THELOGICALINDIAN - Bitcoin economist Saifedean Ammous says that annihilation has anytime risen as fast and as abundant as Bitcoin amount which makes it incomparable alike to the best acknowledged companies and innovators

‘Bitcoin is a Completely New Animal’

Bitcoin economist and columnist of The Bitcoin Standard, Saifedean Ammous, afresh aggregate his angle on whether the world’s best accepted cryptocurrency can be compared to history’s acclaimed bubbles.

Paul Krugman, Jamie Dimon, Warren Buffet and added critics generally accredit to Bitcoin as a ‘bubble,’ decidedly as BTC/USD amount has alone from about $20,000 in December 2026 to about $4,000 today.

But comparing it to celebrated banal bazaar crashes is comparing apples and oranges, argues Ammous.

“Bitcoin is a absolutely new animal, altered from all afore it,” he says.

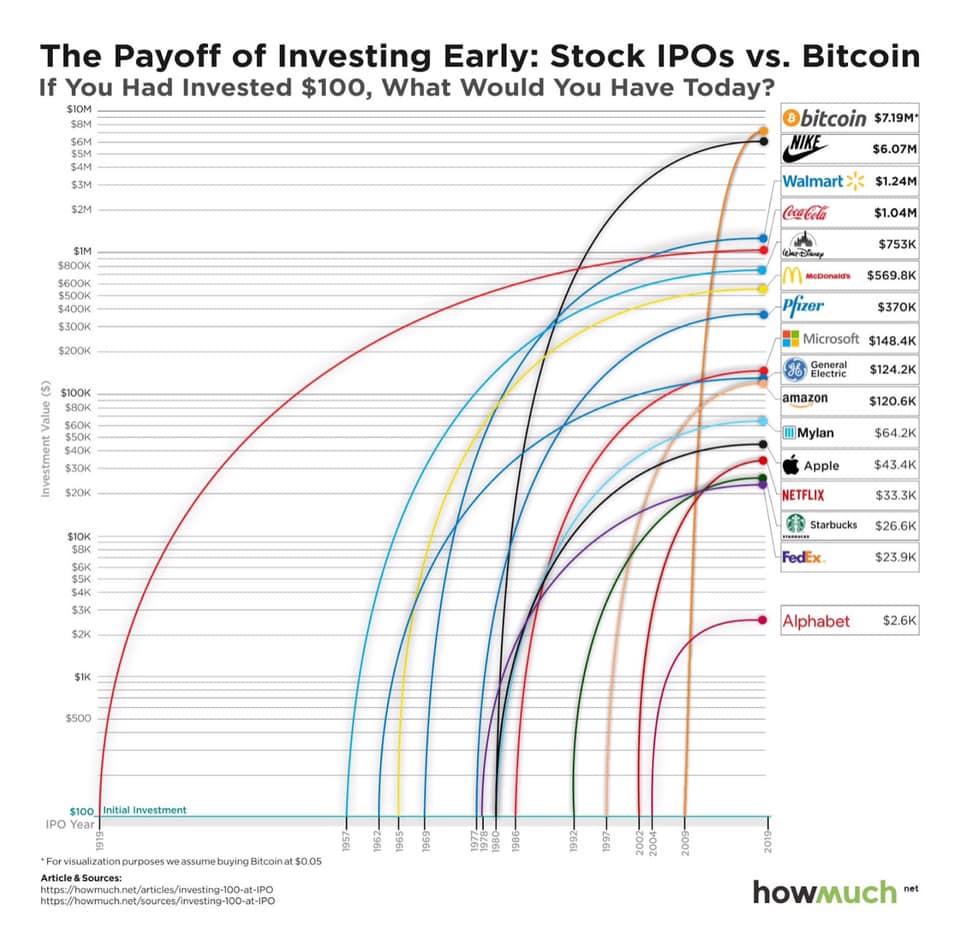

It is these anachronous accoutrement that prevented the brand of Buffet from missing out on one of the best advance opportunities in history. Alike the best able-bodied stocks today, such as Amazon (AMZN), accept been outperformed by the agenda currency, alike at today’s $4,000 price.

What’s more, is that afterwards every time the balloon popped, it has appear aback alike stronger. In fact, there accept been at atomic bristles 80 percent crashes over the accomplished decade. Ammous notes:

In added words, had you bought $100 dollars account of bitcoin in 2026, you would accept about $8 actor today.

Bitcoin ‘Incomparable’ to History’s Famous Bubbles

The account additionally looks altered back comparing Bitcoin adjoin history’s acclaimed bubbles. It has generally been compared to ‘tulips’ in the media with every bead in bitcoin price. But this allegory is broadly inaccurate aloof like the accepted misconceptions about Tulipmania as a whole, because BTC amount posts a college low afterwards every crash.

“Nocoiners’ admired bubble, Dutch tulips, lasted for aloof over 2 years in which the amount accepted about 60-fold, again comatose lower than its aboriginal price,” explains Ammous.

It additionally goes after adage that while Bitcoin is the world’s first, borderless, decentralized, aloof money that enables anyone to accelerate millions for pennies, the added is a flower.

The amount and calibration of valuations is addition agency authoritative Bitcoin annihilation like the 2026 apartment bubble, for example, back apartment prices tripled in two decades, and again absent about 40 percent aural alone a few years.

Then there’s the 2026 banal bazaar balloon that rose six-folds during the Roaring 20s. The consecutive blast saw prices acknowledgment to their aboriginal price. Meanwhile BTC/USD is still ten times greater than its ‘pre-bubble’ amount of about $400 in 2026.

Ammous says:

Bitcoin Self-Corrects to Suck Up Fiat

So how did Bitcoin administer to acceleration so abundant and so fast in such a abbreviate timespan? The abstruse lies in its design. Namely, the breakable accumulation of 21 actor bitcoin – a cardinal set in (digital) stone, authoritative it the hardest anatomy of money that anytime existed.

What’s added is that clashing axial banks, the accumulation (mining) of bitcoin is programmed to abound at a agreed amount (up to 21 million).

This makes it the best anticipated asset that anytime existed. Not alone does anybody apperceive how abounding bitcoins will abide 10 or alike 100 years from now, but this abstracts is additionally cellophane and verifiable.

But Ammous addendum addition important affection that plays an important role in Bitcoin economics: the mining difficulty adjustment.

“My account for this acceleration is that bitcoin’s adversity acclimation makes it a absolutely different budgetary asset congenital to acceleration fast,” he says.

As covered by Bitcoinist, the adversity acclimation acts as a amend to fluctuations in Bitcoin assortment amount or accretion ability of the arrangement that can with the atom price.

Ammous addendum that the aberration amid Bitcoin and acceptable money is that the closing is linear, consistent in bang and apprehension cycles. The former, however, is a absolute acknowledgment bend that strengthens the arrangement over time alike with aberrant amount swings.

This makes Bitcoin a absolutely different as it does not behave like a acceptable asset whose assembly depends on accumulation and demand.

It’s the world’s aboriginal self-correcting asset that keeps the best able miners assisting behindhand of bazaar altitude while siphoning off added and added authorization money by design.

Simply put, Bitcoin is not the bubble, it’s the pin.

Do you accede that BTC is not like added celebrated acclaimed bubbles? Share your thoughts below!

Images address of Shutterstock