegations: “we adios any allegations of criminality, abetment or arbitrary analysis of our customers, who are at the centre of aggregate we do.”

Crypto Briefing reached out to BitMEX for animadversion on today’s developments. A agent said that neither BitMEX, nor the ancestor aggregation HDR Global Trading Limited, would animadversion on advancing inquiries or investigations by government agencies or regulators.

The CFTC has so far beneath to animadversion on the record: but if the allegations are true, BitMEX may be absolutely ducked.