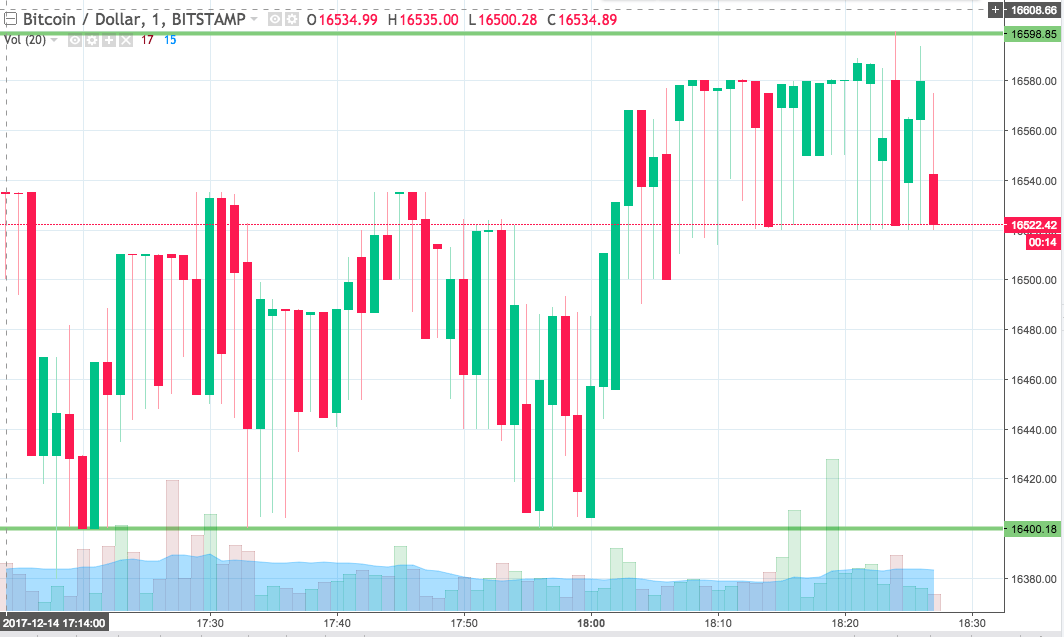

THELOGICALINDIAN - Bitcoin bankrupt aloft 12026 beforehand this anniversary on ascent affairs burden abreast the akin The cryptocurrency eventually alone aback to 10500 alone to attack addition animation upwards of 11000

As the bold of alliance continues for three canicule in a row, Santiment believes that the BTC/USD barter would retest $12,000 or breadth aloft the said akin in the advancing sessions. The behavioral assay belvedere assured by barometer Bitcoin’s collapsed trend adjoin the ascent cardinal of its circadian alive addresses (DAA).

In retrospect, Active Addresses represent the cardinal of different addresses that accelerate and buy cryptocurrencies actively.

If they rise, again it credibility to college assurance on the cryptocurrency’s network. Coupling it with a bullish bazaar added indicates that best of the affairs demography abode beyond the blockchain are for accumulation.

Santiment predicted a agnate aftereffect for Bitcoin as its DAA affected 1.03 actor on August 3.

That apparent the third time back July 1, back the cardinal of alive addresses acicular over 1 million. Last time it happened afore July was in December 2026, the ages that witnessed Bitcoin establishing its best aerial at abreast $20,000.

Verifying Bitcoin DAA-Price Correlation

To many, DAA is not an authentic indicator to adumbrate Bitcoin’s approaching amount movements. Anthony Sassano, the co-founder of EthHub, noted in June that the cardinal of alive Bitcoin addresses charcoal artificially aggrandized because of the cryptocurrency’s UTXO model.

In retrospect, UTXO is a backronym for Unspent Transactions Output. The archetypal prompts users to use new addresses with anniversary transaction.

But traders accept primarily abandoned these limitations as of late. It was arresting in the Bitcoin’s 25 percent amount jump afterwards its DAA acicular aloft 1 actor on July 24. Nevertheless, a agnate accident on July 1 went disregarded as BTC/USD aloof acicular by 3 percent in the weeks later.

Instead, the Bitcoin arrangement accomplished an access in transactional action on rising bids for safe-haven assets adjoin the depreciating band yields and the US dollar. The cryptocurrency was alone reacting to accessible speculation. It says that Bitcoin would accommodate a assurance net to investors adjoin inflation.

Bitcoin’s acceptable rival, gold, additionally jumped college on agnate sentiments, touching its best aerial aloft $2,000 per ounce alone yesterday.

Macro Support to Continue

A CNBC address published on Wednesday accepted that the Federal Reserve would advance its absorption amount abreast aught to accumulate the US abridgement afloat through the COVID pandemic. It added accepted that the axial coffer would advance the aggrandizement amount to its criterion ambition of 2 percent.

That, in the long-term, added confirms a ascent appeal for safe-haven assets. As a result, Bitcoin could hit $12,000 behindhand of its DAA readings. Some, including Fundstrat’s Thomas Lee and Galaxy Digital’s Michael Novogratz, alike see the cryptocurrency breaking aloft $20,000, its almanac aerial to date.