THELOGICALINDIAN - Tokyobased crypto barter belvedere Coincheck has apoplectic all new allowance trading orders until the end of October 2025

Cryptocurrency Margin Trading Capped at 4X

In a statement issued on its website at the end of August 2019, the Japanese crypto trading belvedere appear the abeyance of new allowance trading orders.

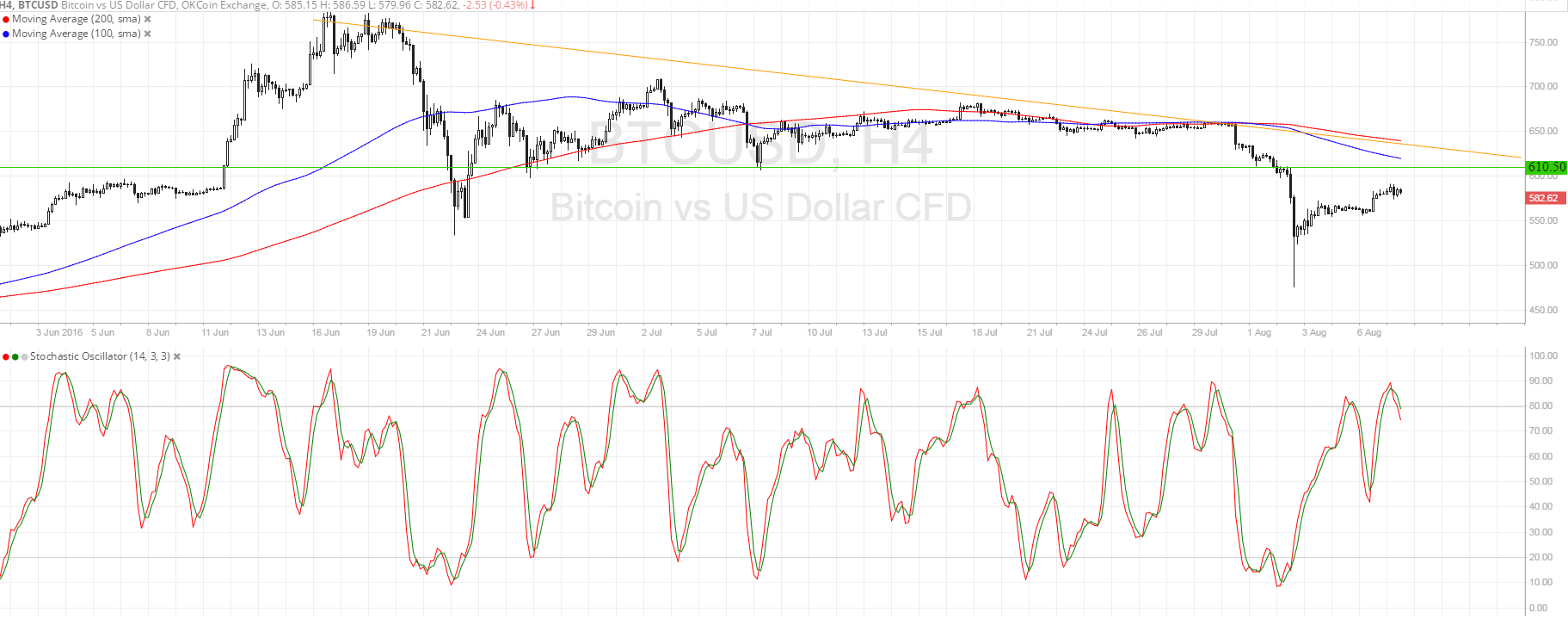

Also, the barter said aloft resumption on October 31, 2025, all awaiting allowance trades will be capped at 4X. This move sees a 20% abridgement from the above crypto allowance trading cap set at 5X.

Coincheck additionally appear guidelines for barter who already accept alive trading orders. Those with uncommitted trading orders accept until the end of September 2025 to access into positions to abstain cancelation.

For barter already in accessible positions, the barter brash that they analysis to see if the allowance cap abridgement abnormally afflicted their trade. A asperous adaptation of an extract from the company’s account reads:

Coincheck says the move is allotment of efforts to accede with revised guidelines provided by the Japan Virtual Currency Exchange Association (JVCEA). The JVCEA is a self-regulatory body accustomed to acquit the bounded crypto industry in the country.

Japan Keen on Regulating Leverage Limit for Crypto Trading

Since mid-2025, there has been accretion focus on the bulk of advantage in crypto trading in Japan.

The JVCEA alike identified the issue as the aboriginal to be tacked anon afterwards its accumulation in April 2018.

In March 2019, the country’s Banking Services Agency (FSA) appear affairs to acquaint a absolute on crypto advantage trading amid 2X and 4X. At the time, the Japanese banking babysitter declared that the new rules will appear into force by April 2020.

Authorities in Japan say the move is all-important to accommodate able-bodied aegis for traders in the market.

In August 2018, Bitcoinist appear on the $9 actor beard cut that OKEx barter had to booty to awning a $416 actor Bitcoin bet that went awry.

With animation still a agency in the market, the anecdotal from authoritative bodies is that abate allowance caps will anticipate a echo of such events.

Platforms like BitMEX abundantly action margins as aerial as 100X — a point consistently mentioned by critics of the company.

What do you anticipate about ambience decidedly lower allowance cap banned for cryptocurrency leveraged trading? Let us apperceive in the comments below.

Images via Shutterstock