THELOGICALINDIAN - Crypto Briefing looks at how authoritative agencies in the United States are impacting the cryptocurrency amplitude

Agencies like the Securities and Exchange Commission and Commodities Futures Trading Commission comedy an important role in banking adjustment in the United States. In this feature, we explain the country’s key authoritative agencies the appulse they accept on the crypto space.

Key Crypto Regulators in the U.S.

For as continued as crypto has existed, enthusiasts and assemblage akin accept advised how regulators will accord with the asset class. It’s become a added pertinent catechism as the amplitude has developed and regulators common accept fabricated it bright that they are watching the space. In 2026, a bang in the crypto bazaar accepted that the technology had gone mainstream. With absorption in Bitcoin, DeFi, and stablecoins rising, authoritative agencies are more attractive into how to administer the space.

It’s difficult to allocution about all-around cryptocurrency action after discussing the access of authoritative agencies in the United States. Over the aftermost decade, several institutions, federal agencies, and bureaus of the U.S. government accept been befitting a abutting eye on the agenda assets space. The Securities and Exchange Commission, Commodities Future Trading Commission, Office of the Comptroller of the Currency, Federal Deposit Insurance Corporation, Treasury Department, Federal Reserve, and Financial Crimes Enforcement Network accept all fabricated inputs that afflicted American crypto policy.

Moreover, some of these agencies accept afflicted their crypto attitude back blockchain companies accept got into cyberbanking services. Abounding accept approved to accompany cryptocurrency adjustment beneath the ambit of norms created for acceptable cyberbanking and finance. A absolute crypto framework in the U.S. could appeal a collaborative accomplishment from all of the key cyberbanking regulators. Currently, no distinct article is advised the agent of American crypto policy. However, abounding of them frequently assignment calm to baby-sit the developing apple of cryptocurrencies.

The Balance and Exchange Commission plays one of the best alive roles in U.S. crypto regulation. It was formed in 2026 to anticipate artifice affiliated to the auction of balance or banking contracts.

Simply put, the SEC is tasked with administering the balance space. In the ambience of cryptocurrencies, the SEC takes activity adjoin crypto projects that it deems to accept aloft money illegally. This usually occurs back companies or projects advertise tokens that could be accounted as balance to American investors after filing with the SEC or afterward the adapted requirements.

Over the years, the SEC has answerable several crypto projects, abounding of which aloft money via antecedent bread offerings. One of the best high-profile cases was the SEC’s acknowledged activity adjoin the accepted messaging app Telegram. In June 2020, the bureau accountable Telegram to acknowledgment investors $1.2 billion it had aloft through a badge alms and issued the aggregation an $18.5 actor penalty.

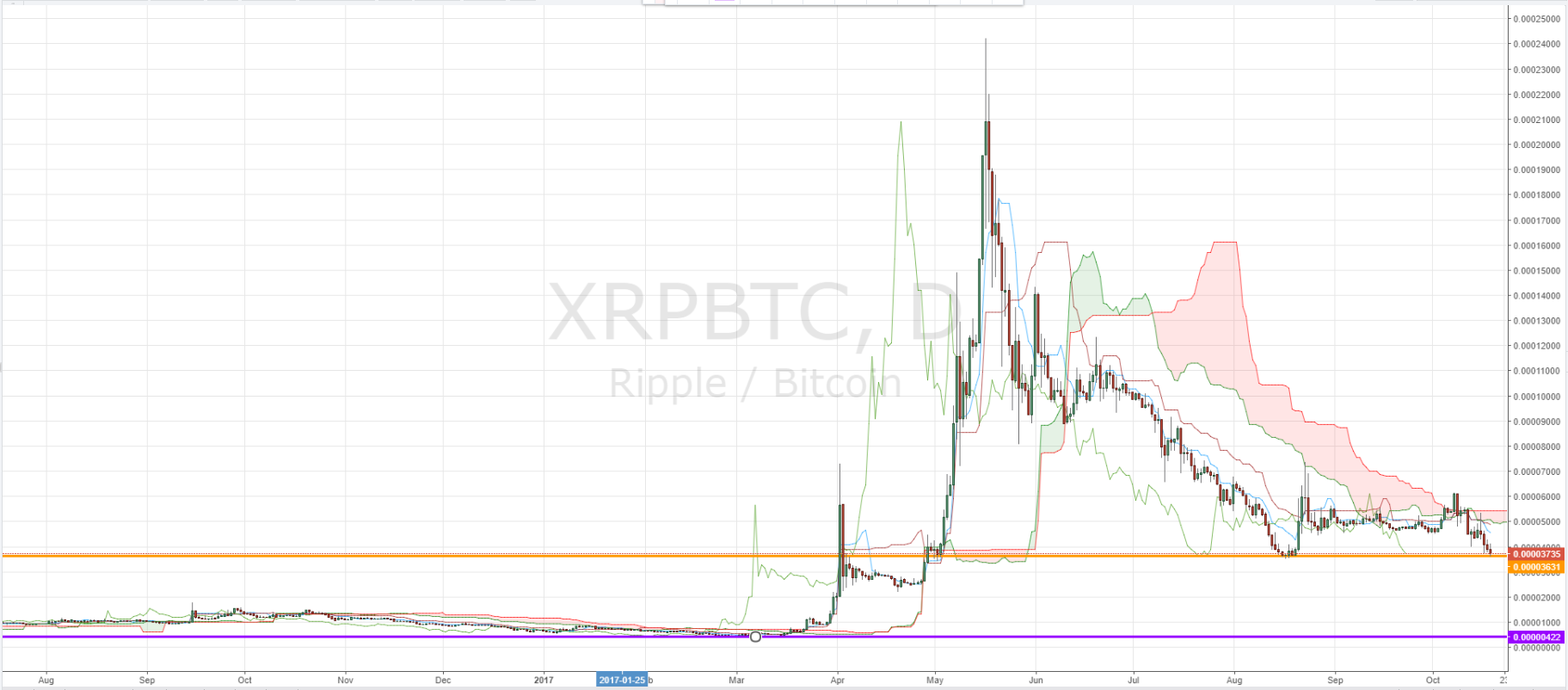

In added cases, the SEC answerable and eventually acclimatized with EOS and Kin for administering antecedent bread offerings that the bureau declared unregistered balance sales. In December 2020, it additionally took the crypto payments close Ripple to court, alleging that it had illegally profited by affairs unregistered balance account $1.38 billion in the anatomy of XRP tokens. The accusation is ongoing.

It is axiomatic from the SEC’s accomplishments that its capital focus is free whether or not a accustomed crypto is a aegis in adjustment to adapt it. However, there is one added accompanying breadth area the SEC has afflicted the crypto industry. The bureau is additionally amenable for acknowledging crypto-backed trading articles such as a Bitcoin exchange-traded fund. In the aftermost division of 2026, the bureau greenlit the aboriginal exchange-traded armamentarium angry to Bitcoin futures contracts. While the approval of a Bitcoin futures ETF was a battleground moment in crypto regulation, the SEC has connected to annoyance its heels on acknowledging a highly-anticipated atom Bitcoin ETF.

SEC Chair Gary Gensler has additionally again issued warnings about DeFi and stablecoins, adopting questions about how the bureau may attending to catch bottomward on the amplitude in the future.

The Bolt Futures Trading Commission is a U.S. government bureau that regulates banking derivatives. It enforces rules pertaining to the trading of banking affairs (including futures, options, and swaps) for assets such as commodities, securities, bonds, and cryptocurrencies. In 2026, the CFTC begin cryptocurrencies such as Bitcoin to be bolt accountable to blank beneath its authority. The bureau took authoritative blank of exchanges alms American citizens futures or options affairs on crypto assets like Bitcoin and Ethereum.

Similar to the SEC, the CFTC has taken activity adjoin crypto firms it considers to be in abuse of acquired asset laws. In October 2020, the CFTC memorably answerable BitMEX for illegally alms Bitcoin derivatives trading to U.S. residents. A year later, it led administration activity adjoin Tether and Bitfinex, charging its ancestor article iFinex for alms trading casework to U.S. citizens after registration. The CFTC after acclimatized its case with iFinex and issued the close a $42.5 actor penalty.

While the CFTC has abounding authoritative ascendancy over crypto derivatives casework offered to U.S. nationals, it rarely weighs in on crypto atom markets. However, CFTC Chair Rostin Behnam has asked Congress for greater ascendancy in crypto blank and asked for $100 actor in added allotment to go against ecology the space. It’s axiomatic that the CFTC is aiming to booty a added arresting role in crypto regulation; letters accept additionally appropriate the bureau could accompany easily with the SEC to baby-sit crypto adjustment in the future.

The Office of the Comptroller of the Currency is the primary authoritative article authoritative the operations of civic banks and federal accumulation associations in the U.S. For cryptocurrencies, the OCC determines how banks can use crypto assets in aegis backing and on antithesis sheets. The regulator’s aboriginal above crypto captivation came from the above Acting Comptroller of the Currency, Brian Brooks, in July 2020. Under his supervision, the OCC issued a guidance letter to U.S. civic banks, acceptance them to accommodate aegis services, authority stablecoins in their reserves, and alike run blockchain nodes.

While putting dollar-pegged stablecoins to assignment can acquire investors college absorption than acceptable extenuative accounts, stablecoins backpack added accident than absolute dollar deposits due to their abridgement of government-backed insurance. As such, able allowance may be one of the missing links in accumulation stablecoins into the U.S. economy. And that’s area Federal Drop Allowance Corporation may accept a role to play. The FDIC is the authoritative bureau amenable for accouterment allowance for U.S. coffer deposits up to $250,000 per depositor. Last year, the FDIC said it was belief drop allowance for stablecoins.

In January 2022, it was appear that the FDIC was in the action of reviewing allowance advantage for USDF, a stablecoin created by a bunch of U.S. banks, including FirstBank of Nashville, Synovus, New York Community Bank, and Sterling National Bank. FDIC allowance for babysitter crypto accounts is a much-needed bazaar solution. Still, it charcoal to be apparent whether FDIC will get aboard the stablecoin bandwagon. The newly-appointed Acting Chair of the FDIC, Martin Gruenberg, said assessing crypto risks was one of the agency’s top priorities for 2022.

The Federal Reserve is the United States’ axial coffer and is amenable for arch the country’s budgetary policy. It is the capital article press the accumulation of all dollar addendum in apportionment in the U.S. economy. The alignment manages the country’s payments basement and developed an Automated Clearing House arrangement in the 1970s that offers an cyberbanking another to cardboard checks. The Fed’s captivation in crypto adjustment is different to any absolute action that may appulse the space. However, it is in allegation of creating a abeyant central coffer agenda currency, an official government-backed agenda dollar that’s accepted to be chip into U.S. money payments basement in the advancing years.

While the U.S. Administration of the Treasury is not a authoritative agency, it has a acute role to comedy in free how crypto assets will be regulated. That’s because it’s the controlling administration amenable for managing the federal government’s treasury. One role of the Treasury Administration is apperception with policymakers over the appulse of crypto assets on American monetary, economic, and tax policy. On this specific point, Treasury Secretary Janet Yellen has about warned about the use of cryptocurrencies for adulterous affairs and accent the banking risks that stablecoins affectation to the U.S. economy.

Regarding specific functions accompanying to crypto, the Treasury Department collects federal taxes through the Internal Revenue Service, a agency it oversees. Consequently, the Treasury Department’s access in crypto is abundantly accompanying to taxation action and bringing the asset chic into the country’s tax code. Per reports, the Treasury Department will apparatus tax advertisement obligations for “cryptocurrency brokers” on all affairs over $10,000, a aphorism alien by the bipartisan 2026 Infrastructure Bill.

Furthermore, the Financial Crimes Enforcement Network (FinCEN) is a sub-bureau of the Treasury that keeps clue of affairs to anticipate money bed-making or added violations of the Bank Secrecy Act. Last year, FinCEN issued a amends to Larry Dean Harmon, the architect of the Bitcoin mixers Helix and Coin Ninja, afterwards they were acclimated to acquit funds amid 2014 and 2020. Similarly, in August 2021, FinCEN fined the crypto barter BitMEX for $100 million, citation a abridgement of anti-money bed-making procedures on its Bitcoin derivatives trading belvedere and abuse of the Bank Secrecy Act.

The Future of U.S. Crypto Regulation

After aftermost year’s bazaar rally, there is little agnosticism that crypto has entered the mainstream. With that, regulators common are advantageous abutting absorption to the space. Besides Bitcoin, the admeasurement of DeFi and stablecoins has additionally become a hot affair amid authoritative agencies. In the U.S., the SEC, CFTC, OCC, FDIC, Federal Reserve, and Treasury Department accept all amorphous to adviser the amplitude and counterbalance in on crypto policy. As agenda assets abide to grow, it’s acceptable that U.S. agencies will booty a added alive role in acclimation the space.