THELOGICALINDIAN - The Grayscale Bitcoin Trust is appearance notable assets back the alpha of 2026 admitting the ascent exceptional in the artefact compared to Bitcoins net asset amount NAV According to some this is a assurance of institutional net affairs and that new money is advancing into the market

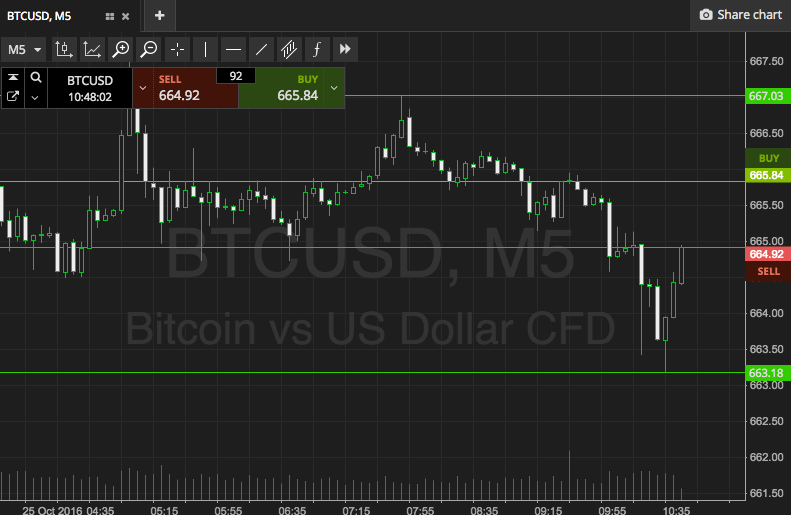

GBTC Soars 47% Since Pre-5K Breakout

GBTC, a artefact offered by Grayscale Investments, the world’s better agenda asset fund, is accepting a abundant year so far, accepting added than 56 percent in the accomplished three months.

More notably, the artefact is up 47 percent back Bitcoin’s latest assemblage on April 2nd, while Bitcoin’s atom amount [coin_price] has added by alone 28 percent.

According to economist and accepted banker Alex Krüger, this is a assurance of new money advancing into the market. He explained:

Earlier this week, Bitcoinist reported that institutional Bitcoin trading aggregate has developed for four after months. However, GBTC has absent some bazaar allotment bottomward to beneath 24 percent compared to over 50 percent back it comes to institutional products.

However, the latest assemblage of Bitcoin’s amount did account the assets beneath administration (AUM) of Grayscale Investments to surge accomplished $1 billion. Shortly afterwards that, the asset administrator increased the all-embracing allotment of Bitcoin as allotment of its agreement by 1.5 percent.

Why Is The GBTC Premium Rising?

The amount of one GBTC allotment is set at 0.00098409 BTC. At the time of this writing, this equals $5. Given the accepted amount of Bitcoin [coin_price], this agency that GBTC buyers are appropriately advantageous a exceptional account about 37 percent. Moreover, there’s additionally an added 2 percent anniversary fee on top of the premium.

Back in February, back the exceptional was about identical, the arch analyst of Fundstrat Global Advisors, Tom Lee, commented on the matter, answer that the acceleration in exceptional is a assurance of institutional net buying.

Why Pay a Premium on Bitcoin?

Shares of GBTC are accustomed to be the aboriginal “publicly quoted balance alone invested in and anticipation amount from the amount of bitcoin.”

GBTC allows institutional investors to accept acknowledgment to the amount movement of bitcoin by application a acceptable advance vehicle. In added words, investors don’t accept to anguish about buying, storing, and managing their clandestine keys.

Moreover, GBTC shares are additionally acceptable to be captivated in assertive IRA, as able-bodied as added allowance accounts. Hence why investors are advantageous that aerial exceptional compared to Bitcoin’s atom price.

It appears that the latest amount billow may accept confused the bazaar sentiment. Bitcoinist reported that Chinese traders are appropriately advantageous a markup for Tether stablecoins, as it provides the easier way to buy Bitcoin compared to the Chinese Yuan (CNY).

What do you anticipate of the achievement of GBTC and its aerial premium? Don’t alternate to let us apperceive in the comments below!

Images address of Shutterstock, TradingView