THELOGICALINDIAN - There accept been abounding fears over contempo years that axial banks and added authorities will ambition Bitcoin as they may see it as a blackmail to acceptable banking basement According to Dan Tapiero admitting these fears are unfounded for the time being

Bitcoin May Not Be Macro Relevant Yet, Despite Price Surge

Dan Tapiero is the co-founder of DTAP Capital, Gold Bullion Int., amidst added firms. He has been carefully afterward Bitcoin for a while now, actuality one of the aboriginal macro choir to access the space.

He afresh commented that until Bitcoin hits $250,000, or a bazaar assets of about $5 trillion, it may not accept appliance on a macro scale:

His contemperary Raoul Pal, a above Goldman Sachs arch of barrier armamentarium sales and Real Vision CEO, afresh commented that Bitcoin is “irrelevant on a all-around asset scale.”

A Common Belief

Tapiero’s and Pal’s point that Bitcoin currently isn’t accordant on a macro calibration has been echoed by Tom Lee of Fundstrat Global Advisors. Lee, as the arch of analysis and co-founder of Fundstrat, has been afterward cryptocurrencies for years, consistently allegory the space.

Lee said at a appointment in Singapore in 2018 that afore a Bitcoin ETF should be accustomed by the U.S. Securities and Exchange Commission, it should barter at $150,000 or more. Bloomberg wrote on his comment:

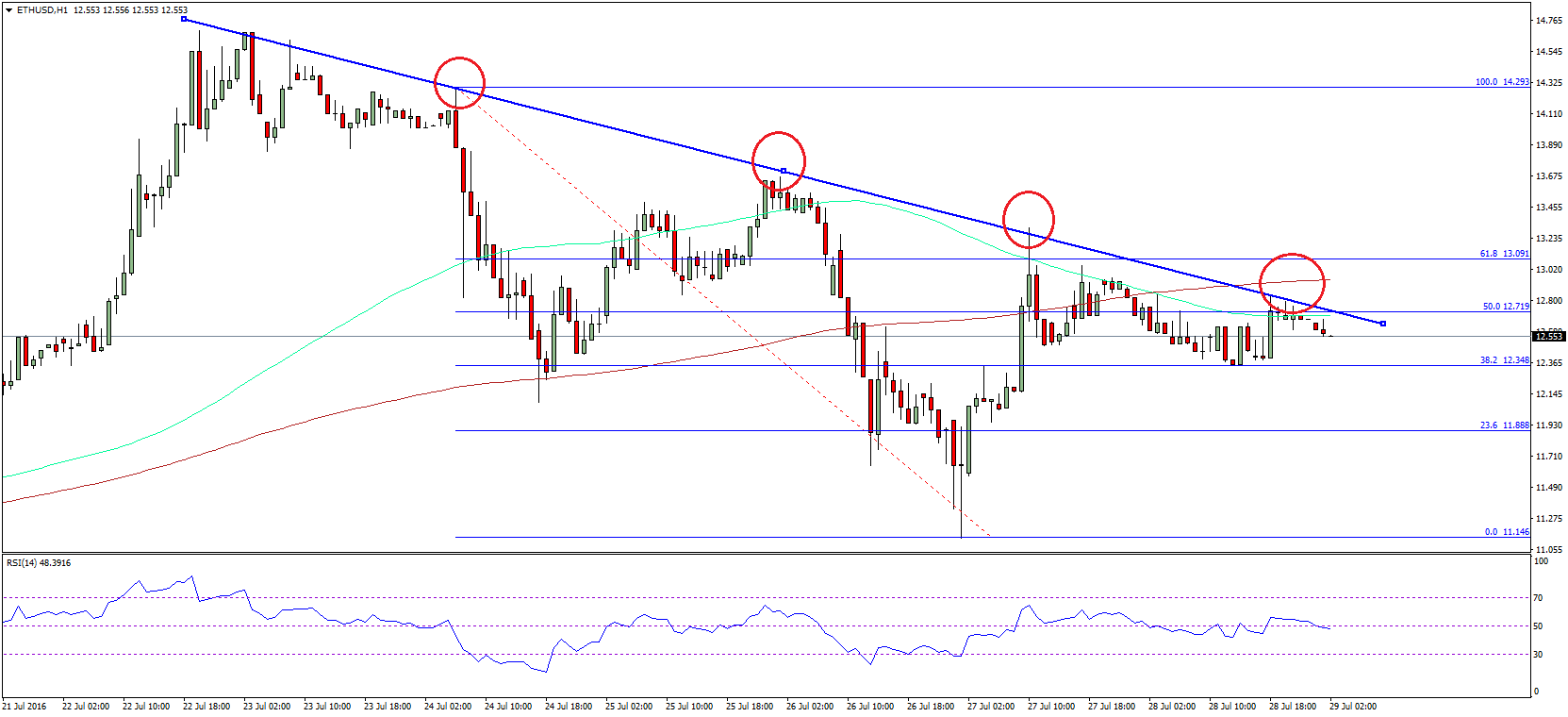

While Bitcoin has apparent immense advance over contempo months and years, it charcoal a baby asset on the macro scale.

Case in point: alone afresh did Paul Tudor Jones, a billionaire barrier armamentarium manager, activate dabbling in the cryptocurrency. And it’s account acquainted that he’s abundantly attached his acknowledgment to Bitcoin.