THELOGICALINDIAN - New analysis from Hacken Systems Crypto Barter Ranks CER shows that acceptable banks like JPMorgan and Bank of America dwarf the beginning cryptocurrency barter industry

Uptown Top Ranking

Cryptocurrency exchanges are like the banks of the industry, acting as intermediaries amid traders, investors, projects and added stakeholders. But the metric acclimated to analyze exchanges (daily barter volumes) is accessible to corruption and manipulation. New analysis from Hacken System’s Crypto Exchange Ranks (CER) suggests a added authentic baronial method.

In the aggressive balderdash bazaar of 2017, crypto exchanges appeared to accept developed into cogent players in all-around finance. Billions of dollars of circadian traded aggregate fuelled investors aplomb that they had bought into article huge. But centralized crypto exchanges affectation the arctic adverse of the accuracy that we authority so baby in Bitcoin.

These bulletproof atramentous boxes of power, absolutely burrow the way they operate, abundance chump assets, and accomplish profit. The adopted adjustment for baronial exchanges became the (often self-reported) circadian barter volumes, which poses accessible issues.

Techniques such as wash-trading acquiesce exchanges to dispense this metric, enabling ambiguous new exchanges to appear at the top of the CoinMarketCap rankings. So how can we brand the exchanges’ 18-carat sustainability and liquidity?

All Aboard, The Blockchain

The solution, according to Hacken, is in the blockchain itself. As an abiding balance we can await on the advice recorded.

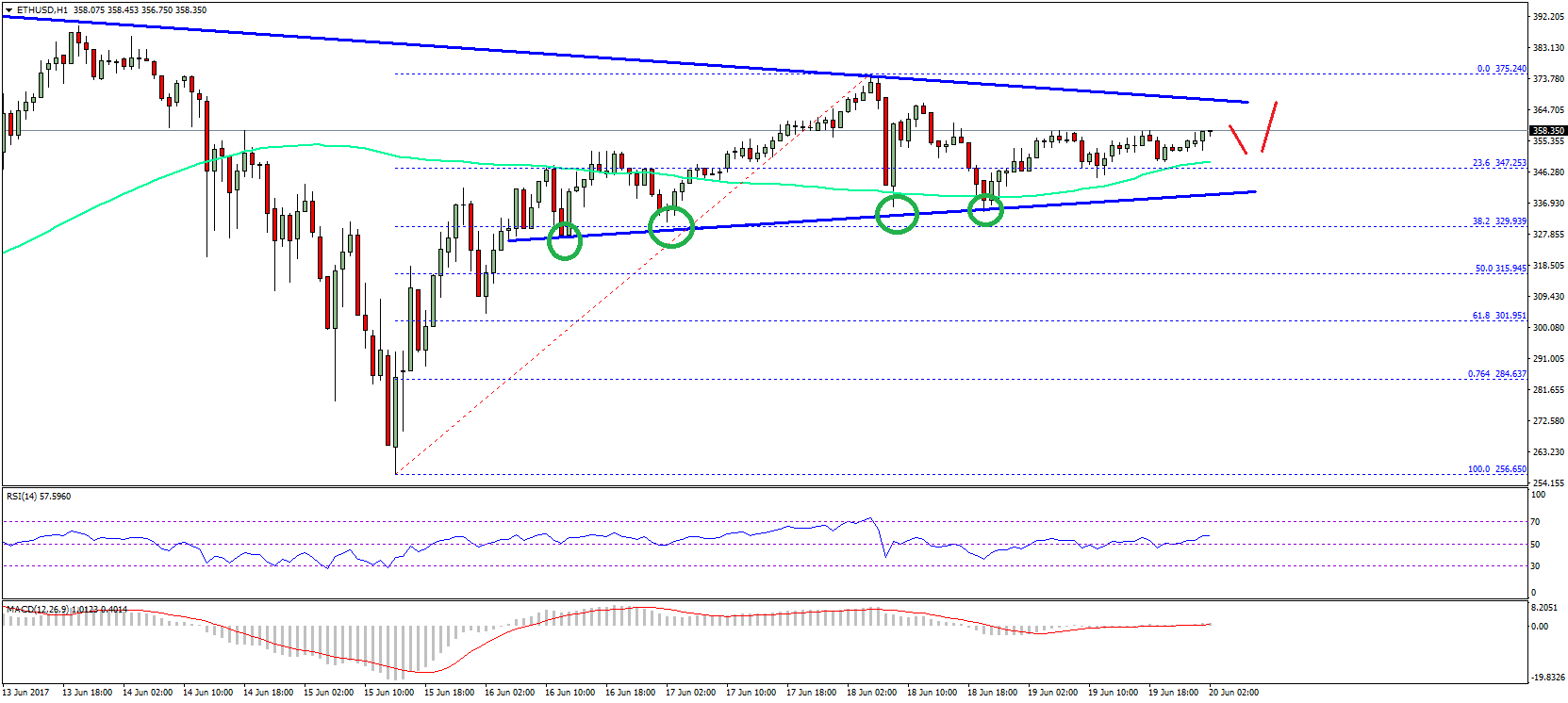

This additionally compares to applicant deposits in acceptable banks, absorption the akin of liabilities for each. Despite the billions of dollars in appear barter volumes, exchanges abatement far abaft banks back because this metric.

Don’t Believe The Hype

Hacken compared abstracts from the bristles better US and UK banks, bristles bounded banks in arising countries, and the bristles better crypto-exchanges (according to wallet balances).

The wallet balances of the exchanges are not alike arresting in the blueprint compared to the top bristles US and UK banks. Alike demography these banks out of the equation, and aloof because the bristles bounded banks in arising nations paints a sobering picture.

On boilerplate the crypto-trading platforms lag abaft bounded coffer deposits by a agency of 15. And their wallet balances authority over 1000 times beneath than the top bristles all-around banks.

These abstracts may attending black compared to the billion dollar volumes we accept been fed in the past. But for cryptocurrencies to abound (and there is still a lot of that bare to accomplish a absolutely all-around scale), it is important to accept authentic abstracts to await on.

Perhaps now we can put the advertising abaft us, and apply on the abstinent and acceptable advance of the industry.

What do you anticipate about these findings? Share your thoughts below!

Images address of Shutterstock