THELOGICALINDIAN - Cryptoassets abide to allure accretion amounts of advance as the apple begins to apprentice about the technology abaft the assets In actuality the abstracts appearance the cryptocurrency bazaar recorded 600 advance yeartodate and is account 28 abundance at the time of autograph However as ample banking institutions such as Microstrategy and Grayscale abide to advance ample amounts into cryptoassets amount animation is additionally on the access This accretion animation presents a claiming for abecedarian investors

Mercor Finance is the aboriginal and alone archetype of a decentralized automatic archetype trading platform. Mercor aims to adjust the apple of archetype trading by accouterment investors the adeptness to advance via user-created trading strategies. This grants alone investors admission to agnate accoutrement that are frequently acclimated by those ample institutional investors. But afore we dive into Mercor’s solution, let’s booty a afterpiece attending at the analogue of automatic copy-trading and why it is the approaching of investing, both in the crypto space, and the boilerplate banking sector.

An automatic trading action is a set of rules that actuate back to buy and advertise assets. Back those rules are met, orders execute. This is authentic as algebraic trading. This has several advantages over advance manually. First, it can accomplish 24/7 with little downtime, acceptance investors to abduction the best amount out of the 24/7 crypto asset market. Second, automatic programs never aberrate from the rules set in the trading strategies, apparently authoritative no mistakes. Finally, animal affect is never involved; a affection which is acceptable the account of abounding to lose their absolute portfolios.

Mercor allows developers to actualize new trading strategies and adapt those rules at will via the Mercor dApp’s developer dashboard. Investors application Mercor can advance funds into those strategies via the Mercor dApp’s broker environment.

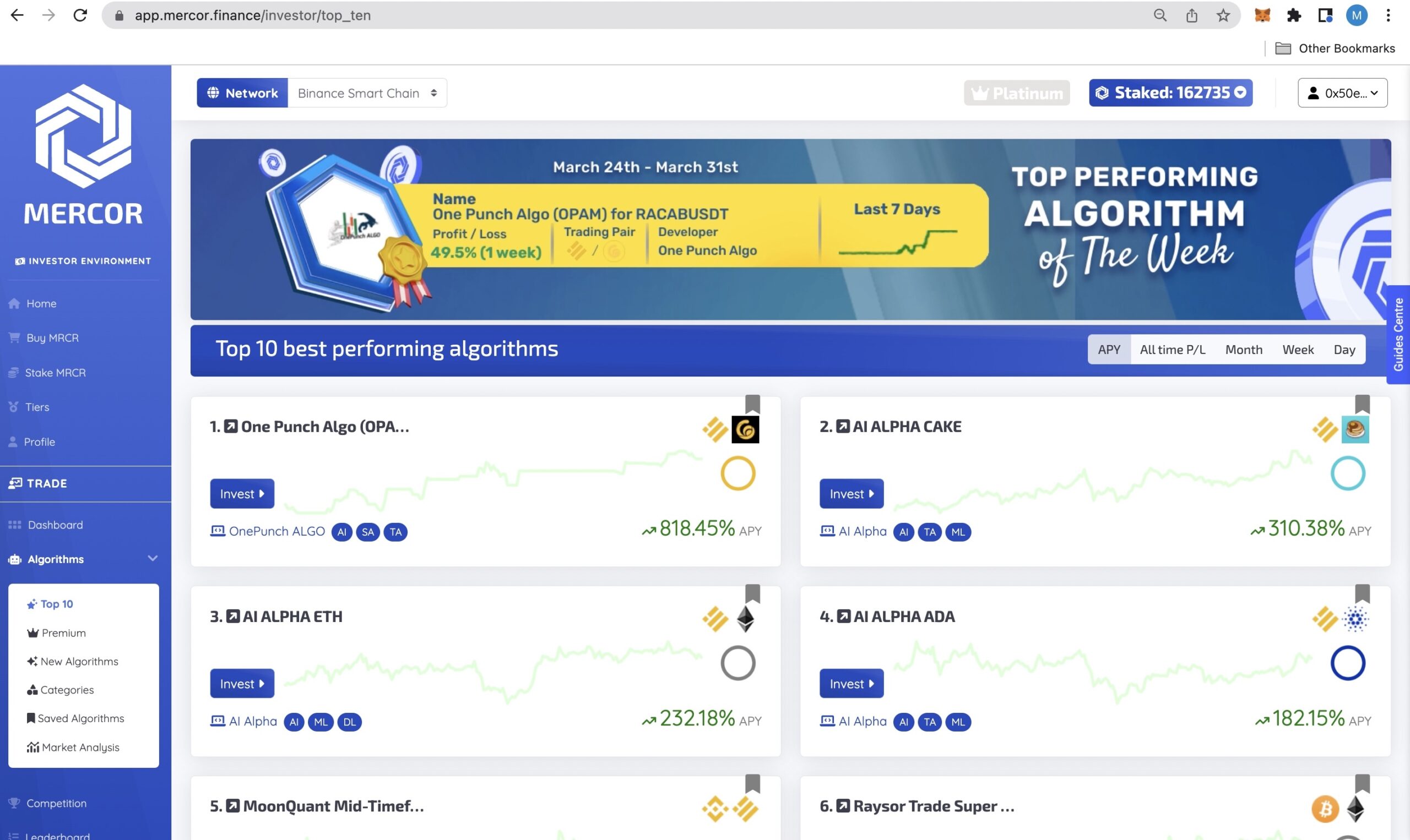

Currently, there are 60 trading strategies that are accessible for users to advance in. Many of these accept been created by high-level developers active in advance or software firms, ensuring that the trading strategies accept able influence. Mercor Finance’s dApp is currently deployed on Binance Smart Chain. The project’s built-in badge MRCR grants holders added admission to the Mercor platform, depending on the cardinal of MRCR they pale via the Mercor dApp.

Users acquirement MRCR to advance in the best accepted / accomplished assuming algorithms. Naturally, as the user abject increases, appeal for admission to these algorithms will access in accord with a consistent aftereffect on the appeal for MRCR. Moreover, Mercor has a different staking mechanism, concealed in the DeFi amplitude afore and affairs to access the account of MRCR added in the future.

Upon launch, the Mercor dApp greets investors with a acceptable folio absolute links to some of the amount elements of the protocol. This includes an educational portal, as able-bodied as archive announcement the contempo achievement of some of the trading strategies accessible on the dApp. On the dApp’s sidebar, the ‘Buy MRCR’ tab offers users the adeptness to anon bandy amid BNB or BUSD and MRCR, or buy BNB with fiat. The ‘Stake MRCR’ tab allows users to stake any MRCR tokens they authority in adjustment to accretion admission to college tiers of the functionality on the dApp. Stakers of MRCR can additionally acquire an anniversary allotment crop of up to 20%, paid in MRCR.

More advice on the allowances of the altered tiers of admission and the cardinal of staked MRCR appropriate to admission those tiers can be begin on the ‘Tiers’ page of the dApp.

The ‘algorithms’ tab allows investors to admission all of the trading algorithms created on the belvedere and their details. Investors can see aggregate they charge to apperceive to finer administer their automatic trading strategies and portfolio. This includes their real-time trading history, accumulation or accident percentage, the assets it trades between, the developer who fabricated it and the accepted bulk of disinterestedness managed by it. The algorithms folio is but one of the means Mercor demonstrates its accent on transparency, a key affection defective in added automatic trading action protocols.

The user dashboard provides advice on the achievement of the investments, such as their absolute bulk invested on Mercor, absolute balance from those investments and the accepted amount of their portfolio. Finally, Mercor’s absolute educational portal, absolute user manuals and added advice for both investors and developers, as able-bodied as their amusing media profiles, can be accessed via the dapp’s sidebar.

When creating an algorithm, developers aboriginal accord it a few key ambit like a name, the brace of assets it trades between, a abbreviate description of how it works and some class labels. Algorithms created on Mercor are deployed as acute affairs to the BSC blockchain. After deploying a Mercor algorithm, the developer is accustomed a abstruse API key which allows the algorithm to acquaint with Mercor’s API. The developer can again use Mercor’s Python amalgamation in affiliation with the API to address their algorithm.

Once an algorithm is deployed and ‘live’ on the Mercor platform, the algorithm’s developer can clue its achievement via the dapp’s developer dashboard. The home awning of Mercor’s developer dashboard shows developers their absolute balance from the algorithms they’ve created, the absolute bulk of disinterestedness managed by their algorithms, the absolute cardinal of investors with funds in their algorithms and the cardinal of created algorithms that are ‘live’ on the dapp. There is additionally a table on the developer dashboard, agnate to the broker dashboard, which displays a few key statistics on the achievement of anniversary algorithm that the developer has created.

The aggregation abaft Mercor has been adamantine at assignment establishing partnerships with investors and development teams alike, with firms such as BlockBank, Ramp and Darkpool (amongst abounding others) partnering with Mercor and a alternation of acclaimed developers in the amplitude actively developing on the platform.

In accession to actuality the aboriginal and alone absolutely decentralized algebraic archetype trading platform, Mercor Finance has several added advantages. Mercor creates an absorbing amusing dynamic, acceptance investors to ability out to developers. This creates accelerated iteration, acceptance algorithms to be fine-tuned for best performance.

Finally, the achievement of some of the algorithms accessible to investors on Mercor is noteworthy. Despite recent amount downtrends beyond abounding crypto assets, the top-performing algorithms on Mercor Finance accept connected to accomplish absolute allotment for investors. In fact, several single-pair strategies accept accomplished up to 70% acknowledgment on advance aural a distinct month, with multi-token trading strategies extensive over 1,200% annually.

Combined, the avant-garde belvedere is already accession itself at the beginning of development in the automatic archetype trading space.

Mercor Finance has been on a developing bacchanalia in contempo years. Their roadmap includes advance absolute appearance aural the Mercor dApp, accretion the account of the MRCR badge and partnering with added organizations to added access Mercor’s address to abeyant users.

Mercor aims to add the functionality for developers to actualize multi-asset brace algorithms, about acceptance developer-created indices. Moreover, the MRCR badge will become accessible via added decentralized and centralized exchanges, authoritative it accessible for acceptable bazaar assets to be added to Mercor algorithms.

Mercor Finance is additionally appreciative to advertise that it has partnered with Venus Protocol.

Venus Protocol is currently the better decentralized borrowing and lending exchange on the Binance Smart Chain. Mercor’s affiliation with Venus Protocol will advance the achievement of algorithms and accord developers continued accoutrement to actualize strategies that beat the market. The affiliation will additionally accredit Mercor Algorithms to accumulation clamminess to the Venus Protocol which can be acclimated by users of Venus.

Mercor investors will be adored with an APY generated by the fees paid by Venus Protocol users. This APY will be automatically added to the acquirement generated by the algorithm.

Being a top 20 agreement in agreement of absolute amount locked, with assorted big updates planned throughout 2022 and accepting a abundant and loyal community, Mercor is assured this affiliation will accompany abundant amount to both Mercor and Venus users.

Moreover, Mercor Finance is proving to be a avant-garde in both the crypto advance apple and the algebraic trading world.

For added on Mercor’s avant-garde service, built-in badge and how it is abolition the crypto-asset advance world, appointment the dApp here.