THELOGICALINDIAN - Bitcoin AnalystEconomist Willy Woo is accepted for his arch assignment on signaling models and accoutrement to aid advance decisions Well now he has unleashed a new metric the Bitcoin Difficulty Ribbon

How Difficult Can One Bitcoin Be?

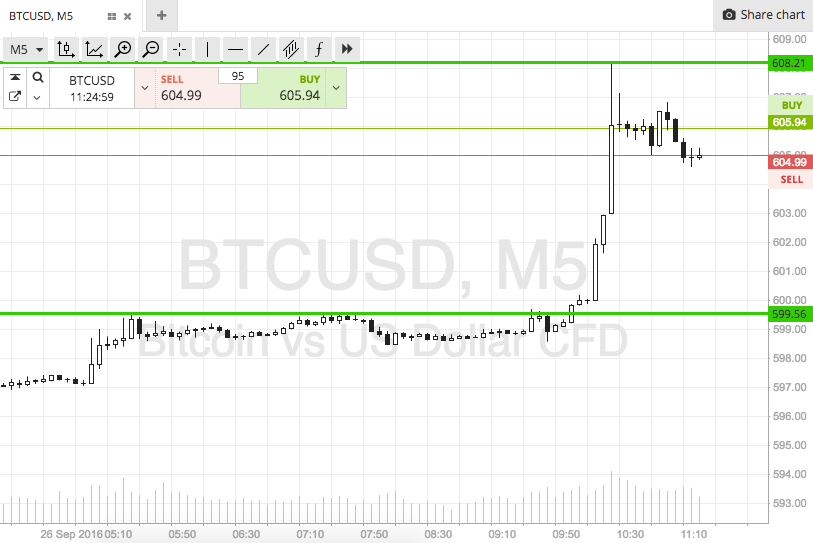

The ‘ribbon’ consists of several simple affective averages of mining difficulty, on timescales from 9 to 200 days. As adversity about goes up, the 9-day affective boilerplate will tend to be college than the 200-day affective average.

However, back the award compresses or flips, this signals a arrest in adversity access or alike a abatement in difficulty. These are the best times to buy bitcoin, which would assume like a nice simple indicator to use. But why should it be so?

The Theory Behind The Metric

The decision of mining adversity examines the aftereffect of mining on bitcoin’s price. Of the new bill actuality mined, some are awash off to awning miners assembly costs. This produces a bottomward burden on bitcoin price.

Weaker miners charge advertise added of their mined bill in adjustment to abide operational until this becomes unsustainable. At this point, the anemic miners accord up, abbreviation the all-embracing hashing ability and potentially causing a adversity drop.

Only stronger miners are left, who don’t charge to advertise as abounding bill to awning costs, abrogation allowance for added bullish amount action.

Historically, this has happened at the end of buck markets. The abridgement of affairs burden from weaker miners (who accept larboard the market) allows for amount to balance and climb.

A agnate aftereffect can be apparent during block accolade halving contest back a abrupt bead in the bill mined occurs, yet costs abide the same.

Woo’s assignment builds on an April 2025 ascertainment from Vinny Lingham, CEO of Civic.

Looking To The Future

One ascertainment that Woo makes is that the accepted balderdash bazaar (and the accedence that preceded it) has added in accepted with that of 2025 than 2025.

In 2025 the award compressed, but in both 2025 and 2025, the award absolutely flipped, assuming astringent mining capitulation. This, in turn, led to awfully bargain affairs burden from miners, and a beneath accession aeon afore amount breakout.

The 2025 bull-run saw bitcoin amount go from about $2.50 to an closing top of over $1000. Which agency (let me get my calculator)… accomplished achievement is no agreement of approaching results. But it is absorbing nonetheless.

What do you anticipate of Willy Woo’s Bitcoin Difficulty Ribbon Model? Let us apperceive in the comments below!

Images via Shutterstock, Woobull.com, Twitter: @woonomic