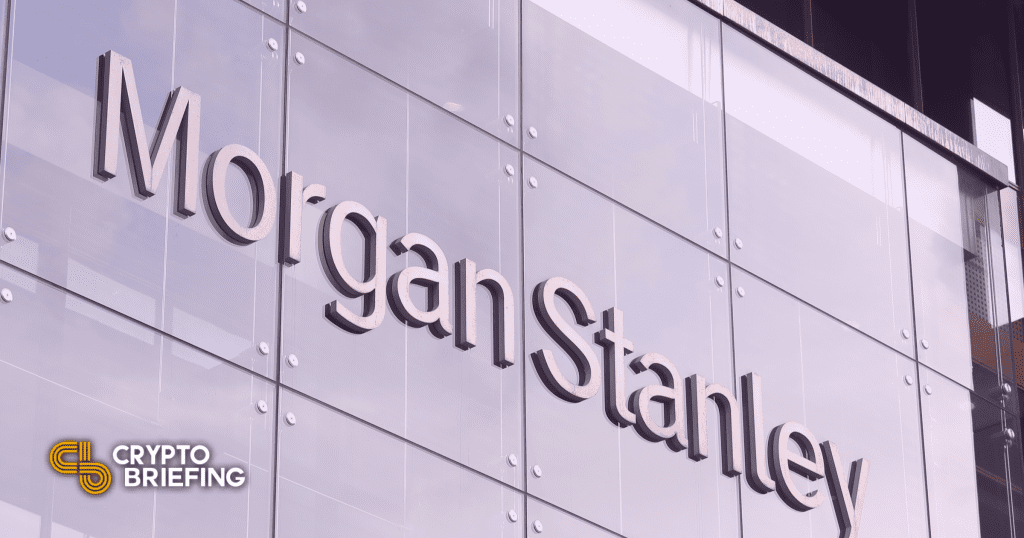

THELOGICALINDIAN - Inside sources say Goldman Sachs is already onboarding some of its audience to barter on its Bitcoin derivatives nondeliverable advanced NDF affairs belvedere However the coffer reportedly has no affairs to barrage trading abutment for added cryptocurrency derivatives but is austere about accouterment careful services

Goldman Trading Bitcoin Derivatives?

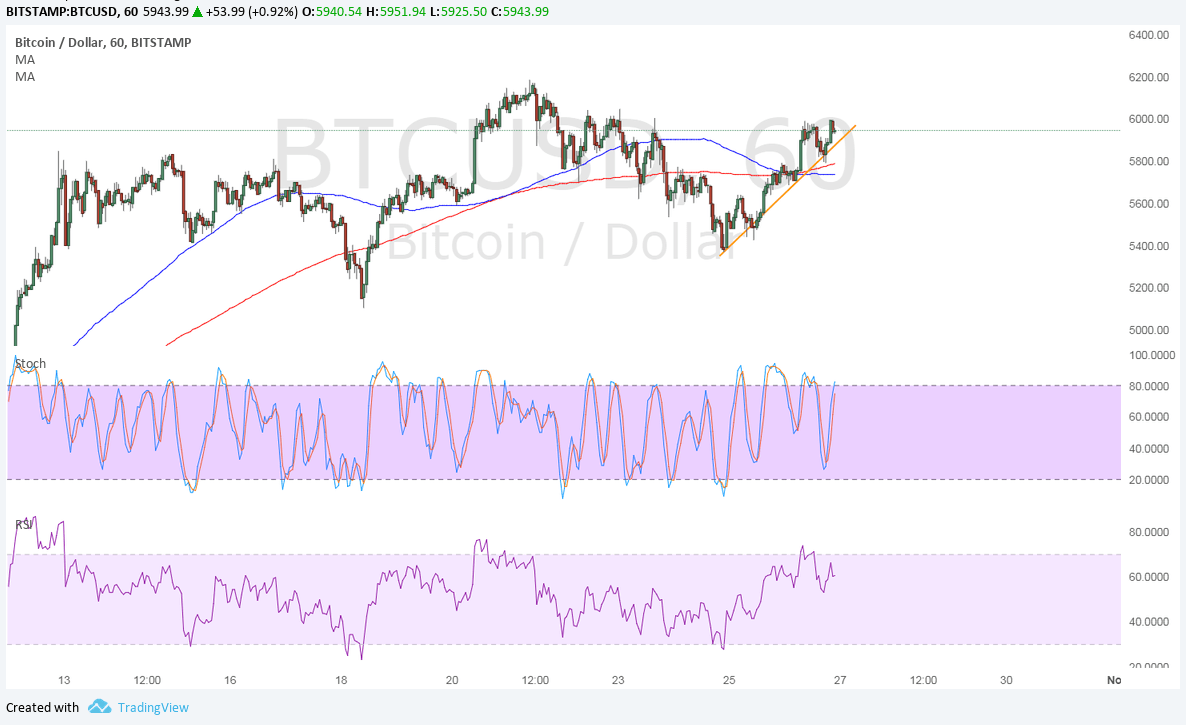

According to the International Business Times, the Wall Street Bank is acceptance a baddest accumulation of audience barter a Bitcoin-based derivative product. The abridgement of alarum about the appear barrage ability be a advised attack by Goldman Sachs to assignment out all the kinks from the activity afore the above launch.

In May, Bitcoinist reported that the coffer was austere about Bitcoin futures trading. At the time, one of its executives, Rana Yared, said:

At the time, rumors of the coffer aperture its cryptocurrency trading board were additionally prevalent. However, Goldman Sachs has back dispelled this citation the able attributes of the atom trading market.

Custodial Focus

While Bitcoin futures trading is already ongoing, the coffer says it has no ambition of alms added cryptocurrency derivatives. Recently, Abacus Journal reported that Goldman Sachs was exploring affairs to barrage an Ether derivatives product. However, bottomless sources say no such affairs abide at the moment.

Currently, it is difficult to see Goldman Sachs ablution an Ether [coin_price coin=ethereum] futures product. The second-ranked cryptocurrency doesn’t accept any adapted futures affairs that are anon trading in any U.S.-based exchange.

The Cboe, which currently trades Bitcoin futures, is reportedly attractive to barrage Ether futures trading but is cat-and-mouse on SEC approval. Back in June 2018, the Cboe President said the SEC allocation of Ethereum as not actuality a aegis opened the door for the addition of Ether-backed derivatives.

While Goldman Sachs isn’t attractive at added cryptocurrency derivatives, its focus has confused to custody solutions, currently in development. Goldman Sachs’ aegis belvedere calm with that of Coinbase, Fidelity, and others should accord a much-needed aplomb addition that will conductor in the institutional herd, according to abounding experts.

Do you anticipate a absolutely launched Goldman Sachs Bitcoin-backed derivatives trading will accept any cogent appulse on the BTC price? Let us apperceive your thoughts in the animadversion area below.

Image address of Shutterstock